Author: Denis Avetisyan

Researchers are drawing inspiration from the human hippocampus to build more effective systems for identifying fraudulent activity in online finance.

This work introduces HIMVH, a novel multi-view hypergraph learning framework inspired by the hippocampus for improved web finance fraud detection, particularly in scenarios with complex relationships and rare anomalies.

Despite advances in financial crime mitigation, online fraud continues to plague web ecosystems due to increasingly sophisticated camouflage and imbalanced data distributions. This challenge is addressed in ‘Bridging Cognitive Neuroscience and Graph Intelligence: Hippocampus-Inspired Multi-View Hypergraph Learning for Web Finance Fraud’, which introduces HIMVH, a novel framework inspired by the cognitive functions of the hippocampus. By leveraging multi-view hypergraphs and mechanisms mirroring scene conflict monitoring and novelty detection, HIMVH significantly improves the identification of both camouflaged and rare fraudulent transactions. Could this biologically-inspired approach herald a new era of robust and adaptive fraud detection systems in the increasingly complex landscape of online finance?

The Evolving Landscape of Deception

Conventional fraud detection systems, reliant on rule-based systems and static thresholds, are increasingly challenged by the ingenuity of modern attackers. These adversaries no longer simply create anomalous transactions; instead, they meticulously imitate legitimate patterns of behavior, blending fraudulent activity seamlessly into the normal flow of financial data. This shift towards imitation-based attacks renders traditional signature-based methods ineffective, as the fraudulent transactions closely resemble valid ones, evading detection. Consequently, systems designed to flag outliers now struggle to differentiate between genuine activity and cleverly disguised fraud, necessitating the development of more nuanced and adaptive detection strategies capable of identifying subtle deviations from established behavioral norms.

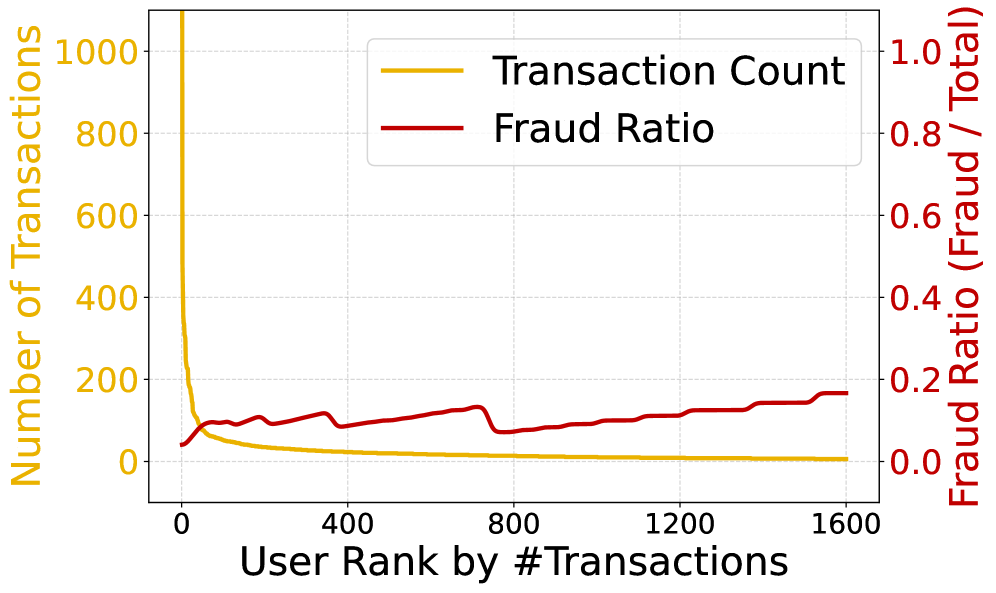

The increasing complexity of modern financial transactions, coupled with the prevalence of infrequent but damaging fraudulent activities, presents a significant escalation in detection challenges. Traditional fraud analysis often relies on identifying common patterns, but the shift towards intricate schemes and the observation that a small percentage of fraudulent events account for a disproportionately large share of losses-a phenomenon known as a long-tailed distribution-renders these methods less effective. This dynamic means that systems must not only process a greater volume of data but also prioritize the identification of rare, nuanced behaviors that deviate from the norm. Consequently, a robust fraud detection strategy necessitates algorithms capable of handling high-dimensional data and effectively modeling the infrequent, high-impact events that characterize contemporary financial crime, moving beyond simple rule-based systems to more adaptive and statistically sophisticated approaches.

While Graph Neural Networks (GNNs) have emerged as a promising tool in combating web finance fraud by leveraging the inherent relational structure of financial transactions, their current capabilities often fall short when confronting nuanced fraudulent activities. Existing GNN models frequently struggle to differentiate between legitimate, complex transactions and cleverly disguised fraud due to an inability to capture subtle, high-order patterns within the network. These models typically focus on immediate connections and local network features, overlooking the long-range dependencies and intricate behavioral signatures indicative of sophisticated attacks. Consequently, research is actively focused on enhancing GNN architectures with mechanisms for improved feature extraction, attention mechanisms to prioritize critical connections, and the incorporation of temporal dynamics to model evolving fraudulent schemes, ultimately striving for more robust and accurate fraud detection in an increasingly complex digital financial landscape.

Modeling the Labyrinth: A Hippocampus-Inspired Framework

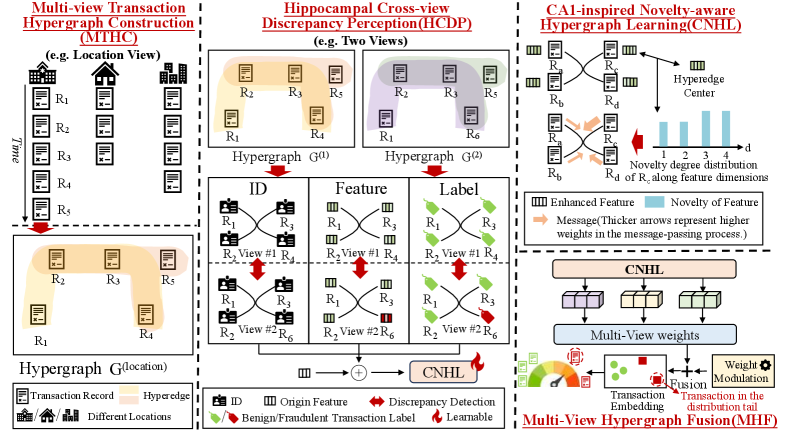

HIMVH (Hippocampus-Inspired Multi-View Hypergraph) is a novel framework designed for the detection of camouflaged fraudulent activities within web-based financial transactions. The architecture draws inspiration from the functional principles of the hippocampus, specifically its role in contextual memory and pattern separation. Unlike traditional fraud detection systems that often rely on singular transaction features, HIMVH aims to model the complex relationships inherent in financial networks. This is achieved through the construction of a multi-view hypergraph, allowing representation of transactions from multiple perspectives – such as user behavior, device information, and payment details – and enabling the system to identify anomalous patterns indicative of fraudulent behavior that might otherwise remain concealed.

HIMVH represents web finance transactions as a multi-view hypergraph to facilitate comprehensive contextual analysis. Traditional transaction representations often focus on single-dimensional relationships, such as user-item interactions. In contrast, HIMVH constructs a hypergraph where nodes represent entities – users, merchants, IP addresses, devices – and hyperedges capture relationships exceeding pairwise connections. These hyperedges represent transactions viewed from multiple perspectives, including temporal sequences, geographical locations, and device characteristics. Each view is incorporated as a distinct hyperedge connecting relevant entities, allowing the model to capture complex, non-linear relationships and richer contextual information than conventional graph-based approaches. This multi-view construction enables the identification of subtle patterns indicative of fraudulent activity that might be missed when analyzing transactions through a single lens.

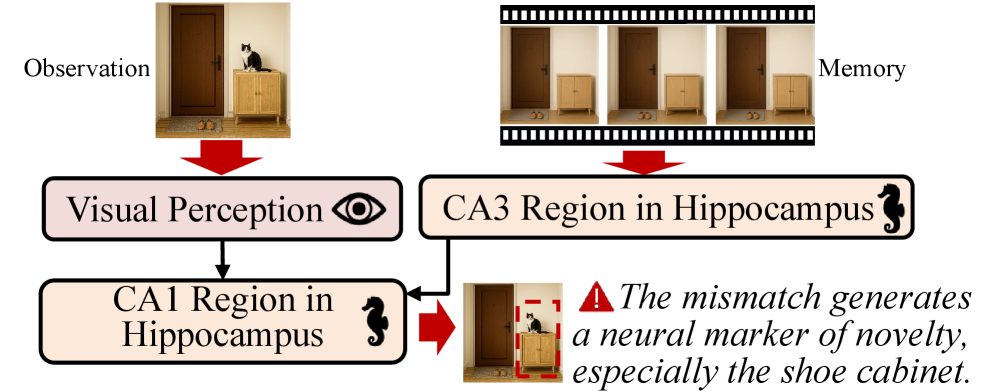

The Hippocampal Cross-View Discrepancy Perception module within HIMVH functions by analyzing representations of financial transactions constructed from multiple perspectives – or “views” – to identify anomalous patterns indicative of fraud. This is achieved through a comparative analysis where the module assesses the consistency of features across these different views. Significant deviations or inconsistencies between corresponding transaction attributes in different views trigger a discrepancy signal. These signals are then weighted and aggregated to produce a discrepancy score, which serves as a key indicator of potentially fraudulent activity. The module’s efficacy relies on the principle that camouflaged fraud often manifests as subtle inconsistencies across various transaction facets, which are difficult to detect when examining data from a single perspective.

Unveiling the Novel: Hypergraph Learning for Rare Events

The CA1-inspired Novelty-aware Hypergraph Learning module demonstrates high performance in identifying infrequent fraudulent transactions, specifically within datasets characterized by long-tailed distributions. Traditional fraud detection systems often struggle with these distributions due to the limited representation of rare events; however, this module leverages hypergraph learning to model complex relationships between transactions and nodes, enabling the detection of anomalies even when the fraudulent instances constitute a small percentage of the overall data. This capability is achieved by representing multiple transactions as hyperedges, which allows the model to capture higher-order correlations and identify previously unseen fraud patterns that would be missed by pairwise analysis. The module’s architecture is inspired by the CA1 region of the hippocampus, known for its pattern separation and completion abilities, allowing it to effectively distinguish between known and novel transaction patterns.

The module mitigates the impact of heterophily – a common network characteristic where connections frequently occur between nodes with dissimilar attributes – by enabling fraud detection in scenarios where traditional methods falter. Heterophilous connections often represent novel or evolving fraudulent behaviors not captured by models trained on homophilous data; by effectively handling these dissimilar node relationships during hypergraph construction, the module can identify previously unseen fraud patterns. This is achieved through a hypergraph representation capable of modeling complex relationships beyond pairwise connections, allowing the system to recognize fraudulent activities even when they manifest as connections between atypical nodes or groups of nodes.

Hyperedge construction within the Novelty-aware Hypergraph Learning module utilizes Temporal Sliding Window techniques to model evolving relationships between transactions. This approach defines a fixed time interval – the “window” – and groups transactions occurring within that window into a single hyperedge. As the window slides forward in time, new hyperedges are created, and outdated ones are discarded, effectively capturing the sequential nature of transaction data. This dynamic hyperedge formation allows the model to identify patterns that emerge over time, such as a series of transactions indicative of fraudulent activity, which would be missed by static graph representations. The window size is a configurable parameter, tuned to the specific characteristics of the transaction data and the expected temporal scale of fraudulent behaviors.

A System Forged in Validation: Impact and Explainability

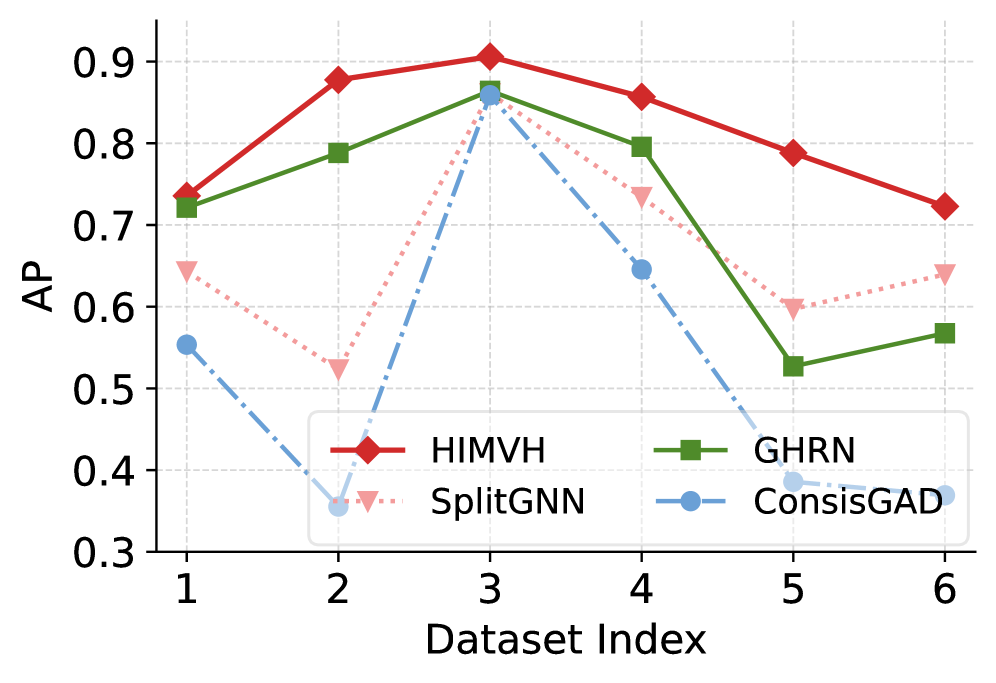

Extensive evaluations confirm that the Hierarchical Multi-View Heterogeneous (HIMVH) model significantly outperforms existing graph neural network (GNN) baselines in web finance fraud detection. Across six distinct datasets, HIMVH consistently achieved substantial improvements: an average of 6.42% in Area Under the Curve (AUC), a 9.74% increase in the F1 score, and a remarkable 39.14% boost in Average Precision (AP) when contrasted with fifteen state-of-the-art models. These results underscore HIMVH’s capacity to more accurately identify fraudulent activities, suggesting a notable advancement in the field and offering a robust solution for enhancing the security of online financial transactions.

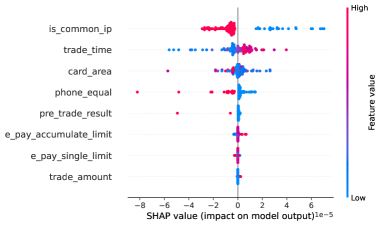

A detailed SHAP (SHapley Additive exPlanations) analysis of the HIMVH framework demonstrates its ability to pinpoint the most influential features driving fraud detection. The system doesn’t simply identify fraudulent transactions; it highlights why, revealing that discrepancies between different data views – for instance, inconsistencies in user behavior and transaction details – are key indicators. Crucially, HIMVH excels at novelty detection, flagging transactions that deviate significantly from established patterns. This focus on both discrepancy and novelty allows the framework to move beyond recognizing known fraud types and effectively identify emerging threats, providing a transparent and explainable approach to bolstering online financial security. The resulting feature importance rankings offer valuable insights into the characteristics of fraudulent activity, aiding in the refinement of fraud prevention strategies.

The developed framework establishes a resilient defense against increasingly sophisticated online financial fraud, directly bolstering the security and trustworthiness of digital transactions. By effectively identifying and flagging malicious activity, the system minimizes financial losses for both consumers and institutions. This enhanced reliability fosters greater confidence in online financial platforms, encouraging wider adoption and participation in the digital economy. The framework’s capacity to adapt to evolving fraud patterns ensures its continued effectiveness, providing a proactive layer of protection against future threats and solidifying the integrity of online financial ecosystems.

The pursuit of robust fraud detection, as demonstrated by HIMVH, isn’t about erecting impenetrable fortresses against malicious actors. It’s about cultivating a system capable of adapting to the inevitable shifts in deceptive strategies. The framework’s focus on multi-view hypergraphs mirrors the brain’s own capacity for associative learning, recognizing that anomalies aren’t isolated events but emerge from complex relational patterns. As G.H. Hardy observed, “Mathematics may be compared to a tool, but it is a tool that creates as well as measures.” This HIMVH framework doesn’t merely measure fraud; it creates a richer understanding of the underlying network dynamics, anticipating evolution rather than simply reacting to current threats. Long stability in fraud detection is, after all, the quiet prelude to a cleverly disguised disaster.

What Lies Ahead?

The pursuit of increasingly elaborate architectures for fraud detection-here, a hippocampus-inspired hypergraph-feels less like innovation and more like a detailed cataloging of potential failure modes. The system performs, undoubtedly. But each successful deploy merely postpones the inevitable: the emergence of a fraud pattern subtle enough to bypass even this complexity. The question isn’t whether it will fail, but when, and what new, unforeseen behavior will herald that moment.

The true challenge isn’t capturing relationships, but accepting their inherent instability. The focus on ‘heterophily’ – different nodes relating differently – acknowledges this, but the attempt to model it risks freezing a dynamic system into a static representation. Perhaps the energy is better spent not on richer graphs, but on systems that gracefully degrade, that flag their own uncertainty, and that readily incorporate new, unpredicted connections – even if those connections initially appear anomalous.

One suspects that the documentation for this framework, like all documentation, will become a historical artifact. A snapshot of a system that no longer accurately reflects the reality it attempts to model. No one writes prophecies after they come true. The field needs to shift from seeking definitive answers to cultivating resilient adaptability, embracing the inevitability of change rather than attempting to preempt it.

Original article: https://arxiv.org/pdf/2601.11073.pdf

Contact the author: https://www.linkedin.com/in/avetisyan/

See also:

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- The Hidden Treasure in AI Stocks: Alphabet

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- The Labyrinth of JBND: Peterson’s $32M Gambit

- The 35 Most Underrated Actresses Today, Ranked

- If the Stock Market Crashes in 2026, There’s 1 Vanguard ETF I’ll Be Stocking Up On

- 20 Must-See European Movies That Will Leave You Breathless

- ‘Bugonia’ Tops Peacock’s Top 10 Most-Watched Movies List This Week Once Again

- XRP’s 2.67B Drama: Buyers vs. Bears 🐻💸

2026-01-19 07:03