The democratization of wealth, a phrase so earnestly deployed, has, in truth, merely broadened the avenues for both prosperity and, let us be frank, exquisitely patterned disappointment. Vanguard, with its predictably named funds, has facilitated this expansion, allowing the diligent, or merely the hopeful, to assemble portfolios. But diversification, my dear reader, is not simply a matter of scattering seeds; it is an exercise in discerning which soils harbor genuine potential, and which are merely… aesthetically pleasing.

One begins, naturally, with the ubiquitous S&P 500. A perfectly serviceable index, though lacking, shall we say, a certain… je ne sais quoi. Its broader sibling, the Total Stock Market ETF, is similarly adequate. However, for the discerning investor – the one who views the market not as a bull or a bear, but as a lepidopterist views a field – a more nuanced approach is required. And that, inevitably, leads us to the realm of healthcare.

A Vital Sign, or a Phantom Limb?

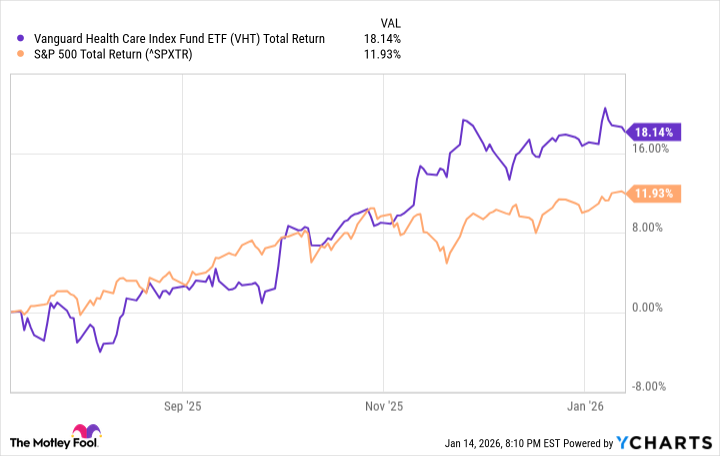

The Vanguard Health Care ETF (VHT), a compendium of over four hundred pharmaceutical, biotechnological, and medical device entities, has, in recent years, exhibited a performance that could be charitably described as… languid. Five years ago, it trailed the S&P 500 with a dispiriting lack of enthusiasm. Yet, a curious reversal has occurred in the last six months. VHT has begun to stir, to exhibit a tentative vitality. This is not, I suspect, a sudden burst of inherent strength, but rather a recalibration, a subtle shift in the prevailing winds.

The current bull market, now entering its fourth year, is, of course, susceptible to the inevitable gravitational pull of correction. Pundits, those delightful purveyors of probabilistic pronouncements, are already sharpening their knives. In such circumstances, a defensive sector like healthcare offers a certain… ballast. People, alas, remain stubbornly prone to illness and injury, regardless of macroeconomic fluctuations. A grim truth, perhaps, but a profitable one.

But healthcare is not merely a refuge for the cautious. A far more compelling narrative is unfolding, driven by the burgeoning market for weight-loss drugs. Eli Lilly, VHT’s most substantial holding, is at the forefront of this revolution, wielding GLP-1 medications with a revenue-generating potency that would make a lesser company blush. Morgan Stanley’s projections – a $150 billion market by 2035, up from a mere $15 billion in 2024 – are, if realized, nothing short of… substantial. A veritable pharmacopoeia of profit.

As of this writing, VHT is up a modest 2% in 2026. A seemingly unremarkable figure, perhaps, but consider it not as a destination, but as a point of departure. For those seeking to diversify a portfolio increasingly dominated by the ephemeral allure of technology, this Vanguard ETF offers a quiet, almost understated, appeal. A paleontology of the portfolio, if you will – a careful excavation of enduring value amidst the shifting sands of the market. It may not ignite the imagination, but it might, just might, preserve one’s capital. And in the long run, my dear reader, isn’t that the most exquisitely patterned satisfaction of all?

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- The Hidden Treasure in AI Stocks: Alphabet

- TV Pilots Rejected by Networks

- The Labyrinth of JBND: Peterson’s $32M Gambit

- USD PHP PREDICTION

- 20 Must-See European Movies That Will Leave You Breathless

- The Worst Black A-List Hollywood Actors

- You Should Not Let Your Kids Watch These Cartoons

2026-01-18 13:06