Right. So, the 13F filings are out. Those quarterly reports that tell us what the big boys have been up to. It’s like peering into someone else’s portfolio and thinking, “Oh, they bought that? Interesting…” It’s always 45 days delayed, of course. Because transparency is so efficient. Anyway, it seems Warren Buffett, even in semi-retirement, has been dabbling. And the dabbling involves Alphabet. Google. That one. It’s…unexpected. Not in a disastrous way, just…late to the party.

I mean, Buffett always said stick to what you understand. Easy businesses. Value investing. And AI? AI is…complicated. And expensive. And frankly, a bit terrifying. My current understanding of AI extends to being repeatedly targeted by oddly specific ads for things I mentioned in passing to my sister. So, a foray into that world felt…uncharacteristic. Units of Cryptocurrency Lost: 12. Hours Spent Watching Charts: 9. Number of Panicked Texts to Friends: 24. All related to trying to understand what a “large language model” actually is.

But he did it. Berkshire Hathaway bought nearly 17 million shares of Alphabet in Q3. That’s around $6 billion, which, let’s be honest, is a sum of money that makes my grocery bill weep. It’s about 1.9% of their portfolio. Not insignificant. It suggests he thinks Alphabet will win in the AI race. Which, honestly, is a fairly sensible opinion. Though, as someone who once invested heavily in Betamax, I’m hesitant to declare any technology a “winner” prematurely.

Buffett & the Alphabet Puzzle

Buffett’s always been a Google fan, ostensibly. He just…didn’t buy the stock. For years. It’s like admiring a really nice handbag, then realizing you’ve accidentally spent all your money on artisanal cheese. It’s a choice. A lifestyle. And now, finally, he’s in. Though I suspect someone on his team, possibly a millennial who actually understands algorithms, did the heavy lifting.

The question is, what did he see? Or, more accurately, what did his team see? Alphabet was trailing behind in the generative AI game. They’ve caught up, apparently. Which is good. Though I remain skeptical of anything described as “generative.” It sounds…procreative. And potentially messy.

Timing is Everything (Isn’t It?)

Here’s where it gets tricky. Because we’re looking at historical data. And historical data, as anyone who’s ever regretted a fashion choice can tell you, is rarely a reliable predictor of future success. Alphabet’s stock price in July, when Berkshire could have started buying, was around $175. By the end of September, it was $243. A significant jump. A rather large difference. It’s like buying a concert ticket at face value, then finding out your friend bought the same ticket on the resale market for five times the price. You feel…vindicated, but also slightly foolish.

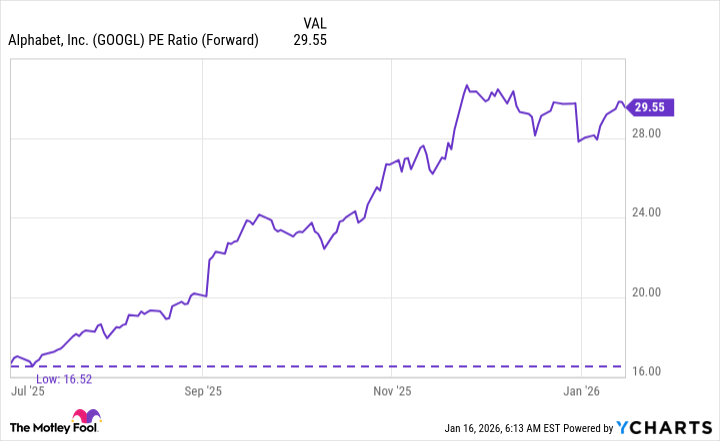

The monopoly case resolution undoubtedly helped. A little bit of legal clarity goes a long way. If Buffett got in before that news dropped, he’s a genius. If he waited, he’s just…following the herd. Either way, the stock is now trading at around 30 times forward earnings. Not exactly a bargain. It’s the equivalent of finding a slightly chipped antique vase at a very high price. You convince yourself it’s worth it because it’s…unique. And you have a weakness for chipped antiques.

Still, 30 times earnings isn’t outrageous for a big tech company. It’s the price of admission to the innovation party. And Alphabet is leading in several fields. They’re growing. They have…potential. So, while I won’t be mortgaging my house to buy more, I don’t think it’s overvalued. Not yet, anyway. Will become disciplined long-term investor: 0%. Number of impulse stock purchases: 7. Current state of financial plan: questionable.

So, a late party? Perhaps. But sometimes, even arriving fashionably late is better than not arriving at all. And, honestly, who am I to judge? I once spent an entire afternoon trying to understand NFTs. The less said about that, the better.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- The Hidden Treasure in AI Stocks: Alphabet

- If the Stock Market Crashes in 2026, There’s 1 Vanguard ETF I’ll Be Stocking Up On

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Senate’s Crypto Bill: A Tale of Delay and Drama 🚨

- Lumentum: A Signal in the Static

- Actors Who Jumped Ship from Loyal Franchises for Quick Cash

- Berkshire After Buffett: A Fortified Position

- Celebs Who Fake Apologies After Getting Caught in Lies

2026-01-21 05:12