![]()

Many years later, as the algorithms themselves began to whisper of obsolescence, old Manuela remembered the day the cloud first settled over the valley of Silicon. It wasn’t a storm cloud, not precisely, but a shimmering, ethereal haze that promised connection and efficiency, and carried, unbeknownst to anyone, the seeds of a peculiar reckoning. GitLab, a name that tasted of damp earth and distant servers, was then a rising star, a beacon in that digital firmament, though even then, the most astute traders felt a subtle tremor, a premonition of the long fall to come.

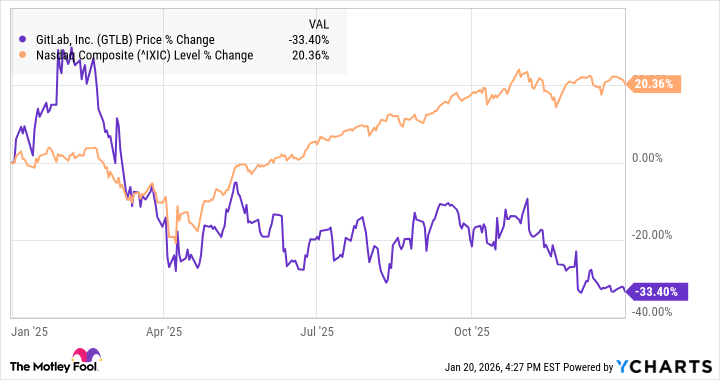

The year 2025, viewed from the vantage point of a fading optimism, proved to be a cruel teacher. Shares of GitLab, the cloud-based DevSecOps platform, surrendered a third of their value, a slow, agonizing descent mirroring the erosion of trust in the very foundations of the tech boom. It wasn’t a sudden collapse, not a dramatic implosion, but a gradual leaching of momentum, a subtle draining of the color from its once-vibrant chart. The market, of course, soared around it, a mocking chorus of success while GitLab listed, a wounded bird in a flock of eagles. The tariffs, they said, were the cause, the “Liberation Day” pronouncements echoing like a death knell. But the truth, as always, was more complex, a tapestry woven with threads of slowing growth, inflated expectations, and the unsettling realization that even innovation has its limits.

The early months had been deceptively kind. A feverish hope, fueled by the promise of Artificial Intelligence, had lifted the stock, a fragile balloon inflated with the breath of speculation. But the market, a capricious lover, soon turned its attention elsewhere, and the inevitable correction arrived, bringing with it the chill of February and March. GitLab, though relatively shielded from the immediate impact of trade wars and budget cuts, was not immune. Its valuation, a shimmering mirage built on future potential, proved particularly vulnerable to the prevailing winds of fear. A promising fourth-quarter earnings report offered a fleeting respite, a momentary bloom in the encroaching darkness, but the underlying anxieties persisted, like a persistent cough in a humid room.

The guidance for the year, alas, was a disappointment, a carefully worded admission that the growth trajectory was beginning to flatten. By the third quarter, the numbers told a more sobering tale: revenue up 25% to $244.4 million, a respectable increase, certainly, but no longer enough to justify the lofty expectations. A murmur of discontent began to ripple through the investor community, a suspicion that the generative AI revolution, far from being a boon, might actually be a threat. The ease with which code could now be generated, some whispered, diminished the value of the platform itself. And then there was the shadow of Microsoft, its GitHub looming large, a rival with seemingly limitless resources and a relentless ambition.

The stock, already bruised, slumped further, its decline mirroring the fading light of the year. Even the broader enthusiasm surrounding AI, a fever dream of automation and efficiency, failed to lift its spirits. It was as if the platform, once a symbol of progress, had fallen into a digital melancholy, a quiet resignation to its fate.

What’s Next for GitLab

The sell-off, extending into the new year, has left GitLab trading at a price-to-sales ratio of just 6, a stark contrast to the extravagant valuations of a year or two ago. It is a humbling moment, a reckoning with reality. The question now is whether the company can convince investors that it can not only survive in the age of AI but thrive, maintaining its growth rate and, crucially, delivering a meaningful profit on a GAAP basis.

For the moment, the market remains skeptical. The task before GitLab is a formidable one, a climb up a steep and treacherous slope. Many believe it may be too tall an order, a prophecy destined to remain unfulfilled. But in the valley of Silicon, as old Manuela knew, even the most improbable miracles have a way of unfolding, often in the most unexpected of ways.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- The Hidden Treasure in AI Stocks: Alphabet

- If the Stock Market Crashes in 2026, There’s 1 Vanguard ETF I’ll Be Stocking Up On

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Lumentum: A Signal in the Static

- Actors Who Jumped Ship from Loyal Franchises for Quick Cash

- Berkshire After Buffett: A Fortified Position

- Celebs Who Fake Apologies After Getting Caught in Lies

- AI Stocks: A Slightly Less Terrifying Investment

2026-01-21 03:52