NVDA”>

Wall Street, ever optimistic, predicts data center revenue of $320 to $330 billion by 2026. A sum sufficient to purchase a small principality, or perhaps fund a particularly ambitious opera. Nvidia, it seems, is capturing a full 60% of big tech’s infrastructure spending. One begins to suspect a conspiracy. A secret pact between silicon and ambition.

These hyperscalers, you see, are entering into multiyear agreements. A peculiar habit, really. As if they anticipate a prolonged period of… something. Nvidia, naturally, is positioned to benefit. Gaining revenue and profit visibility with each new contract signed. It’s a beautifully simple scheme, really. Like a well-oiled machine. Or a particularly cunning fox.

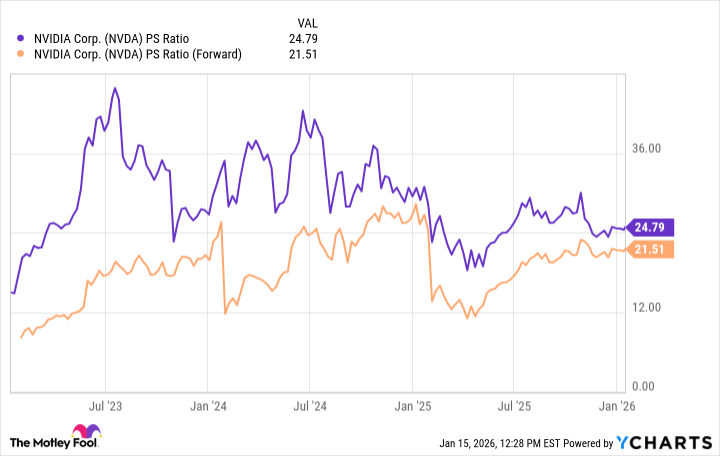

A Most Peculiar Valuation

Observe this chart, if you will. It illustrates the trends in Nvidia’s price-to-sales ratios. Note how both multiples have compressed over the last year. It suggests, perhaps, that the market is beginning to view Nvidia not as a hypergrowth stock, but as… a mature business. A rather unsettling thought, wouldn’t you agree? As if the company were suddenly afflicted with a touch of… respectability.

But fear not! There is still hope for further valuation expansion. Even as the multiples tighten. The key, you see, is to remember that Nvidia is, relatively speaking, absurdly cheap. Compared to other contributors to this AI boom – the enterprise software vendors, the cloud computing providers – it looks like a bargain. A positively scandalous bargain, in fact.

The Fortune Teller’s Prediction

Over the last twelve months, Nvidia has generated $167 billion in data center revenue. At its current valuation, the company is valued at roughly 27 times those sales. Should it double those sales, as it intends, it would be worth almost $9 trillion. Assuming, of course, that its valuation profile remains the same. A rather large assumption, wouldn’t you agree? As if the market were a perfectly rational actor.

Let us be conservative, then. Let us assume that the ratio between market cap and data center sales compresses to 21. At this multiple, the business would be worth about $7 trillion. A perfectly respectable sum. Sufficient to build a magnificent palace, or perhaps fund a particularly extravagant ballet.

This, of course, is merely a mathematical exercise. A fanciful speculation. But the key takeaway is this: Nvidia is in a position to generate further gains. Even with its valuation multiples normalizing. It is a company built on a foundation of silicon and ambition. And that, my friends, is a rather potent combination.

By the end of 2026, I predict that Nvidia could be worth anywhere between $7 trillion and $9 trillion. At the midpoint of this range, it could be trading for roughly $330 per share. Implying more than 70% upside from current levels. A most peculiar fortune, indeed. One that leaves me with a distinct feeling of… unease.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- The Hidden Treasure in AI Stocks: Alphabet

- If the Stock Market Crashes in 2026, There’s 1 Vanguard ETF I’ll Be Stocking Up On

- Warby Parker Insider’s Sale Signals Caution for Investors

- Beyond Basic Prompts: Elevating AI’s Emotional Intelligence

- Actors Who Jumped Ship from Loyal Franchises for Quick Cash

- Celebs Who Fake Apologies After Getting Caught in Lies

- 20 Must-See European Movies That Will Leave You Breathless

- 2 Hot AI Stocks You Should Consider Selling Right Now

2026-01-20 03:32