The marketplace, a vast and often capricious garden, has lately offered little sustenance to those seeking simple, wholesome fare. The cost of nourishment, both literal and financial, has risen, leaving many to choose between a full plate and a hopeful future. It is a curious thing, this hunger, and a more curious still that those who sought to ease it now find themselves diminished.

Two ventures, Sweetgreen and Beyond Meat, once promising seedlings in this garden, have withered under the harsh glare of the recent season. Their shares, once emblems of a hopeful new harvest, have fallen nearly eighty percent. A stark reminder that even the most carefully cultivated ambitions can be overtaken by the winds of circumstance.

Both bear the marks of struggle, yet one may offer a more tenacious root system. Let us examine their condition, not as mere numbers on a ledger, but as narratives unfolding within the larger story of our times.

The Measure of Growth

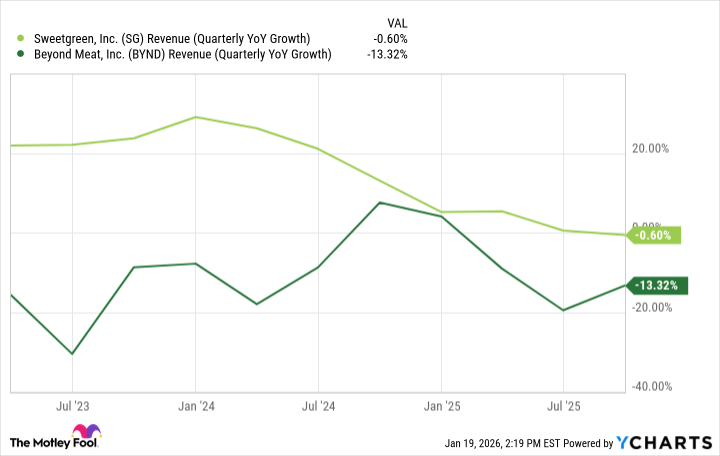

Both Sweetgreen and Beyond Meat have felt the slowing of the spring thaw, their rates of expansion diminished. Sweetgreen, offering its carefully assembled salads at a price that whispers of indulgence, has seen its momentum tempered. Beyond Meat, striving to replicate the familiar comfort of meat without the source, faces a crowded field and a growing skepticism about the true cost of such artifice.

Sweetgreen, at least, has not yet descended into outright contraction. It remains a fragile bloom, but one that still reaches for the light. Beyond Meat, however, seems to be losing ground, its offerings met with a weariness that suggests a deeper dissatisfaction.

Sweetgreen, therefore, possesses a slight advantage – a resilience born not of strength, but of merely not yet failing entirely.

Margins and the Weight of Loss

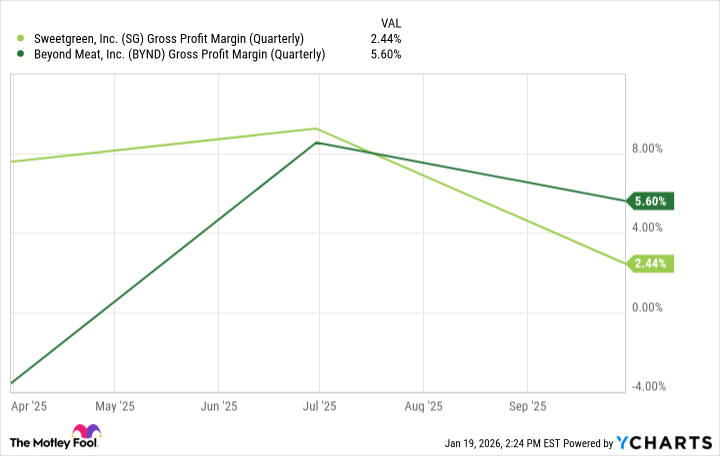

Both companies currently operate at a loss, their accounts reflecting a hemorrhage of resources. Yet, the gross profit margin – that delicate balance between cost and revenue – offers a glimpse into which might staunch the flow. It is a subtle indicator, a whisper in the wind, but one worth heeding.

Beyond Meat has shown recent improvement, a fleeting resurgence of vitality. Sweetgreen, too, has avoided the abyss of negative margins, though its position remains precarious. Neither is truly strong, but both exist in a state of fragile equilibrium. A tie, perhaps, but one forged in the fires of uncertainty.

The Currents of Finance

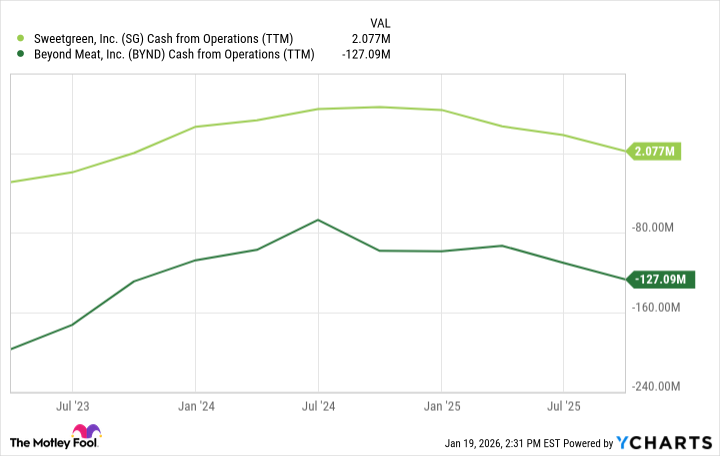

The true test of any venture is its ability to weather the storms. Can it sustain itself through lean seasons, or will it be swept away by the relentless currents of finance? Operating cash flow – the lifeblood of any enterprise – is the measure of its resilience.

Sweetgreen, remarkably, has generated positive cash flow, a testament to its ability to navigate the turbulent waters. Beyond Meat, however, struggles to keep its head above water, its cash reserves dwindling with each passing quarter. It is a dangerous position, one that may force difficult choices – dilution, debt, or, ultimately, dissolution.

Beyond Meat’s reserves, a mere $117 million as of September, are a slender shield against the coming winter. Without a significant change in its fortunes, it risks being consumed by the very forces it seeks to overcome.

A Cautious Bloom for 2026

If forced to choose, to cast a seed upon the uncertain soil of the market, I would place it with Sweetgreen. Its fundamentals, though imperfect, are stronger. Its cash flow, a steady pulse in a troubled landscape, offers a measure of security. Beyond Meat, while striving to innovate, appears to be losing ground, its efforts hampered by competition and a growing skepticism about its offerings.

Both ventures face an uphill battle, but Sweetgreen, with its cautious bloom, may have a better chance of turning things around. It is a gamble, to be sure, but one guided by a careful reading of the currents, and a recognition that even in the darkest of seasons, a single, resilient seed can still take root.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- The Hidden Treasure in AI Stocks: Alphabet

- If the Stock Market Crashes in 2026, There’s 1 Vanguard ETF I’ll Be Stocking Up On

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Lumentum: A Signal in the Static

- Actors Who Jumped Ship from Loyal Franchises for Quick Cash

- Berkshire After Buffett: A Fortified Position

- Celebs Who Fake Apologies After Getting Caught in Lies

- AI Stocks: A Slightly Less Terrifying Investment

2026-01-21 01:43