The silicon plains offer little comfort, yet fortunes are built and lost upon them. Advanced Micro Devices, they call it – AMD – and Nvidia, its larger, more gilded cousin. For years, Nvidia has basked in the sun of profit, a towering structure built on the backs of eager consumers. Five years ago, their stock soared, a flight of fancy while AMD merely… climbed. A 1300% ascent for one, a modest 160% for the other. The difference, as always, is not merely in the numbers, but in the labor that fuels them.

Last year, a shift. A murmur in the machine. Investors, perhaps weary of the obvious, turned a gaze toward AMD. A 77% rise, outstripping Nvidia’s 39%. A small rebellion, you might say. But is it a true turning, or merely a temporary eddy in the current?

The Promise of Alternatives

AMD”>

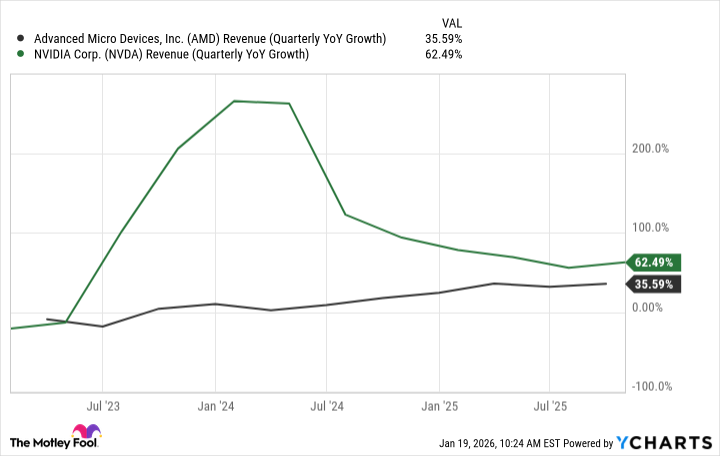

The past two years have seen AMD’s ascent accelerate. A sign, perhaps, that their new chips are finding purchase, that demand is stirring. Meanwhile, Nvidia’s growth, once a relentless march, shows signs of slowing. The mighty sometimes stumble, but rarely fall completely.

Size and Substance

AMD’s market capitalization – around $380 billion – pales in comparison to Nvidia’s $4.5 trillion. A vast gulf. It would seem, on the surface, that AMD is poised for a greater leap. But the market, like life, is rarely so simple. To judge solely on valuation is to ignore the weight of earnings, the sweat and toil behind the numbers.

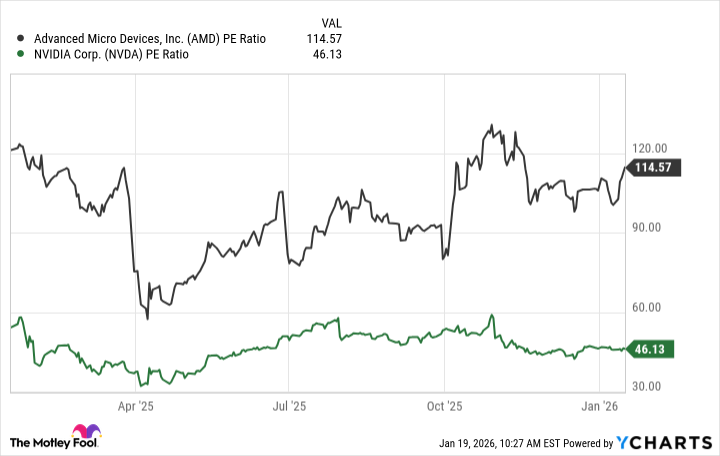

And here, the disparity is stark. Nvidia, despite its higher valuation, is the cheaper investment, at least for now. A sobering thought for those seeking a bargain. AMD, striving to catch up, carries a heavier burden.

As AMD strives to master the art of artificial intelligence chips, profitability should improve. The earnings multiple, currently at 37, should fall. But Nvidia, with a forward P/E of 24, still holds the advantage. A testament to established dominance.

Profitability, ultimately, is the true measure. Nvidia, in the past year, generated nearly $100 billion in earnings. AMD? A mere $3.3 billion. A chasm. Nvidia, with deeper pockets and a more robust machine, is better positioned to weather any storm. The question is not merely who is growing faster, but who can endure.

The Road Ahead

To choose a winner between these two is a fool’s errand. Both have their strengths, their vulnerabilities. AMD, smaller and more nimble, has the potential for a greater leap. But only if its earnings can truly transform. Revenue growth alone is not enough.

Nvidia, the established leader in AI, is not destined to relinquish its crown anytime soon. As long as the demand for AI remains strong, the stock should continue to thrive. But the weight of expectation can be a heavy burden.

I suspect AMD will outperform Nvidia this year. Its earnings, though a fraction of its rival’s, should improve as the AI chip business scales. And with investors finally taking notice, a larger rally may be in the offing. But remember this: the silicon plains are unforgiving. And fortunes, like the tides, can turn quickly.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- The Hidden Treasure in AI Stocks: Alphabet

- If the Stock Market Crashes in 2026, There’s 1 Vanguard ETF I’ll Be Stocking Up On

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Senate’s Crypto Bill: A Tale of Delay and Drama 🚨

- Lumentum: A Signal in the Static

- Actors Who Jumped Ship from Loyal Franchises for Quick Cash

- Berkshire After Buffett: A Fortified Position

- Celebs Who Fake Apologies After Getting Caught in Lies

2026-01-21 05:22