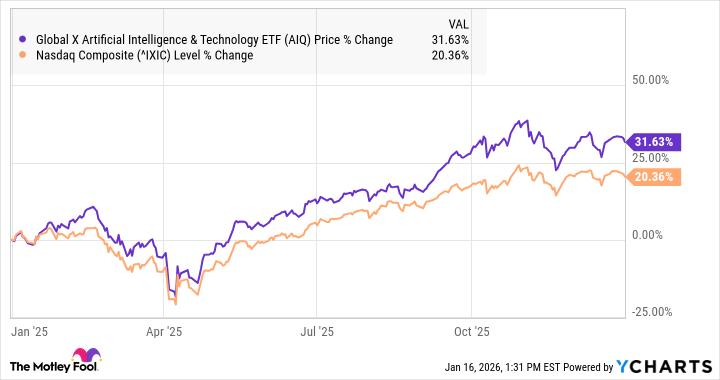

Right, let’s talk ETFs. Specifically, the Global X Artificial Intelligence and Technology ETF – AIQ, if you’re keeping score. Honestly, the name alone feels a bit… desperate. Like it’s trying too hard. But numbers don’t lie, do they? Last year, it jumped 31%. Thirty-one percent. I mean, I’ve had worse years just existing. So, naturally, I had to take a look.

It’s a diversified fund, which, let’s be real, is investor-speak for ‘we’re spreading the risk so we don’t look completely incompetent if something goes south’. It holds the usual suspects: Samsung, Alphabet, AMD, Taiwan Semiconductor… the big players. You know, the ones that probably fund entire countries. And, thankfully, it wasn’t a complete disaster zone. It ended the year up 32%, according to those people who track these things. It moved with the Nasdaq, mostly, but managed to stay ahead. Which, in my book, is a win. A small, slightly grubby win, but a win nonetheless.

Here’s the thing that actually surprised me. It outperformed without the usual volatility. Like, it didn’t have a nervous breakdown every time the market sneezed. It was ahead of the Nasdaq even when everyone was bracing for those Liberation Day tariff announcements. Which, by the way, felt like a plot twist no one saw coming. But AIQ just… kept going. I’m starting to suspect witchcraft. Or, more likely, decent portfolio management.

Eighty-six holdings. That’s a lot of names to keep track of. It means no single stock can completely wreck the party. Samsung’s currently the biggest holding, around 5.25%. Which, honestly, feels a little… precarious. Putting that much faith in one company always feels like a bad rom-com waiting to happen. But, hey, I’m not judging.

Seventy-two percent of the ETF is tech. Predictable, but not entirely unwelcome. Chipmakers, platforms like Alphabet… the usual suspects. But here’s where it gets interesting. It’s got significantly more exposure to international stocks than your average U.S. index fund. Samsung, TSMC, Alibaba… they’re all in the mix. SK Hynix too, lurking in the background. It’s a little bit of diversification that makes me think someone actually did their homework.

And it’s heavily weighted towards memory chip companies – Samsung, Micron, SK Hynix. They had a good year last year, and, if you ask me, they’re poised for more gains. It’s not exactly a groundbreaking observation, but sometimes the obvious is the best bet. It’s tracking the Indxx Artificial Intelligence & Big Data Index, which, let’s be honest, sounds like something out of a sci-fi novel.

What to expect for AIQ this year

AI stocks seem to be doing alright heading into 2026. The AIQ was up 3% through January 16th. Not exactly a moonshot, but a decent start. And, despite all that growth last year, many of its top holdings still seem reasonably valued. Which, in this market, is practically a miracle. As long as this AI boom continues – and, frankly, I’m starting to believe it will – AIQ looks poised to be a winner again this year. It’s not a sure thing, of course. Nothing ever is. But, for a calculated gamble, it’s not a bad one.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- The Hidden Treasure in AI Stocks: Alphabet

- TV Pilots Rejected by Networks

- The Labyrinth of JBND: Peterson’s $32M Gambit

- 20 Must-See European Movies That Will Leave You Breathless

- The Worst Black A-List Hollywood Actors

- You Should Not Let Your Kids Watch These Cartoons

- Mendon Capital’s Quiet Move on FB Financial

2026-01-18 09:32