The market, a vast and bewildering bazaar, continues to offer temptations, though one suspects most are merely gilded illusions. One searches for solidity, for something that doesn’t dissolve into vapor at the first whiff of unfavorable news. Today, we shall consider three such… possibilities. Not guarantees, mind you. The future is a capricious beast, and financial projections are often scribbled on the backs of pigeons.

Amazon: The Everything Emporium (and Its Peculiarities)

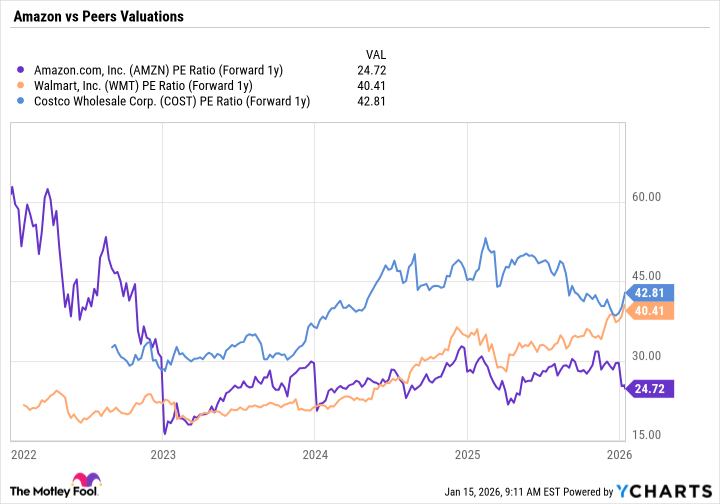

Amazon, that sprawling digital estate, remains a curious entity. It sells everything from aardvark accessories to zither strings, and yet, its valuation seems… reasonable. A most unsettling development. The market, in its infinite wisdom (or lack thereof), has momentarily overlooked its dominance. One observes the shares trading at a discount to lesser rivals, Walmart and Costco – a situation akin to a nobleman bartering with a fishmonger.

Its North American sales rose a perfectly respectable 11%, while operating income, as if possessed by a minor demon of efficiency, shot up 28%. This, naturally, is a positive sign. But the true marvel lies in its advertising business. It has become a digital billboard, subtly influencing the desires of millions. Revenue is up 24%, and one suspects it could be higher if they weren’t hampered by the sheer volume of cat videos uploaded daily.

And then there’s Amazon Web Services, a cloud of computing power that sustains the modern world. It benefits from the current frenzy over artificial intelligence – a pursuit that promises either salvation or utter chaos, depending on whom you ask. AWS revenue rose 20%, and the company is constructing a data center for Anthropic, a venture that sounds suspiciously like something out of a forgotten science fiction novel. One wonders if the engineers have considered the possibility of a rogue algorithm escaping into the wild.

Chewy: The Auto-Ship Oracle

Chewy, purveyor of pet supplies, is another intriguing specimen. It trades at a modest price-to-earnings ratio, which, in this age of inflated valuations, is akin to discovering a lost ruble in one’s coat pocket. Its auto-ship model – a relentless stream of kibble and chew toys delivered to the door – is remarkably resilient. One suspects it could survive even a zombie apocalypse, as long as there are still pets to feed.

Sales are rising, gross margins are expanding, and the company has even launched a paid membership program – a desperate attempt, perhaps, to establish a sense of exclusivity in the world of pet ownership. It is also dabbling in sponsored ads, a practice that feels vaguely unethical, but undeniably effective.

But the true genius of Chewy lies in its expansion into health and pharmacy items. It has become a compounding pharmacy for pets, concocting custom medications for ailing gerbils and melancholic goldfish. And its private-label offerings – suspiciously affordable bags of kibble – carry a higher gross margin. One suspects they are made from recycled cardboard and the dreams of forgotten puppies.

e.l.f. Beauty: The Crimson Smudge of Hope

e.l.f. Beauty, purveyor of affordable cosmetics, admittedly stumbled in the previous year. But its overall growth story remains intact, and the acquisition of Rhode, a premium skincare brand, looks like a stroke of… well, not genius, perhaps, but a competent maneuver. The stock is attractively valued, and its price/earnings-to-growth ratio is near 0.4 – a figure that suggests either undervaluation or impending doom.

The company has done a commendable job gaining market share in the mass cosmetics market – a realm of brightly colored powders and questionable ingredients. And now it has an opportunity to do the same with Rhode, a brand founded by Hailey Bieber, a woman whose eyebrows alone could launch a thousand ships.

Rhode has already expanded into Sephora, a temple of beauty and exorbitant prices. And with e.l.f.’s presence at Ulta Beauty and Target, those are natural outlets for expansion. A recent price increase of each product – ostensibly to offset tariff impacts – will surely drive sales growth. Or perhaps it will simply enrage the consumers, leading to a mass revolt against the tyranny of overpriced lipsticks. One can never be certain.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- The Hidden Treasure in AI Stocks: Alphabet

- TV Pilots Rejected by Networks

- The Labyrinth of JBND: Peterson’s $32M Gambit

- USD PHP PREDICTION

- 20 Must-See European Movies That Will Leave You Breathless

- The Worst Black A-List Hollywood Actors

- You Should Not Let Your Kids Watch These Cartoons

2026-01-18 16:22