My uncle, bless his heart, is convinced Lucid is the future. He sends me links, breathless pronouncements about battery technology, and charts that look suspiciously like someone sneezed on a spreadsheet. He keeps saying it’s a “ground floor opportunity.” I tried to explain that sometimes, the ground floor is just… damp. And potentially infested. But he’s already picturing himself driving a shimmering, silent status symbol, and frankly, it’s easier to let him dream.

Lucid, for those not actively dodging unsolicited investment advice from relatives, makes electric vehicles. Expensive ones. Very expensive ones. They’ve sunk a frankly terrifying amount of money into this venture, and while the cars themselves are, by all accounts, quite nice – a sort of rolling art installation – they’re facing the same problem as my uncle’s collection of porcelain thimbles: nobody really needs another one.

I’ve been following them for a while, not because I’m particularly interested in luxury EVs, but because I specialize in turnarounds. Companies on the brink. The ones everyone else has given up on. It’s… a hobby. A stressful, financially questionable hobby. And Lucid, let’s just say, is leaning heavily into the “brink” category.

They’re currently operating with what I’d politely call “limited runway.” Their last report indicated they had enough cash to keep the lights on until mid-2027. That’s a surprisingly specific date. It’s as if they’ve meticulously calculated the exact moment the accountants will start locking the doors. They presented this as a positive, which is like telling me my cholesterol is “elevated, but with potential.”

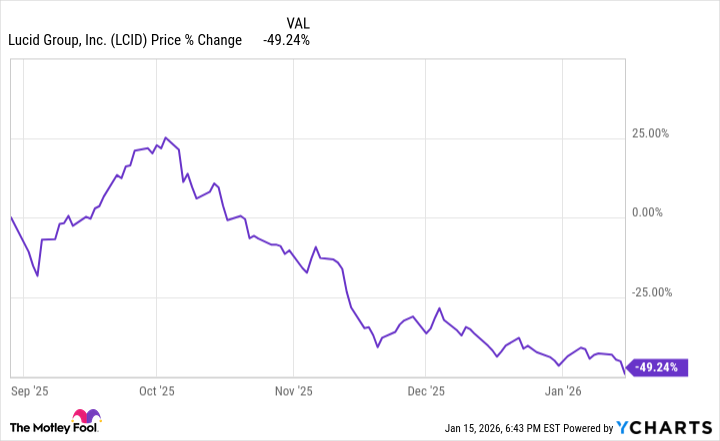

Then there was the reverse stock split. Oh, the reverse stock split. It’s a financial maneuver designed to artificially inflate the share price, mostly to avoid getting delisted from the NASDAQ. It’s like wearing platform shoes to appear taller. It doesn’t change anything fundamental, it just… obscures the reality. Before the split, they were hovering around a dollar. Now it’s… well, it’s still not great, but it’s a slightly less embarrassing number. They’re hoping investors won’t notice the emperor has no charge.

I’ve seen this movie before. A charismatic founder, a lot of hype, a mountain of debt, and a dwindling cash supply. The EV market is a bloodbath right now. Every major automaker is throwing money at it, and Lucid is trying to compete with companies that have decades of manufacturing experience and established supply chains. They produced 18,378 vehicles last quarter, which is up 104% year-over-year. Sounds impressive, until you realize that Tesla is churning out hundreds of thousands. It’s like entering a pie-eating contest with a teaspoon.

Look, I’m not saying Lucid is doomed. They have some genuinely innovative technology. But they’re facing an uphill battle. And right now, I see a lot more red flags than green lights. Most investors should probably steer clear. Unless you’re my uncle, in which case, please, for the love of all that is financially responsible, don’t listen to me. I’m just a grumpy investor with a penchant for pointing out the obvious.

I suspect my uncle will remain convinced he’s about to get rich. He has a way of seeing potential where others see peril. It’s endearing, really. And who knows? Maybe he’ll be right. But I’m not holding my breath. I’m too busy bracing myself for the inevitable “I told you so.”

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- The Hidden Treasure in AI Stocks: Alphabet

- TV Pilots Rejected by Networks

- The Labyrinth of JBND: Peterson’s $32M Gambit

- The Worst Black A-List Hollywood Actors

- You Should Not Let Your Kids Watch These Cartoons

- Mendon Capital’s Quiet Move on FB Financial

- Live-Action Movies That Whitewashed Anime Characters Fans Loved

2026-01-18 00:22