Alright, settle in, folks! We’re diving into the exciting world of… nuclear reactors. Yes, nuclear. Don’t worry, I’ve got a lead-lined wallet just in case. See, for years, everyone thought splitting the atom was a recipe for disaster. Now? It’s a potential goldmine! Seems the world’s realized we need power, especially with all these AI data centers popping up like mushrooms after a radioactive rain. They’re hungry, those silicon brains, very hungry.

This has led to a bit of a frenzy around stocks like NuScale Power (SMR +6.83%) and Nano Nuclear Energy (NNE +6.86%). Both went on a tear last year, then took a little tumble. Volatility, they call it. I call it a good excuse to buy low and blame the market when it doesn’t work out. Don’t tell my broker I said that.

So, the question is: which one of these reactor companies will actually enrich your portfolio, and which one will just… well, let’s not go there. Think of it as a financial duel… with glowing green consequences if you pick wrong.

Still in the Early Stages (Like a Bad Play)

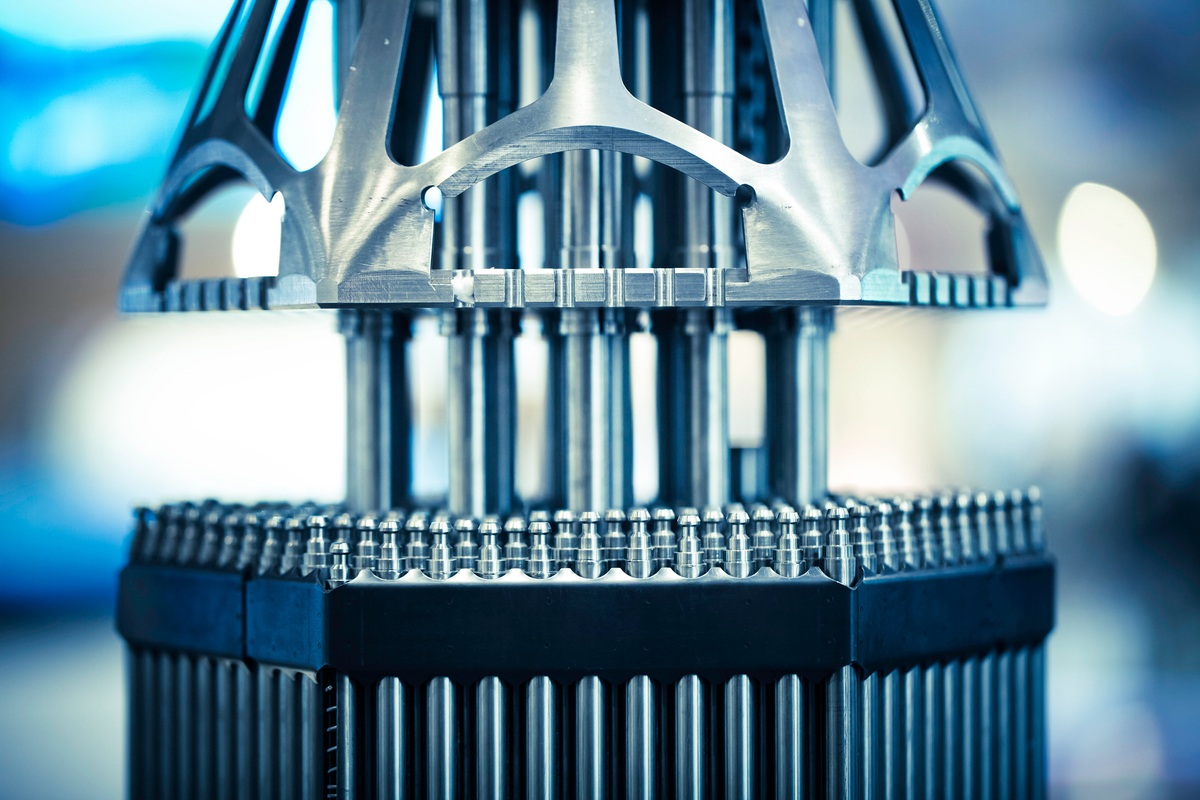

Now, both NuScale and Nano are playing in the Small Modular Reactor (SMR) sandbox. The U.S. Department of Energy says these little reactors are cheaper and more efficient. Sounds good, right? Like getting a discount on doomsday devices.

NuScale is building the permanently installed kind – think of them as the brick-and-mortar reactors. Nano? They’re all about microreactors – portable power plants! Imagine that – a reactor you can take on vacation. (Don’t actually do that.) Both companies are still in the “hope and a prayer” phase, which, frankly, is where most startups begin.

Investors are valuing these companies on potential, not profits. It’s like betting on a horse that hasn’t been born yet. Nano might be the smaller company, but don’t assume that means it has less upside. Sometimes, the little guy has a secret weapon… or a really good publicist.

NuScale: The Slightly Less Risky Gamble

Currently, NuScale has a market cap of around $6 billion, while Nano’s is closer to $1.75 billion. Now, you might think that means Nano has more room to grow. And you’d be right… if everything goes perfectly. But remember, a lower market cap also means more uncertainty. It’s like a tightrope walk without a net. Or a reactor without a containment vessel. Bad analogy? I’m sticking with it.

NuScale already has regulatory approval – a huge deal – and is starting to commercialize its reactors. Last year, they brought in $40 million in revenue, and analysts think they could more than triple that this year. That’s progress, folks! That’s almost enough to buy a small island… and a really good Geiger counter.

Unless Nano announces some game-changing partnership or regulatory breakthrough, I’d say NuScale is the more established, and therefore, the slightly less terrifying, option. It’s still a gamble, mind you. Investing in nuclear startups is not for the faint of heart… or those who prefer their power plants to be powered by sunshine and rainbows. But hey, what’s life without a little risk? Especially when it involves potentially explosive returns? Just don’t stand too close.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- The Hidden Treasure in AI Stocks: Alphabet

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- The Labyrinth of JBND: Peterson’s $32M Gambit

- 20 Must-See European Movies That Will Leave You Breathless

- ‘Bugonia’ Tops Peacock’s Top 10 Most-Watched Movies List This Week Once Again

- XRP’s 2.67B Drama: Buyers vs. Bears 🐻💸

- Warby Parker Insider’s Sale Signals Caution for Investors

- If the Stock Market Crashes in 2026, There’s 1 Vanguard ETF I’ll Be Stocking Up On

2026-01-18 21:22