The whispers have begun, haven’t they? Of quantum computing, of a future unbound by the limitations of mere binary code. Investors, those eternally optimistic souls, are now turning their gaze toward this…curiosity. It’s a predictable pattern, really. First, the hype, then the frantic scrambling for shares, and finally, the quiet realization that even the most revolutionary technology rarely delivers overnight miracles. The promise, of course, is tantalizing: machines that don’t merely calculate, but think…or at least, approximate thinking with a level of complexity that would make a bureaucrat blush.

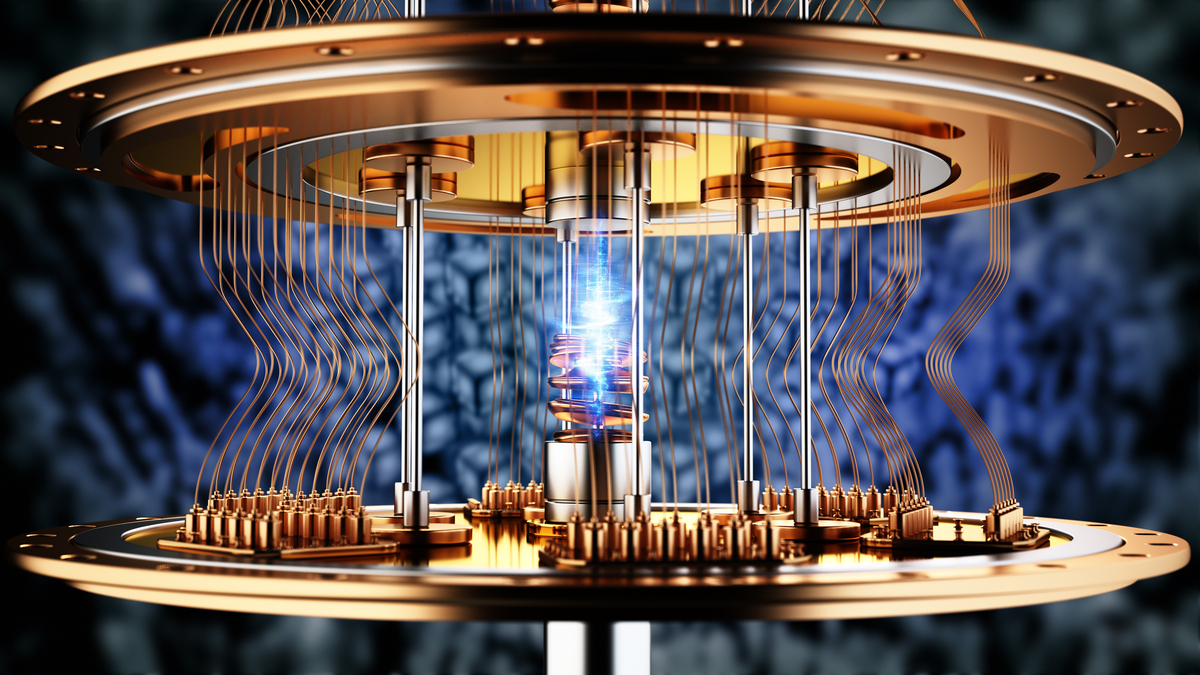

They speak of qubits, of exponential scaling, of solving problems beyond the reach of our current, perfectly adequate machines. As if the problems we have aren’t numerous enough. The fragility of these qubits, however, is a detail conveniently glossed over. They are, it seems, rather sensitive creatures, prone to errors, much like the analysts predicting their success. And yet, the titans of industry are wading in, throwing money at the problem, as if sheer financial force can overcome the laws of physics. It’s a spectacle, really, like watching a particularly well-funded Don Quixote tilting at windmills.

So, which stock to anoint as the savior of our digital future? Let us dispense with the breathless pronouncements about “pure-play” quantum companies. Such ventures are, shall we say, optimistic. Better to seek refuge in the established behemoths, the companies with the resources to weather the inevitable storms and the cynicism to see this through, not as a quest for enlightenment, but as another opportunity for profit.

A Colossus Among Electrons

Alphabet, owner of the Google platform, presents itself as a suitable vessel for our hopes – or, more accurately, our capital. The advertising revenue, of course, is the bedrock upon which this quantum fantasy is built. A constant stream of data, harvested from our every search, every click, every fleeting desire. It’s a comforting thought, isn’t it? That our digital footprints are financing the next technological revolution. They’ve even managed to surpass the hundred billion dollar mark in quarterly revenue, a feat worthy of a particularly ambitious tax collector.

Quantum Accomplishments (or the Art of Controlled Demonstration)

And what of the actual quantum computing? They’ve unveiled a chip called Willow, apparently capable of reducing errors as qubits multiply. A remarkable achievement, undoubtedly. Though one wonders if the reduction in errors is proportional to the increase in marketing expenditure. They claim to have surpassed the performance of classical platforms with a Quantum Echoes algorithm. A proof-of-principle experiment, naturally. Two molecules studied. Results matched. Additional information delivered. It’s all very impressive, in the same way that a well-trained parrot is impressive.

So, with Alphabet trading at a mere 29 times forward earnings (a bargain, by the standards of Silicon Valley delusion), now is the time to invest. To hold on for five years, and to watch as the quantum story unfolds. Or, more likely, as the hype gradually subsides and the stock price settles into a more…realistic valuation. But who are we to question the market? It is, after all, a far more mysterious and unpredictable force than even quantum mechanics.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- The Hidden Treasure in AI Stocks: Alphabet

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- The Labyrinth of JBND: Peterson’s $32M Gambit

- If the Stock Market Crashes in 2026, There’s 1 Vanguard ETF I’ll Be Stocking Up On

- 20 Must-See European Movies That Will Leave You Breathless

- ‘Bugonia’ Tops Peacock’s Top 10 Most-Watched Movies List This Week Once Again

- XRP’s 2.67B Drama: Buyers vs. Bears 🐻💸

- The 35 Most Underrated Actresses Today, Ranked

2026-01-19 02:22