Right. Artificial intelligence. Everyone’s lost their minds, haven’t they? It’s the new alchemy. Turn data into gold, apparently. And naturally, the usual suspects – Microsoft, Amazon, the whole lot – are hoovering up the profits. Predictable. But then there’s Palantir. Honestly, it’s a bit… dramatic. Like a Bond villain’s software company. And the stock? Let’s just say I’ve seen more sensible valuations on vintage handbags.

Everyone’s terribly excited about this Tyler Radke at Citi, upgrading his outlook. $235 price target. Thirty-four percent upside. Oh, fantastic. Another analyst throwing fuel onto the bonfire. It’s almost… endearing. Like watching someone desperately try to convince themselves they’ve made a good decision. I mean, I’ve been that person. Several times. Usually involving shoes.

Why is Citi so… optimistic?

Palantir makes software. Fancy software, apparently, called Foundry, Gotham, and Apollo. Sounds like a space program. Or a particularly aggressive marketing department. They sell it to businesses and governments. Which, let’s be honest, is always a good sign. Someone’s footing the bill. The clever bit, and it is clever, is locking people into multi-year contracts. It’s like a really expensive gym membership. They’ve got your money, even if you never actually go.

Everyone’s obsessing over “remaining performance obligations” – RPOs. Basically, money they’ve promised but haven’t actually received. It’s like accepting a wedding gift before the wedding. Looks good on paper, but you might end up with a toaster you don’t need. Radke’s pointing to $3.6 billion in the US commercial segment. Impressive. Though, I suspect a good accountant could make anything look impressive.

And the government, of course. The Department of Defense. Always a reliable source of funding. They’re throwing money at AI like it’s going out of style. Which, let’s face it, it probably is. Palantir could apparently grow its public sector business by 51% in 2026. Or 70%. It’s… ambitious. But hey, why not aim for the moon? Especially when someone else is paying for the rocket fuel.

They’ve got deals with the Army, expansion of Maven Smart System, partnerships with NATO, even France’s intelligence arm. It’s a global operation. And they’re cozy with Nvidia. Which, let’s be real, is basically the plumbing of the entire AI revolution. It all feels… very well-connected. And slightly unsettling. Like a conspiracy theory that might actually be true.

Can this keep going? Seriously?

Okay, let’s talk numbers. In November 2022, Palantir was worth $12.5 billion. Now? Over $400 billion. Greater than Salesforce and Adobe combined. I mean, come on. That’s… a lot. It’s the kind of valuation that makes me clutch my pearls. If I owned pearls, that is. I mostly own regrets.

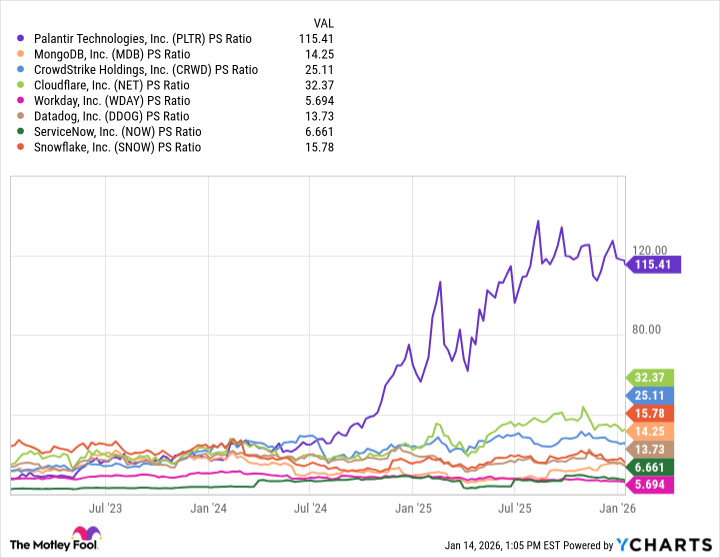

The price-to-sales ratio is 115. One hundred and fifteen! It’s… unsustainable. It’s like building a house of cards on a trampoline. It might work for a while, but eventually, it’s going to come crashing down. And I, for one, don’t fancy being underneath when it does.

A clever play, but let’s be sensible, shall we?

Look, I’m not saying Palantir is a bad company. It’s clever, it’s well-connected, and it’s riding the AI wave. But I also think people are getting carried away. It’s the herd mentality. Everyone piling in, afraid of missing out. And that, my friends, is usually a recipe for disaster. I’d be surprised if it hit $200, sure. But I’d be even less surprised if it didn’t.

Of the 25 analysts covering the stock, 17 say “hold.” They’re not idiots. They see the same frothy valuation I do. So, yes, Palantir might be a winner in the long run. But I suspect there will be more reasonable entry points. For those of us who prefer to exercise a little prudence. And a healthy dose of cynicism. Because, let’s be honest, in this market, cynicism is a survival skill.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- The Hidden Treasure in AI Stocks: Alphabet

- If the Stock Market Crashes in 2026, There’s 1 Vanguard ETF I’ll Be Stocking Up On

- Warby Parker Insider’s Sale Signals Caution for Investors

- Beyond Basic Prompts: Elevating AI’s Emotional Intelligence

- Actors Who Jumped Ship from Loyal Franchises for Quick Cash

- Celebs Who Fake Apologies After Getting Caught in Lies

- 20 Must-See European Movies That Will Leave You Breathless

- Why Shares of Krispy Kreme Are Surging Today

2026-01-20 00:12