Palantir Technologies, a name whispered with a peculiar blend of anticipation and apprehension, has ascended in recent years, a veritable shooting star in the firmament of technology. Its success, inextricably linked to the burgeoning field of artificial intelligence, is undeniable. Businesses, ever seeking efficiency, have turned to its platforms, and Palantir has, for a time, delivered. The recent quarters have borne fruit, and some investors have reaped a considerable harvest. Yet, as with all things touched by such rapid growth, a certain unease settles upon the discerning observer.

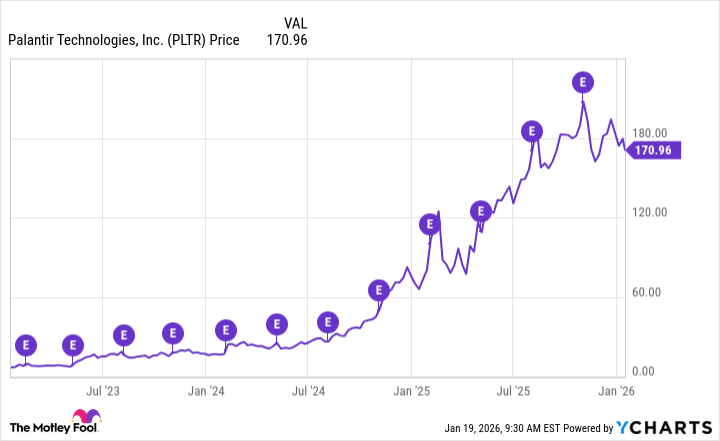

Three years have passed, and the stock has multiplied in value by a factor that borders on the fantastical—a surge of 2,400%. Its market capitalization, exceeding $400 billion, places it amongst the titans of industry, a position earned, perhaps, more through prevailing sentiment than immutable worth. It stands now, a somewhat improbable edifice, built upon the shifting sands of expectation.

On February 2nd, the company is scheduled to unveil its fourth-quarter earnings, a ritual that will either confirm or dispel the illusions that have taken root. The question, then, is not merely whether to acquire shares, but whether to participate in a game whose rules seem increasingly detached from reality.

Does the Market Reward Consistent Performance?

Palantir, it must be conceded, has not been a stock for the timid. Its valuation has long demanded a certain faith, a willingness to look beyond conventional metrics. Yet, even strong results have not always been enough to sustain the upward trajectory. The most recent earnings report, released in November, found the stock already perched at an altitude of $207.52. The subsequent decline, despite management’s pronouncements of exceeding expectations, serves as a quiet reminder that the market, like a fickle patron, can withdraw its favor as swiftly as it bestows it.

The chart, a rather stark depiction of recent performance, reveals a pattern of peaks and valleys. While generally inclined upwards, the most recent descent suggests a limit to the market’s willingness to reward ambition without commensurate returns. It is a lesson learned time and again: even the most promising ventures are subject to the laws of gravity.

Currently trading at a price-to-earnings multiple of approximately 400, Palantir demands a degree of optimism that borders on the audacious. While lower than previous heights, it remains a valuation predicated on expectations of boundless growth. The company must not merely meet, but surpass, these lofty projections if it is to justify its current price. It is a precarious position, akin to a tightrope walker balancing between ambition and reality.

The AI Horizon: Promise and Peril

For Palantir to sustain its valuation, investors will require continued evidence of robust growth and a clear path to future profitability. The prevailing narrative surrounding artificial intelligence, with its promises of transformative change, provides a fertile ground for optimism. Research from Gartner suggests that 60% of brands will deploy agentic AI by 2028, seeking to streamline interactions and automate processes. Palantir, with its AIP agent studio, is positioned to capitalize on this trend.

There is, of course, the ever-present specter of a potential slowdown in AI spending. Yet, as of this moment, there is little evidence to suggest that companies are curtailing their investments. Indeed, demand for AI-related products and services appears likely to remain strong for the foreseeable future, a welcome development for Palantir’s shareholders.

A Measured Approach

Palantir is, without question, a company performing exceptionally well. The recent quarter saw a revenue increase of 63%, and the company remains confident in its future prospects. However, performance alone does not justify any price. Valuation, a concept often overlooked in the heat of speculation, is paramount. To ignore it is to court disaster, for even the most promising business can be rendered unpalatable by an exorbitant price tag.

There are, thankfully, numerous other AI stocks available, trading at more reasonable valuations. These represent, in my estimation, more prudent investments at this juncture. The current price of Palantir, inflated by hype and speculation, makes it, in my view, an unattractive purchase ahead of the earnings report. It is a lesson learned from years of observing the market: patience, and a measured approach, are virtues often rewarded.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- DOT PREDICTION. DOT cryptocurrency

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- NEAR PREDICTION. NEAR cryptocurrency

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Top 15 Insanely Popular Android Games

- USD COP PREDICTION

2026-01-21 02:52