At the close of 2024, I ventured a prediction – Nvidia, a company dealing in the ephemeral realm of silicon and code, would achieve a market capitalization of five trillion dollars by 2025. It seemed, at the time, a reasonable enough fancy. The hyperscalers, those vast digital estates, would continue their insatiable hunger for processing power, and for a brief, shimmering moment, the market obliged. The numbers, as they often do, told a story, though whether it was a tale of genuine progress or merely a collective illusion remains, as always, open to interpretation.

The five trillion mark was, indeed, breached. But like a half-remembered dream, the ascent proved fleeting. The valuation retreated, settling back into more…familiar territory. Still, one anticipates a return to those heights, perhaps in 2026. The market, after all, is a patient, if capricious, god.

The initial surge, it must be admitted, was driven by demand – a relentless, almost desperate, need for graphics processing units. The hyperscalers, it appeared, were willing to spend with a recklessness that bordered on the poetic. This trend, thankfully, has persisted. There is, as yet, no sign of a slowdown, though one learns, through experience, that such periods of exuberance rarely last.

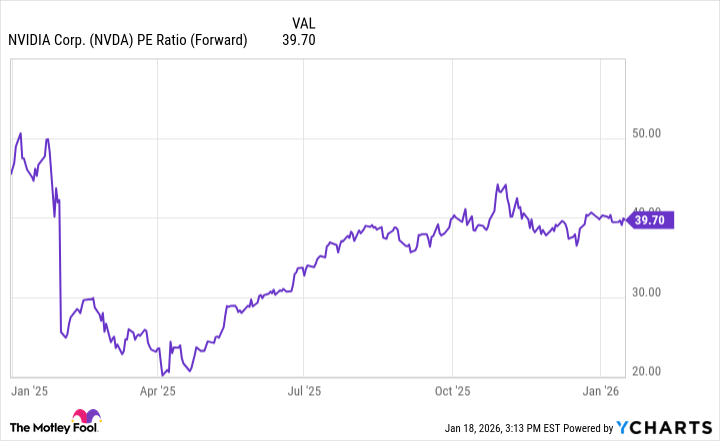

Yet, a detail troubled me. The valuation, while impressive, was not quite as…stratospheric as I had envisioned. At the end of 2024, the price-to-forward earnings ratio stood at 45. A touch expensive, perhaps, but not entirely unreasonable. Now, it hovers around 40. A modest correction, one might say. Though the other large technology companies have also seen their valuations climb, Nvidia still carries a slight premium. A small distinction, easily justified by its growth potential.

Wall Street analysts predict revenue growth of 50%. An optimistic forecast, certainly. But then, optimism is often the lifeblood of the market. Whether Nvidia can sustain such growth remains to be seen. It is, after all, a demanding mistress, progress. And the higher one climbs, the greater the risk of a fall.

Perhaps 2026 will be the year Nvidia finally solidifies its position in the five trillion dollar club. A mere ten percent increase in the stock price, a modest ambition in these volatile times. But even if that goal is not achieved, it will not be a tragedy. The market will continue its dance, indifferent to our hopes and fears. And Nvidia, like all companies, will continue to exist, to innovate, to struggle, and, eventually, to fade into the vast, indifferent landscape of history. It is a comforting thought, in its way. A reminder that even the most ambitious dreams are, ultimately, ephemeral.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- The Hidden Treasure in AI Stocks: Alphabet

- If the Stock Market Crashes in 2026, There’s 1 Vanguard ETF I’ll Be Stocking Up On

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Senate’s Crypto Bill: A Tale of Delay and Drama 🚨

- Lumentum: A Signal in the Static

- Actors Who Jumped Ship from Loyal Franchises for Quick Cash

- Berkshire After Buffett: A Fortified Position

- Celebs Who Fake Apologies After Getting Caught in Lies

2026-01-21 04:13