The year 2025 witnessed a peculiar flourishing for Alphabet, a company that, like a seasoned landowner, managed to outperform many of its more boisterous neighbors in the technological fields. It was a year of recoveries, of belated awakenings, and a proving of resilience. Yet, the circumstances that propelled its ascent—a confluence of anxieties and belated recognitions—are unlikely to repeat themselves with such convenient precision. The market, after all, is seldom so accommodating.

To anticipate a similar surge in the coming year—a replication of that 65% climb—would be, I suspect, a touch of the fanciful. Still, one might reasonably expect Alphabet to navigate the currents and exceed the general pace of the market. It is not a matter of spectacular leaps, but of steady, measured progress – the sort one observes in a well-tended garden.

The Shadows Recede

At the dawn of 2025, Alphabet bore the weight of certain anxieties. Doubts lingered regarding its position in the emerging realm of generative artificial intelligence, a field where nimble newcomers threatened to eclipse the established order. Many whispered that it had fallen behind, become a little…stately, perhaps, in its approach. But the company, to its credit, demonstrated a capacity for adaptation. Gemini emerged, not as a revolutionary upheaval, but as a solid, dependable offering—a capable workhorse amongst the more flamboyant pretenders.

The integration of Gemini into the company’s offerings, and the subsequent adoption by clients seeking to build their own artificial intelligence features, offers a subtle, but promising, avenue for growth. It is a long game, of course. The fruits of such investments are seldom immediate, and the true extent of their yield remains shrouded in the mists of future years. But the foundations, it appears, are sound.

No less significant was the health of Google Search, the venerable source of Alphabet’s prosperity. In the third quarter, it accounted for $56.6 billion of the company’s $102.3 billion in revenue—a considerable sum, even in these extravagant times.

The search engine faced a dual challenge: the disruptive potential of generative AI and the specter of antitrust scrutiny, which threatened to dismantle the carefully constructed ecosystem surrounding Chrome and Android. The integration between these elements—a symbiotic relationship cultivated over years—is a source of considerable strength.

The initial fears regarding generative AI proved largely unfounded. Rather than supplanting traditional search, these new tools were, in a sense, absorbed into the existing framework. The introduction of AI Overviews—those concise, algorithmically generated summaries—proved popular, maintaining Google’s dominance in a field where novelty alone is insufficient.

And, in a turn of events that surprised many, the antitrust proceedings concluded with a relatively lenient outcome. No radical restructuring was mandated, and the concessions required were, in the grand scheme of things, minor. It was a reprieve, a moment of quietude in a world of constant upheaval.

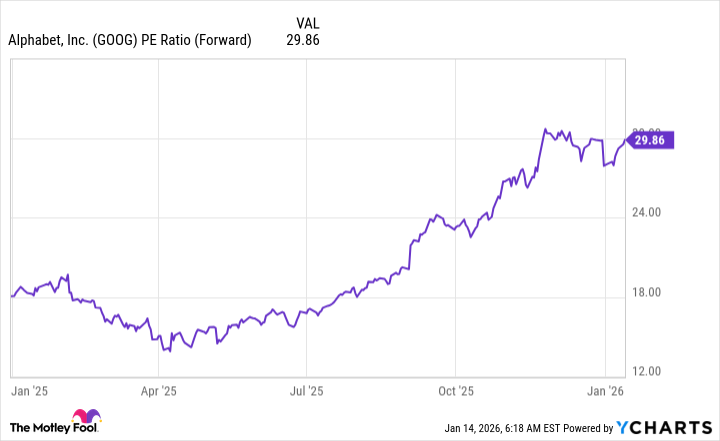

These factors, taken together, contributed to a period of undervaluation at the beginning of 2025. As the shadows receded, the market recognized the company’s inherent worth, and its valuation returned to a more equitable level. The most significant catalysts of the previous year, therefore, are unlikely to exert the same influence in the coming months.

Currently, Alphabet trades at 30 times forward earnings—a reasonable valuation, given the prevailing conditions. From this point forward, its stock price is likely to be closely correlated with its earnings growth—a predictable, if uninspiring, trajectory.

With that in mind, what might we reasonably expect Alphabet’s stock price to be at the end of 2026?

A Season of Consolidation

Alphabet’s revenue is projected to increase by approximately 14% in 2026—a rate that, while respectable, is hardly exceptional. It is a benchmark that all major technology companies must clear to remain attractive to investors—a minimum requirement, if you will.

Assuming that the company continues to trade at 30 times forward earnings at the end of 2026, we must consider projections for 2027. The consensus among ten Wall Street analysts covering the stock is that it will generate $12.76 in earnings per share. At 30 times forward earnings, this would yield a share price of approximately $383—roughly 14% above current levels.

This represents a solid, if unspectacular, return—above the market’s average annual return of around 10%. It is, therefore, a reasonable investment. However, it is important to remember that even a successful year for Alphabet may be overshadowed by a particularly exuberant market. The currents of fortune are fickle, and even the most well-tended garden can be swept away by a sudden storm.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- The Hidden Treasure in AI Stocks: Alphabet

- TV Pilots Rejected by Networks

- The Labyrinth of JBND: Peterson’s $32M Gambit

- The Worst Black A-List Hollywood Actors

- You Should Not Let Your Kids Watch These Cartoons

- Mendon Capital’s Quiet Move on FB Financial

- Live-Action Movies That Whitewashed Anime Characters Fans Loved

2026-01-17 23:13