So, 2025 happened. Apparently, nuclear energy is having a moment. Which, let’s be honest, is a little bit like finding out your grandma is a TikTok star. Unexpected, but…potentially lucrative. Everyone’s building data centers for all this AI stuff – it’s like a digital land grab, and those servers need power. And not the kind you get from hoping really hard. Centrus Energy (LEU +8.14%) had a year, up 264%. It’s up another 26% this year. I’m starting to think I need to trade in my sensible shoes for a hazmat suit.

The International Energy Agency (IEA) says data centers are already sucking up 1.5% of all global electricity. That’s like, one very large, very demanding houseguest. And it’s growing at 12% a year. By 2030, they predict it’ll be 3%. Look, I’m not a mathematician, but that’s…a lot of electricity. The Department of Energy wants to triple U.S. nuclear production by mid-century. It’s ambitious. It’s also, from a dividend hunter’s perspective, interesting.

And here’s the kicker: Centrus is basically in the backyard of the entire data center boom. Northern Virginia is ground zero, and they’re right there. It’s like owning the coffee shop next to the stadium on game day. A good location is 90% of the battle, as they say in real estate, and apparently, in nuclear fuel refinement.

How Does This Whole Nuclear Thing Work?

Okay, so Centrus, based in Bethesda (where, incidentally, they filmed a lot of The West Wing – a good sign, right?), refines nuclear fuel. It’s not like throwing coal on a fire. It’s…more complicated. Uranium isn’t just pulled out of the ground and magically powering your toaster. It requires some… finesse.

Most uranium is this isotope, U-238, which is, shall we say, a bit of a wallflower. It’s radioactive, sure, but it doesn’t really do much. You need to strip off some neutrons – three, to be precise – to get U-235, which is the stuff that actually splits and releases energy. It’s like taking a shy introvert and giving them a microphone. Suddenly, things get interesting.

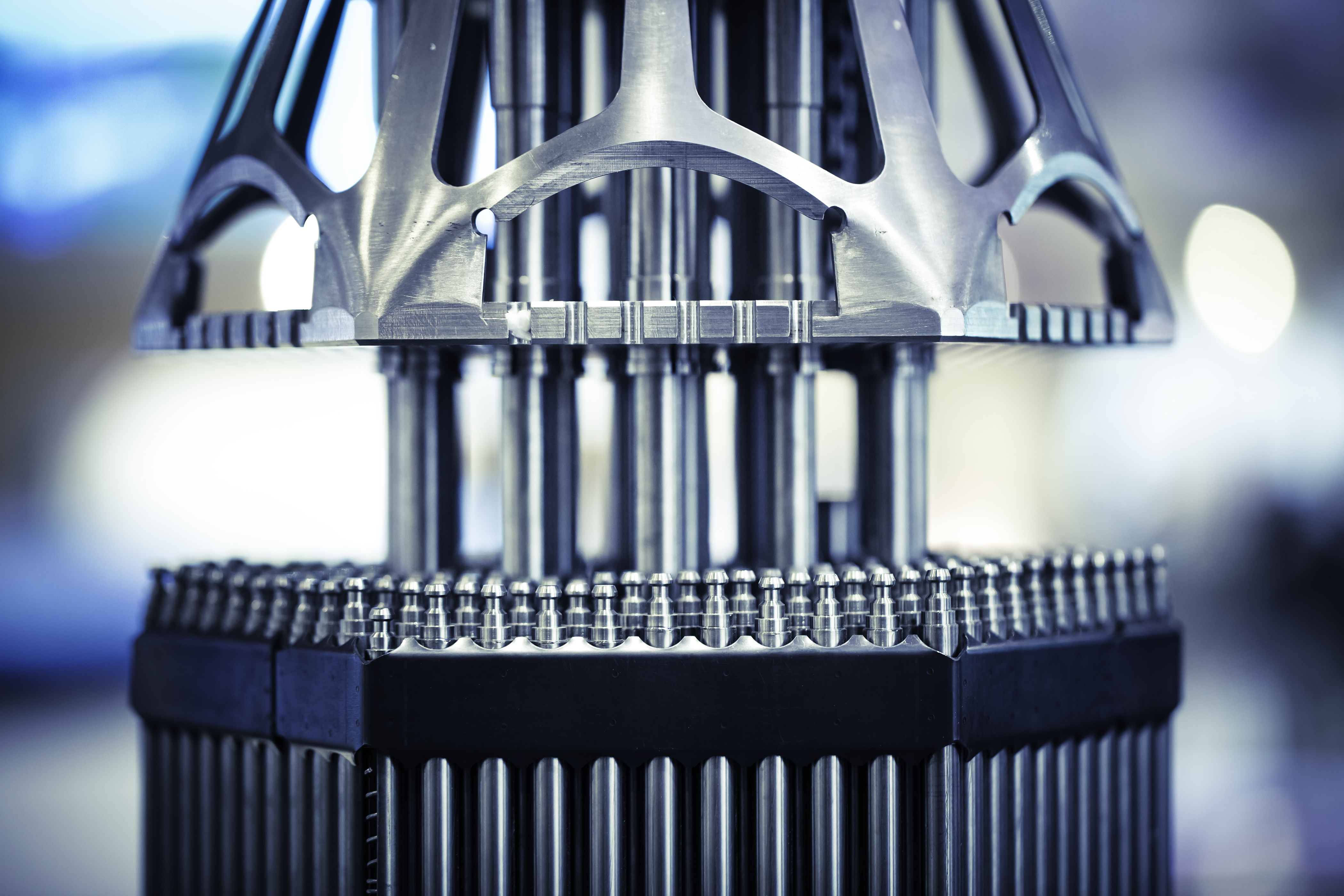

Centrus takes the raw uranium and basically gives it a makeover. They do this at their facility in Oak Ridge, Tennessee. Fun fact: that’s also where they made the stuff for the Manhattan Project. So, you know, no pressure. It’s a complicated process, but they’ve perfected it. And right now, that perfection is worth a lot.

After the Cold War ended, the U.S. shut down its uranium enrichment plants. We were left with…nothing. Then, in 2015, the Department of Energy decided Centrus’ AC100 centrifuge was the best way forward. It took them eleven years, but they ran with it. And in 2025, the stock went ballistic, peaking at $436 before cooling down a bit. Up 315% over the past year. The question is: is there still juice left in this lemon, or has it been squeezed dry?

The Numbers, Because We’re Adults (Mostly)

In the third quarter of 2025, Centrus reported $74.9 million in revenue, up 30% year-over-year. For the first nine months, revenue was $302.5 million, up a more modest 4.1%. But here’s where it gets good: operating income leapt from $2.9 million to $37.4 million. That’s an increase of 1,189.6%. I’m not a financial analyst, but that sounds…promising.

Over the past three years, revenue has grown at a steady 20% compound annual growth rate. And that growth is likely to continue, thanks to the fact that Russia used to supply 24% of America’s uranium enrichment. Now, thanks to…geopolitical factors, that supply is gone. And Centrus is there to fill the gap. It’s like finding out your nemesis has accidentally self-destructed. A little sad for them, but mostly…opportunistic.

Regardless of any future nuclear expansion, this country still gets about 20% of its electricity from nuclear plants. So, whether the uranium comes from Russia or Tennessee, it has to flow. It’s a basic principle of…physics, I think. Or maybe it’s just good business.

Centrus is projecting 40% growth in nuclear energy over the next 30 years, even without any new climate legislation. The Department of Energy wants to triple U.S. nuclear production by 2050, which would get us close to net-zero emissions. And Centrus has factored all of this into its projections. They’re not just building a business; they’re building a…future. Or at least, a very profitable present.

They’ve also built up a nice cash reserve, from $671.4 million at the end of 2024 to $1.63 billion as of September 30, 2025. That means they could pay off their $1.21 billion in debt and still have $400 million left over. Which, let’s be honest, is a good look.

Centrus was founded in 1998, but it feels like their moment has finally arrived. They’re doggedly pursuing the opportunity laid out before them. And after the pullback in late 2025, the stock is looking mighty attractive. It’s not a guaranteed home run, but it’s definitely a swing worth taking. And as a dividend hunter, I’m always looking for a good swing.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- 20 Must-See European Movies That Will Leave You Breathless

- The Hidden Treasure in AI Stocks: Alphabet

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- The Labyrinth of JBND: Peterson’s $32M Gambit

- The 35 Most Underrated Actresses Today, Ranked

- If the Stock Market Crashes in 2026, There’s 1 Vanguard ETF I’ll Be Stocking Up On

- ‘Bugonia’ Tops Peacock’s Top 10 Most-Watched Movies List This Week Once Again

- XRP’s 2.67B Drama: Buyers vs. Bears 🐻💸

2026-01-19 16:03