Right. So, it seems someone somewhere decided to have a little wobble on January 20th. U.S. equities, those things people apparently worry about, had what the newspapers are calling a “rough day.” Selling, as in actual people selling things, swept across every major index. The Dow Jones Industrial Average, which sounds like a very serious league of gentlemen, took the biggest hit, plummeting a frankly alarming 870.74 points. As if that wasn’t enough, even the digital stuff didn’t escape the general air of discontent.

Dow Takes a Tumble, Bitcoin Briefly Remembers What Down Feels Like

U.S. equities generally decided they needed a sit-down on Tuesday, with selling pressure building up like a very impatient queue. The Dow, in its infinite wisdom, decided to lead the charge downwards, tumbling 870.74 points to 48,488.59. The Nasdaq Composite followed suit, dropping 561.06 points to 22,954.32, while the S&P 500 and NYSE Composite also joined the party, losing points with a sort of resigned sigh. It was, in short, a day where nobody won, which is statistically quite likely, actually.

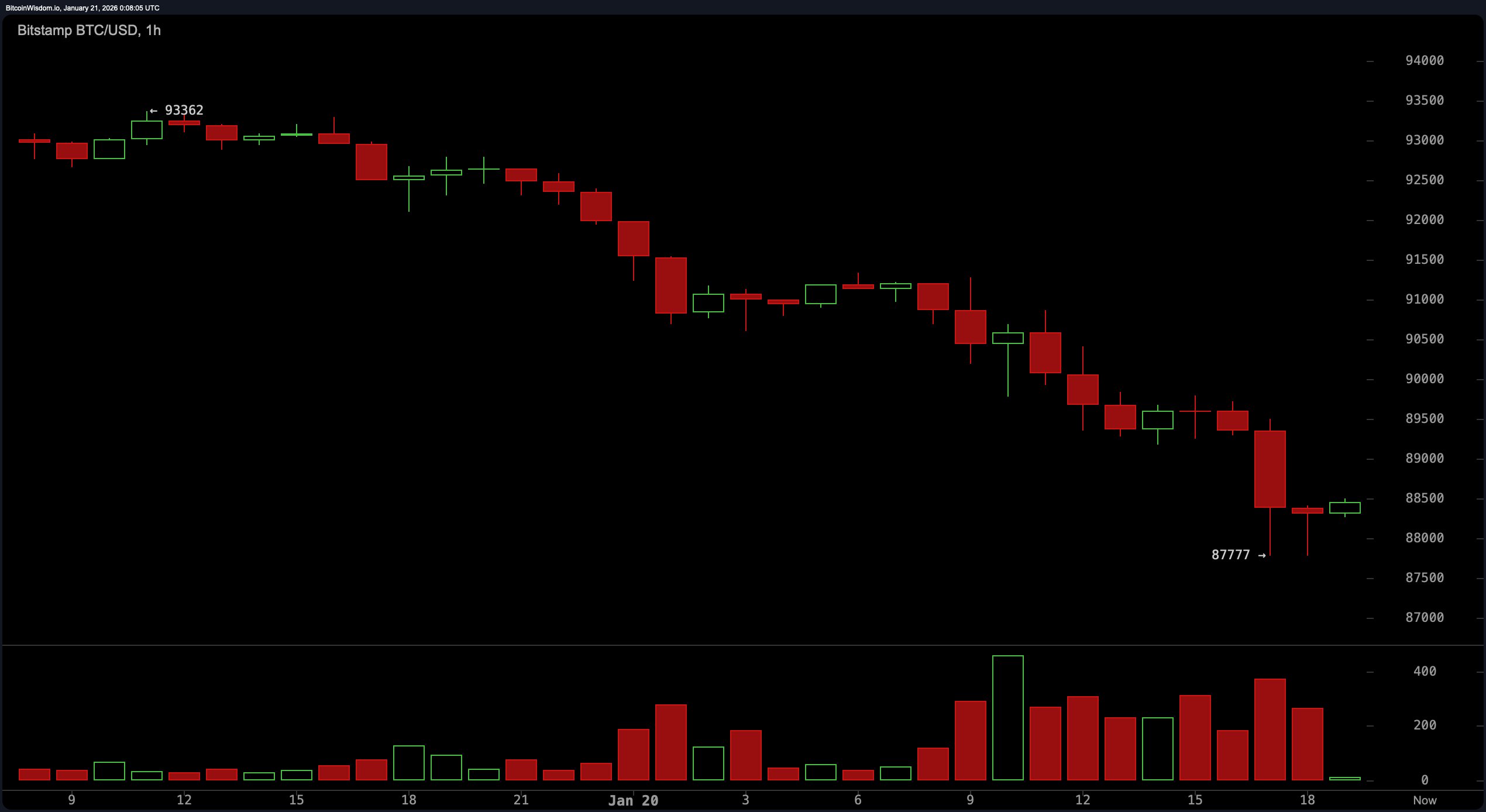

The financial media, those dedicated purveyors of gloom, are blaming it all on President Trump’s latest round of tariff threats. Apparently, someone wasn’t happy with something someone else was doing, and now the whole world gets to feel a bit awkward. Tuesday’s sell-off was, we are told, the biggest single-day slide since October 2025. The crypto market, ever sensitive, is down 4.72%, hovering nervously around the $2.99 trillion mark, and clearly questioning all its life choices. Bitcoin (BTC), naturally, was also affected, slipping below $89,000 to a frankly devastating $88,302 per coin. (Devastating, to a computer, anyway.)

Strategy (Nasdaq: MSTR) took a particularly nasty tumble, sinking 7.76%, while Coinbase (Nasdaq: COIN) also felt the pinch, falling 5.57%. Even USDC issuer Circle Internet Group, Inc. managed to get in on the downward trend, dropping 7.52%. Bullish (NYSE: BLSH) did comparatively well, losing only 0.10%, which, in the grand scheme of things, is basically a victory. And the bitcoin miners? Oh, they were all painted red, like a very depressing abstract artwork.

MARA Holdings led the downward spiral, dropping 8.75% to $10.37. Bitdeer wasn’t far behind, off 7.45% to $14.65, and IREN Limited slid 6.50% to $54.06. The rest followed suit with varying degrees of enthusiasm for self-destruction.

Tuesday’s events were a stark reminder that even seemingly unrelated economic anxieties can somehow combine to produce a general feeling of mild panic. And, rather brilliantly, bitcoin seemed to know all this was coming before anyone else did. Which, come to think of it, is a little suspicious.

So, tariff talk is rattling everyone’s nerves, and stocks, miners, and bitcoin-linked things are all feeling a bit peaky. Bitcoin is still above $88,000, which is technically good, but nobody’s celebrating yet. The markets are now waiting to see if this is just a temporary blip, or the beginning of a full-blown crisis. But honestly, who can tell anymore? It’s all terribly complicated.

Frequently Asked Questions (Because People Ask) ❓

- Why did everything go a bit wobbly on January 20th? President Trump threatened tariffs, and apparently, markets dislike tariffs. It’s a whole thing.

- Which part of the market had the biggest grumble? The Dow Jones Industrial Average. It’s always the Dow Jones Industrial Average.

- What about bitcoin and crypto? They wobbled a bit, too. Because everything wobbles.

- Why did the bitcoin mining stocks look so glum? They follow the general trend. Also, they’re mining digital things, which is inherently a bit weird.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- The Hidden Treasure in AI Stocks: Alphabet

- If the Stock Market Crashes in 2026, There’s 1 Vanguard ETF I’ll Be Stocking Up On

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Lumentum: A Signal in the Static

- Actors Who Jumped Ship from Loyal Franchises for Quick Cash

- Berkshire After Buffett: A Fortified Position

- Celebs Who Fake Apologies After Getting Caught in Lies

- AI Stocks: A Slightly Less Terrifying Investment

2026-01-21 03:27