![]()

They speak of powerhouses – Nvidia, AMD, Broadcom – names that echo in the halls of those who trade in dreams and light. These are the visible gears, the polished brass. But the true weight, the grinding labor that keeps the machine turning, often lies hidden. These companies build the illusions; Taiwan Semiconductor Manufacturing – TSMC – builds what makes the illusions possible. And so, the speculators whisper of a two trillion dollar valuation. A sum large enough to numb a man to the point of forgetting the sweat and toil it represents.

The current obsession, this breathless race toward artificial intelligence, demands chips. Not just any chips, but more chips, faster chips, chips born of precision and, let us not forget, relentless pressure on those who assemble them. TSMC, by virtue of its size and reach, finds itself at the heart of this frenzy. They are not inventing the future, but they are undeniably facilitating it. And in that facilitation lies a certain…opportunity. An opportunity for those who hold the shares, naturally. The question is not whether TSMC will profit, but whether the price asked for a piece of that profit is worth the risk.

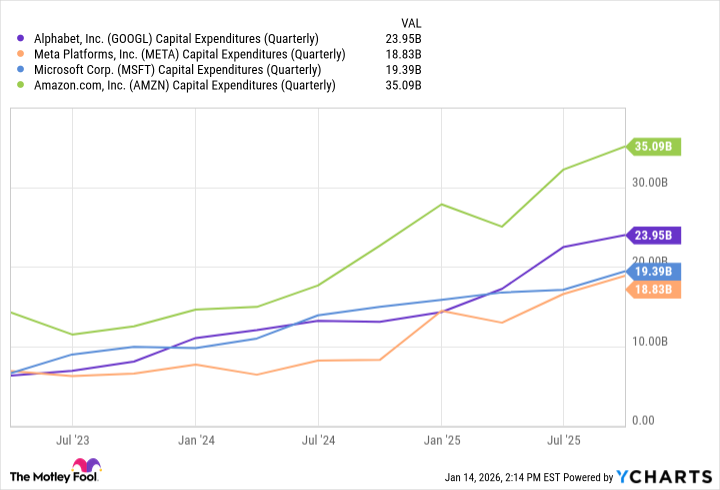

They predict a climb to two trillion. A mere eighteen percent increase, they say, as if such a thing were easily achieved. The stock has rallied, yes, but the market is a fickle beast, prone to sudden chills and irrational exuberance. To assume continued ascent is to mistake a temporary swell for a permanent tide. The figures are tossed about – five hundred and twenty-seven billion dollars in hyperscaler spending by 2026, five trillion by 2030. These are abstractions. What does it mean for the man on the factory floor? For the engineer burning the midnight oil? For the consumer who will ultimately bear the cost of this relentless innovation?

Alphabet, Microsoft, Meta, Amazon – these names represent a concentration of wealth and power unseen in history. They demand more, and TSMC delivers. The company expands its footprint – Japan, Germany, Arizona – a scattering of facilities across the globe, each a monument to the relentless pursuit of efficiency. They speak of diversification, of reducing risk. But risk, like shadows, merely shifts its form. A factory in Arizona does not shield one from the storms brewing in the wider world.

The talk of “pick-and-shovel” opportunities is tiresome. It implies a simple equation: provide the tools, and profit from the gold rush. But the truth is far more complex. The miners keep the gold, and the shovel-makers receive a pittance in comparison. TSMC is not immune to this dynamic. They are a crucial link in the chain, yes, but a link nonetheless. Their pricing power, their ability to dictate terms, is not absolute. Competition exists, and alternatives will emerge. To assume otherwise is to succumb to a dangerous complacency.

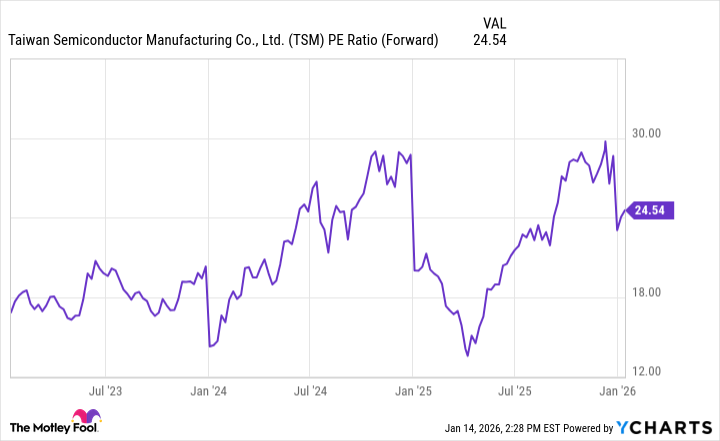

A forward price-to-earnings multiple of 24. Not “cheap,” they admit, but conveniently overlooking the fact that “cheap” is a relative term. Compared to what? To the inflated valuations of other tech darlings? To the promise of limitless growth? The chart shows a dip from previous highs, presented as a buying opportunity. But a dip is merely a pause before another fall, or a prelude to a renewed ascent. There are no guarantees.

They predict $13.26 in earnings per share by 2026, and a potential price of $390 if the company reaches its peak P/E of 30. A reasonable expectation, they claim. Perhaps. But the future is rarely reasonable. It is messy, unpredictable, and often cruel. To stake one’s fortune on such calculations is to play a fool’s game. TSMC is a solid company, undeniably. But it is not immune to the forces that shape the world. To believe otherwise is to mistake a temporary advantage for lasting security.

So, should you buy Taiwan Semi stock? The question is not whether it will make you money, but whether the potential reward justifies the inherent risk. Consider the broader landscape, the underlying currents, the human cost. And remember, in the grand scheme of things, even two trillion dollars is a fleeting sum. Dust and silicon. That is all it is, in the end.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- The Hidden Treasure in AI Stocks: Alphabet

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- The Labyrinth of JBND: Peterson’s $32M Gambit

- If the Stock Market Crashes in 2026, There’s 1 Vanguard ETF I’ll Be Stocking Up On

- 20 Must-See European Movies That Will Leave You Breathless

- ‘Bugonia’ Tops Peacock’s Top 10 Most-Watched Movies List This Week Once Again

- XRP’s 2.67B Drama: Buyers vs. Bears 🐻💸

- Warby Parker Insider’s Sale Signals Caution for Investors

2026-01-18 20:52