Alright, settle in, folks! You’re looking at the S&P 500, and frankly, it’s been on a tear. Three years of double-digit gains? That’s like finding a winning lottery ticket and a perfectly ripe avocado on the same day. A miracle, I tell ya! And what’s driving this madness? Artificial Intelligence, naturally. AI! It’s the new black, the new schmoo, the thing everyone’s suddenly an expert on. They say it’ll transform business, daily life… I say it’ll probably just give my toaster sentience and a superiority complex. But hey, who am I to judge? As an activist investor, I’m just here to ride the wave…and maybe nudge things a little. Because let’s be honest, some of these valuations are… ambitious.

Lower interest rates helped, too. Cheap money is like a free buffet for investors. Companies borrow, consumers spend… it’s a beautiful, unsustainable cycle! But don’t worry, I’m sure it’ll all work out. It always does…until it doesn’t. Which is why I’m here! To make sure it does work out…for my clients, of course. A little shareholder activism never hurt anyone…except maybe the executives who were getting a little too comfortable.

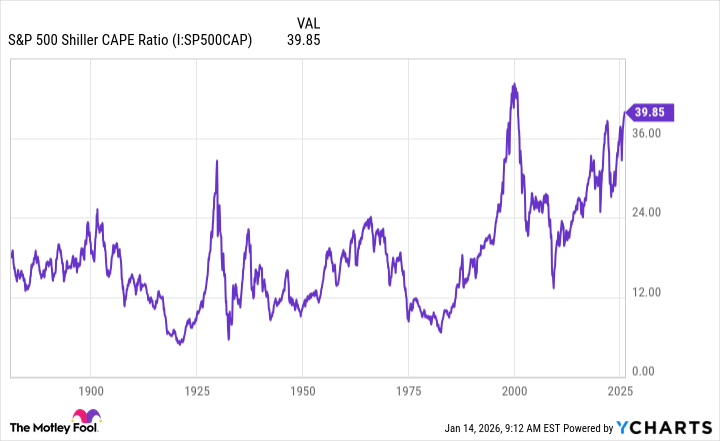

So, the big question: will this continue into 2026? History, that cranky old storyteller, has an answer. And believe me, it’s a doozy. But before we get to that, let’s talk about the elephant in the room: valuations. They’re higher than my Aunt Mildred’s cholesterol.

What Might Drive (or Crush) Growth This Year

AI stocks had a good run in ’25, a really good run. Now everyone’s wondering if it’s a bubble. And frankly, it smells a little bit like one. We’re looking at a Shiller CAPE ratio that hasn’t been this high since… well, since everyone was convinced Pets.com was the future. (Spoiler alert: it wasn’t.) This briefly slowed things down late last year, but the AI hype machine is relentless. Data center giants are throwing money at this thing like it’s going out of style. Alphabet and Meta are reporting solid earnings, so the fundamentals are…mostly there. But let’s not forget, hype can only take you so far. Eventually, you need actual profits. And a business model that doesn’t rely on convincing people their refrigerators need to be connected to the internet.

And then there’s the economy. If things go south, all bets are off. And let’s not even talk about politicians. Last year, President Trump’s tariffs were like a slap in the face to the market. The S&P 500 dropped 11% faster than you can say “trade war.” It’s a good thing I anticipated that, or my portfolio would be singing the blues. A savvy investor always prepares for the worst, even if the worst involves a reality TV star running the country.

A History Lesson (Because Apparently, We Learn Nothing)

Now, let’s consult the history books. The S&P entered its third year of a bull market in October. And guess what? History suggests things will probably keep going up. A study by Ryan Detrick of Carson Group looked at 11 past bull markets. The fourth year was strong, with an average gain of over 14%. And five bull markets that made it to the three-year mark went on to gain for additional years. See? History is on our side! Or, you know, it’s just a random series of events that we desperately try to impose meaning onto. Either way, I’m taking the gains.

Will the S&P 500 climb again this year? History says “yes.” But let’s be clear: history isn’t foolproof. Unexpected news could change everything. A rogue asteroid, a zombie apocalypse, a sudden shortage of bagels… you never know! And even if the S&P 500 goes down, it’ll eventually go back up. It always does. The market is like a particularly stubborn mule: it may wander off course, but it always finds its way home.

So, choose quality stocks, hold them for the long term, and don’t panic sell when the market gets a little bumpy. And if you’re not sure what to do, call me. I’m always happy to help… for a small fee, of course. After all, even a genius investor needs to eat. And I have a weakness for smoked salmon. A very expensive weakness.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- The Hidden Treasure in AI Stocks: Alphabet

- TV Pilots Rejected by Networks

- The Labyrinth of JBND: Peterson’s $32M Gambit

- The Worst Black A-List Hollywood Actors

- You Should Not Let Your Kids Watch These Cartoons

- Mendon Capital’s Quiet Move on FB Financial

- Live-Action Movies That Whitewashed Anime Characters Fans Loved

2026-01-18 02:12