Now, I’m not usually one for fizzy drinks. Give me a solid, reliable dividend stock any day. Something predictable, you understand. But even a hardened devotee of income streams can’t help but be mildly impressed by the recent performance of Celsius Holdings (CELH +1.61%). In 2025, the shares leapt a rather exuberant 74%, while the S&P 500 ambled along at a respectable, but comparatively pedestrian, 16%. I confess, I rather expected it. There’s a certain…logic to these things, if you look beyond the marketing hype and the brightly coloured cans.

Last year, 2024, was a bit of a wobble, mind you. A 52% decline. Enough to give even the most seasoned investor a twitch. I wrote back in December that once the growth numbers perked up – and, crucially, if they did perk up – investors might remember why they’d been interested in the first place. It’s a bit like a slightly neglected garden; a little tending and it can bloom again. It wasn’t a particularly profound observation, but sometimes the obvious is overlooked in the general panic.

And, lo and behold, the growth did indeed return. A rather substantial 75% increase in top-line revenue through the first three quarters of the year. I didn’t foresee that exact number, naturally. Predicting the future is a fool’s game, and I, for one, intend to remain reasonably sane. But I did spot an opportunity that seemed to be lost on a lot of other people. It’s a bit like noticing a perfectly good ten-pound note lying on the pavement – most people are too busy looking at their phones to see it.

What Had Everyone So Confused in 2024?

The trouble, as I saw it, started in the third quarter of 2024. Celsius reported a year-over-year drop in revenue for the first time in ages. Management, with admirable composure, blamed it on inventory fluctuations with PepsiCo, their distribution partner. Investors, however, weren’t buying it. They seemed to think people had simply stopped drinking the stuff. A perfectly reasonable concern, of course, but I suspected a bit of overreaction.

If that fear had been true, well, Celsius would have been in a rather sticky situation. The stock would have followed suit. But I took a different view. I figured consumers still had a taste for it. It wasn’t just wishful thinking, either. The numbers, if you bothered to look at them, suggested otherwise. Market share was increasing, distribution was expanding, and, crucially, end-consumer sales were holding up. It’s like a well-made pair of shoes – people keep wearing them, even when the fashion changes.

I bought more shares on January 17th, 2025, convinced that the stock would rebound. Looking back now, I’m rather pleased I did. It’s not about getting rich quick, you understand. It’s about identifying companies with solid fundamentals and holding them for the long term. A bit like planting a tree; you don’t expect to harvest fruit overnight.

Celsius Bounces Back in 2025

The top-line growth numbers for 2025 are, admittedly, impressive. But there’s a rather large asterisk attached. The company acquired Alani Nu for $1.65 billion in April. That’s a significant acquisition, and inorganic growth doesn’t always tell the whole story. It’s a bit like adding a new wing to a house; it looks good, but it doesn’t necessarily improve the foundations.

However, the Celsius brand itself continues to grow, confirming that the inventory issues were indeed temporary. In the 13 weeks leading up to September 28th, Celsius brand retail sales grew 13% year over year. A solid rate of growth for a company of its size. It’s like a well-maintained engine; it keeps running smoothly, even under pressure.

Investors are now realizing that the sell-off in 2024 was unjustified. Customers didn’t abandon the brand, and the business continues to expand. That’s why the stock has regained ground. It’s a simple story, really. But sometimes the simplest stories are the most compelling.

What About 2026 and Beyond?

Celsius still has a long runway for profitable growth, assuming things continue to go well. That’s why I’m happy to continue holding shares. It’s not about speculation, you understand. It’s about long-term value.

There are several growth levers, including the Alani Nu brand. I initially worried it might cannibalize Celsius’ sales, but so far that hasn’t happened. The Celsius brand continues to grow, even as Alani Nu’s third-quarter net sales were up 115% year over year. It’s a bit like having two strong horses pulling the same cart.

The really interesting thing is that Alani Nu entered PepsiCo’s distribution system after the quarter ended. Management says that will expand Alani Nu’s reach and accelerate its growth. If that happens, it will be good news for Celsius’ overall growth rate. It’s a bit like adding a turbocharger to an already powerful engine.

The other big growth lever is international expansion. Celsius has entered several new markets, but international revenue still accounts for only 3% of total revenue. That means there’s plenty of room for growth. It’s a bit like discovering a new continent.

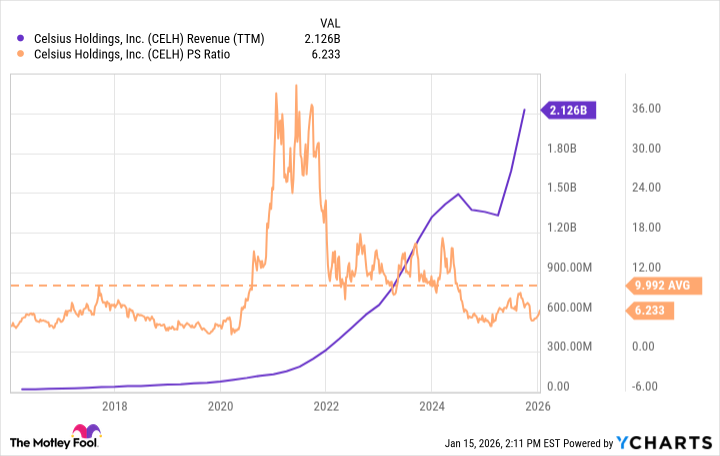

In short, Celsius’ revenue continues to soar, and between Alani Nu and international markets, the uptrend is poised to continue in 2026 and beyond. Meanwhile, the valuation, at a price-to-sales (P/S) ratio of 6, has become attractive. The chart below shows that the current valuation is well below the 10-year average for Celsius stock.

I’d love to see the stock go up by 74% again in 2026, but I won’t hold my breath. That’s a world-class return for a single year, and almost anything can happen over that relatively short time horizon. I’ll keep a five-year time horizon, because it’s the sensible thing to do. Looking out over the long term, I see plenty of growth for Celsius, which should help the stock stay a market-beating investment. It’s not about getting rich quick, you understand. It’s about building a solid, reliable portfolio for the future. A bit like building a sturdy ship to weather any storm.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- The Hidden Treasure in AI Stocks: Alphabet

- TV Pilots Rejected by Networks

- The Labyrinth of JBND: Peterson’s $32M Gambit

- 20 Must-See European Movies That Will Leave You Breathless

- The Worst Black A-List Hollywood Actors

- You Should Not Let Your Kids Watch These Cartoons

- Mendon Capital’s Quiet Move on FB Financial

2026-01-18 11:34