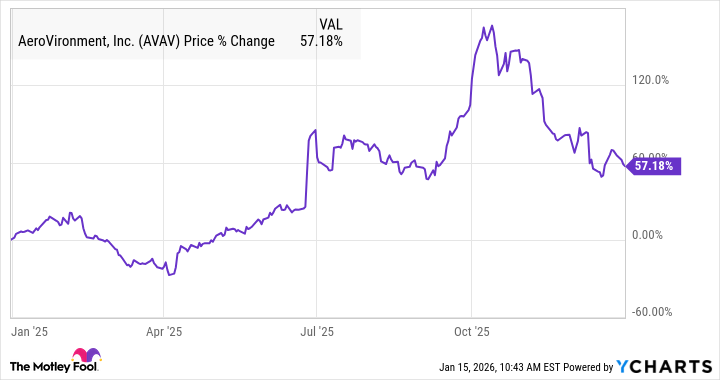

Ah, Aerovironment. A name that rolls off the tongue like a particularly stubborn cog in a vast, governmental machine. This purveyor of unmanned aerial…devices – let us not call them mere ‘drones’, the word lacks a certain gravitas – has experienced a rather…spirited climb in the past year. A 57% ascent, you say? A figure that, upon closer inspection, resembles less a calculated trajectory and more the frantic flapping of a pigeon startled by a passing functionary.

The company, it appears, has been bolstered by the acquisition of BlueHalo. A curious pairing, like a meticulous watchmaker joining forces with a purveyor of slightly-used fireworks. BlueHalo, with its expertise in matters of space, cybernetics, and energies directed with a certain…force, now mingles with Aerovironment’s dedication to all things that fly without a pilot. The result? A broadened scope, they say. I suspect it is more akin to a sprawling, overgrown garden, where one struggles to discern the roses from the weeds.

The second quarter of 2025 revealed a revenue jump of 151%, a figure so astonishing it practically demands a footnote explaining the sudden proliferation of miniature, airborne accountants. Much of this, naturally, stems from the BlueHalo amalgamation, but even the core business exhibited a respectable 21% organic growth. Bookings reached $1.4 billion, a sum that, if laid end to end, would likely stretch from the counting house to the nearest provincial governor’s estate.

One observes, of course, a certain volatility in the stock’s dance. A tremor here, a dip there. It is as if the market itself is afflicted with a nervous twitch. But despite these minor convulsions, the overall trend remains upward. A curious phenomenon, particularly in a world where fortunes are built on the shifting sands of expectation.

And yet, unlike those other ephemeral bubbles – the electric vertical takeoff and landing contraptions, for instance, which seem destined to remain perpetually grounded – Aerovironment has historically demonstrated a capacity for actual, tangible profit. They anticipate earnings per share of $3.40 to $3.55. A modest sum, perhaps, but enough to keep the creditors at bay for another quarter.

The new year began with a rather boisterous flourish. A 52.6% increase through January 15th, driven by a sudden surge of interest in defense stocks following the…shall we say, apprehension of President Maduro. And then there’s President Trump’s pronouncement regarding the 2027 defense budget – a proposed increase from $1 trillion to $1.5 trillion. A sum so vast it could likely pave the entire nation in cobblestones, should one be so inclined. A boon for Aerovironment, naturally, though one suspects the true beneficiaries will be a select group of gentlemen with particularly well-polished boots.

Thus, 2026 shapes up to be another…interesting year for Aerovironment. A year of soaring profits, perhaps. Or perhaps a year of unexpected turbulence. In the grand scheme of things, who can truly say? The market, after all, is a capricious beast, prone to sudden whims and irrational exuberance. And Aerovironment, like a small, well-engineered bird, must simply continue to flap its wings and hope for the best.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- The Hidden Treasure in AI Stocks: Alphabet

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- The Labyrinth of JBND: Peterson’s $32M Gambit

- If the Stock Market Crashes in 2026, There’s 1 Vanguard ETF I’ll Be Stocking Up On

- 20 Must-See European Movies That Will Leave You Breathless

- ‘Bugonia’ Tops Peacock’s Top 10 Most-Watched Movies List This Week Once Again

- XRP’s 2.67B Drama: Buyers vs. Bears 🐻💸

- Warby Parker Insider’s Sale Signals Caution for Investors

2026-01-18 21:32