One really must say, the recent performance of Amazon (AMZN +0.49%) has been…understated. A mere 5% uptick in a year? Terribly pedestrian, especially when one considers the rather frantic pace of the ‘Magnificent Seven’ and the general exuberance of the S&P 500 and Nasdaq Composite. Still, a pause for reflection is often quite beneficial, don’t you think? And frankly, one finds the current market undervaluation rather…inviting.

Let’s not be dramatic, of course. Amazon isn’t about to collapse into a heap of unsold books and disgruntled delivery drivers. Quite the contrary. It simply requires a discerning eye – and a rather robust portfolio – to appreciate its underlying strengths. Here are three perfectly good reasons to double down, as it were.

E-Commerce: From Loss Leader to…Less of a Loss

Everyone, naturally, thinks of Amazon as a purveyor of…everything. But for years, that particular arm of the business operated, shall we say, at a deficit. A charmingly generous approach, perhaps, but hardly sustainable. They relied on other ventures to subsidize the shipping costs of everyone’s impulse buys. How quaint.

Now, however, things are shifting. Robotics and automation, you see, are finally beginning to justify the expenditure. A few jobs lost, admittedly – one can’t make an omelette without breaking eggs, and all that – but the potential cost savings are quite substantial. Morgan Stanley estimates a potential $4 billion saving this year alone, and a staggering $10 billion annually by 2030 if they manage to streamline 30-40% of US orders through their next-generation warehouses. Efficient, wouldn’t you say?

One million robots already deployed. It’s practically a mechanical army. One hopes they’ve given them charming names.

AWS: Capacity and a Touch of Competition

Amazon Web Services – the engine of their profitability, naturally – has been experiencing a touch of…scrutiny. Growth has slowed, and those tiresome upstarts at Microsoft’s Azure and Alphabet’s Google Cloud are nipping at their heels. One hates to see a monopoly challenged, but competition, I suppose, is the price of progress.

A 17-20% year-over-year growth rate isn’t exactly cause for alarm, you understand. It’s perfectly respectable, even if it’s not quite the dizzying heights of some of its rivals. Amazon is investing heavily in AWS, ensuring it’s prepared for the inevitable ‘artificial intelligence arms race’ – a rather dramatic phrase, don’t you think? They’ve added 3.8 gigawatts of computing capacity in the past year, with plans to double that by 2027.

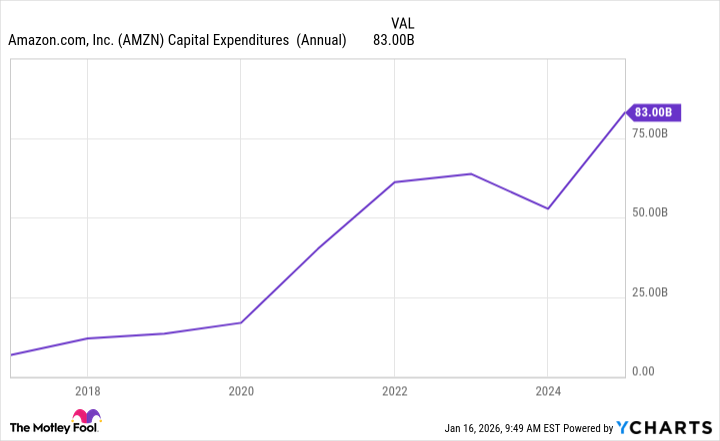

More capacity means clearing backlogs and onboarding customers. It’s rather like widening a particularly congested highway. Amazon’s capital expenditure will likely exceed $125 billion this year – a rather substantial sum, admittedly – but a necessary one. Even if the AI frenzy subsides, these investments will pay dividends long term. They’re powering a significant portion of the internet, after all.

Advertising: A Quietly Lucrative Diversion

E-commerce and AWS get all the attention, naturally. But advertising is quietly becoming a rather lucrative little earner for Amazon. $17.7 billion in revenue in the third quarter of 2025, up 24% year-over-year. It’s their fastest-growing segment, you see.

They have an astonishing amount of data on millions of customers – shopping habits, viewing preferences, browsing history, listening choices. It’s a goldmine for advertisers, allowing them to target their campaigns with unnerving accuracy. And, of course, they can capture eyeballs across Amazon.com, Prime Video, Twitch, Freevee, and their entire device ecosystem.

They won’t reach the scale of Google or Meta Platforms in advertising anytime soon – if ever – but having a third profit center is rather sensible. It allows them to invest in other, more speculative – or simply expensive – ventures. A touch of financial prudence, you see. And one always appreciates a touch of prudence.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- The Hidden Treasure in AI Stocks: Alphabet

- If the Stock Market Crashes in 2026, There’s 1 Vanguard ETF I’ll Be Stocking Up On

- Warby Parker Insider’s Sale Signals Caution for Investors

- Beyond Basic Prompts: Elevating AI’s Emotional Intelligence

- Actors Who Jumped Ship from Loyal Franchises for Quick Cash

- Berkshire After Buffett: A Fortified Position

- Celebs Who Fake Apologies After Getting Caught in Lies

- 20 Must-See European Movies That Will Leave You Breathless

2026-01-20 07:22