The affairs of commerce, like those of families, are ever subject to fluctuation. Certain establishments, though possessed of solid foundations, may, through temporary misfortune or the whims of public sentiment, find themselves in a state of diminished esteem. It is to such instances that a discerning observer may profitably direct their attention, for a recovery, however gradual, is often the reward of patience and a judicious assessment of intrinsic worth.

Two such estates, currently experiencing a period of quiet adversity, present themselves for consideration. Their present circumstances, while perhaps discouraging to the hasty speculator, offer a more reasoned mind grounds for anticipating a restoration of former prosperity.

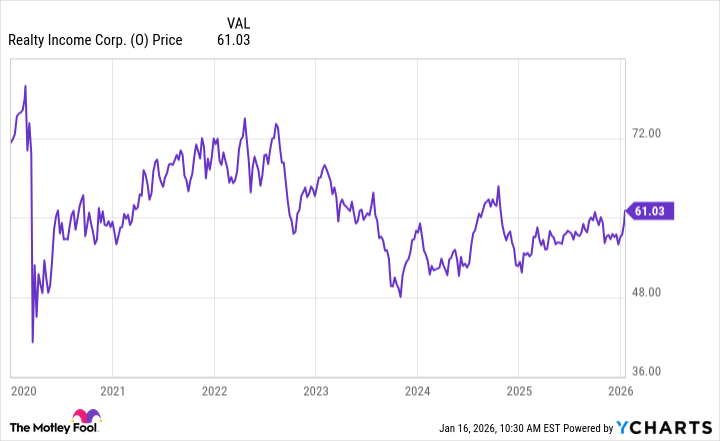

Realty Income

The establishment known as Realty Income, a proprietor of numerous commercial tenancies, has suffered, it appears, from the prevailing anxieties concerning the cost of capital. A circumstance not entirely unexpected, yet one which has, nonetheless, depressed its standing in the eyes of certain investors. It is a truth universally acknowledged that a property owner in possession of a good fortune must be in want of lower interest rates.

Despite these temporary difficulties, the company’s holdings remain remarkably well-occupied, a testament to the enduring demand for suitable commercial spaces. Indeed, the occupancy rate approaches a near-perfect state, suggesting a prudent selection of tenants and a commendable attention to the maintenance of their properties. The continued acquisition of further holdings, while requiring careful consideration, speaks to a confidence in the long-term prospects of their business.

The regularity of their dividend payments, maintained without fail for a considerable period, is a further indication of their stability. A generous return, yielded from a depressed share price, offers a particularly appealing prospect to those of a more conservative disposition. The company’s financial performance, measured by funds from operations, reveals a valuation that appears, to a discerning eye, rather modest.

A decline in the cost of borrowing, should it occur, would undoubtedly alleviate some of the present pressures, freeing capital for further expansion. As conditions improve and dividends continue to rise, a restoration of investor confidence may reasonably be anticipated.

MercadoLibre

The establishment of MercadoLibre, a purveyor of goods and services in the Latin American markets, had, until recently, enjoyed a period of considerable prosperity. Its success, however, appears to have attracted the attention of competitors, and a certain laxity in the management of credit has led to some unwelcome consequences.

The increase in non-performing loans is a matter of some concern, though not, perhaps, insurmountable. The provision made for doubtful accounts, while substantial, is a prudent measure, demonstrating a willingness to acknowledge and address the challenges at hand. Even amidst these difficulties, the company has maintained a respectable level of profitability, though at a somewhat diminished pace.

Despite the prevailing headwinds, revenue continues to grow at a commendable rate, suggesting an underlying strength in the business. Moreover, the prospect of economic improvement in certain key markets offers a glimmer of hope for future prosperity.

The current valuation, though elevated relative to the broader market, is not entirely unreasonable when compared to similar establishments, particularly those engaged in rapid growth. A recovery in the share price appears, therefore, increasingly likely, provided that management continues to exercise prudence and address the challenges at hand.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- The Hidden Treasure in AI Stocks: Alphabet

- TV Pilots Rejected by Networks

- The Labyrinth of JBND: Peterson’s $32M Gambit

- USD PHP PREDICTION

- 20 Must-See European Movies That Will Leave You Breathless

- The Worst Black A-List Hollywood Actors

- You Should Not Let Your Kids Watch These Cartoons

2026-01-18 14:42