As I strolled through the streets of Moscow, I stumbled upon a peculiar sight – the Sonic token, rising like a phoenix from the ashes, had crossed the $0.34 mark on Thursday, July 3. The traders, like a pack of wolves, were placing their last-minute bets ahead of the upcoming unlock event. The air was thick with anticipation, and the technical indicators whispered secrets of a potential 10% breakout. 🤫

Andre Cronje, the maestro behind Sonic, had orchestrated a double-digit gain on Wednesday, a 15% rally that reclaimed the $0.33 level. The market sentiment was a symphony of speculation, with reports hinting at network development updates and the upcoming ecosystem events. 🎵

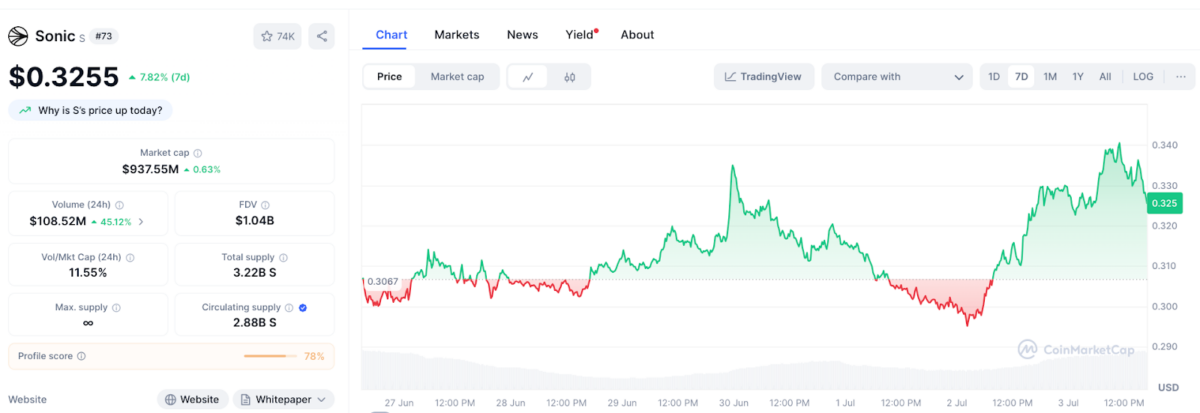

Sonic price action | Source: Coinmarketcap

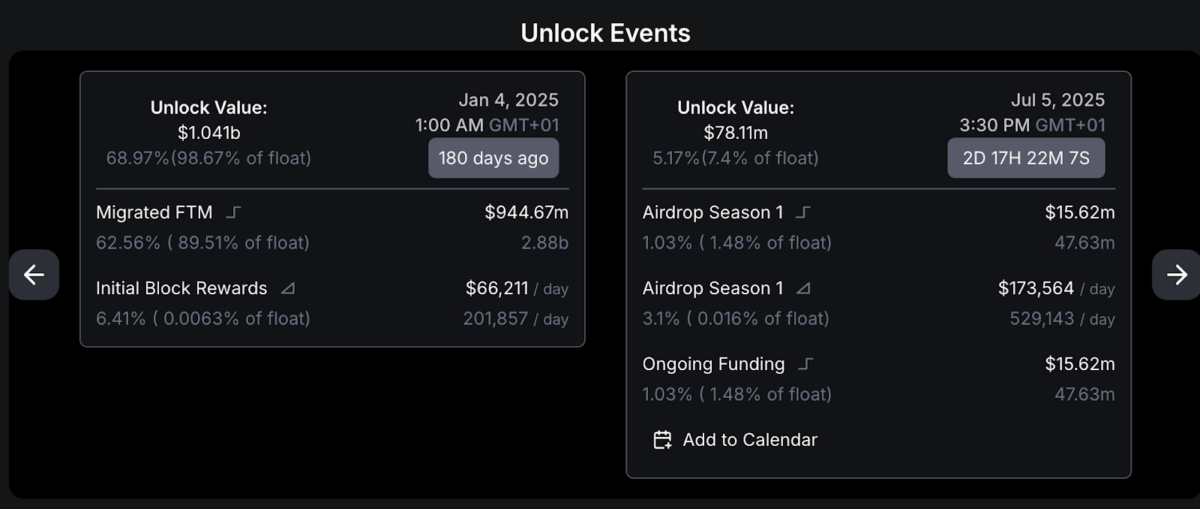

But, my dear friend, the plot thickens. According to DeFiLlama data, Sonic is set to unlock $78.1 million worth of tokens on Friday, July 5. The token unlocks, a bearish event, or so they say. Yet, the speculative traders, like a troupe of acrobats, are betting on heightened activity and liquidity. 🤹♀️

Sonic Token Unlock Scheduled for July 5, 2025 | Source: DeFillam

This pre-unlock optimism, a clever ruse, may explain Sonic’s sharp 10% intraday rally and the token’s current valuation, hovering near the $975 million mark, like a bird in flight. 🐦

Trading volume for Sonic has surged above $90 million, a level not seen since June 27, 2025. The market participation, a grand spectacle, is a testament to the investors’ preparation for post-unlock volatility. 🎪

Now, my friend, let us gaze into the crystal ball of technical analysis. Sonic price has broken above the 20-day Simple Moving Average (SMA) at $0.31, a vital short-term support level. The Parabolic Stop and Reverse (SAR) indicator, a blue dot beneath recent price candles, whispers secrets of an active uptrend. 🔮

Sonic price prediction

The Bollinger Bands, a volatility indicator, are widening, like a serpent uncoiling. This expansion suggests growing volatility and the potential for stronger price swings. If Sonic maintains its position above the middle band at $0.31, it could aim for the upper resistance near $0.36. 🎯

Lastly, the MACD (Moving Average Convergence Divergence) shows a bullish crossover. The MACD line has crossed above the signal line with positive histogram bars, a classic indication that buyer momentum is returning. If Sonic sustains this trend, it could challenge and break above the psychological $0.35 level, and potentially target $0.38 in the days ahead. 🔥

And now, my friend, let us not forget the importance of secure storage. Best Wallet, a non-custodial solution, emerges as the go-to choice for users interacting with fast-moving assets like SONIC. 🔒

With native support for Ethereum, Solana, Arbitrum, and all top Layer-1 and Layer-2 chains, Best Wallet empowers users to manage Sonic and other tokens from a single secure interface. Whether you’re trading Sonic or holding for long-term growth, Best Wallet ensures your assets remain accessible and protected. Visit the official website to buy $BEST token now. 🛍️

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- TON PREDICTION. TON cryptocurrency

- Gold Rate Forecast

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- Top 15 Movie Cougars

- Russian Crypto Crime Scene: Garantex’s $34M Comeback & Cloak-and-Dagger Tactics

- Ephemeral Engines: A Triptych of Tech

- Enduring Yields: A Portfolio’s Quiet Strength

2025-07-03 23:25