It is a truth universally acknowledged, that a company in possession of ample fortune must, in the eyes of its shareholders, seek to distribute it. This distribution, however, is often attended with a peculiar comedy of errors, a striving after appearances that obscures the true measure of value. We observe two principal methods employed in this noble endeavor: the dole of dividends, a regular offering to appease the clamoring public, and the more subtle art of share repurchase, a vanishing act performed with the company’s own coin.

Many a fool rushes in where wisdom ought to tread, fixating upon the superficial glitter of dividend yields. Yet, such a narrow view neglects the deeper magic—the power of a company to diminish the very number of shares outstanding, thereby amplifying the portion belonging to each discerning investor. Thus, let us turn our gaze to General Motors (GM 0.11%), a player upon the stage of industry who, with a touch of theatrical flair, has mastered this art.

The Detroit Icon’s Gambit

A year past, General Motors, with a gesture both bold and calculated, announced a 25% augmentation of its quarterly dividend, matching the largesse of its rival, Ford Motor Company (F 1.45%). But this was merely the overture. The true spectacle lay in the unveiling of a $6 billion share repurchase program—a maneuver designed not merely to return capital, but to reshape the very composition of ownership.

This act of generosity unfolds at a curious juncture. While the industry at large appears to suffer a fit of melancholy, with sales and enthusiasm for electric carriages waning, General Motors stands firm, reinvesting in profitable ventures, strengthening its balance sheet, and, of course, indulging in this delightful game of financial illusion.

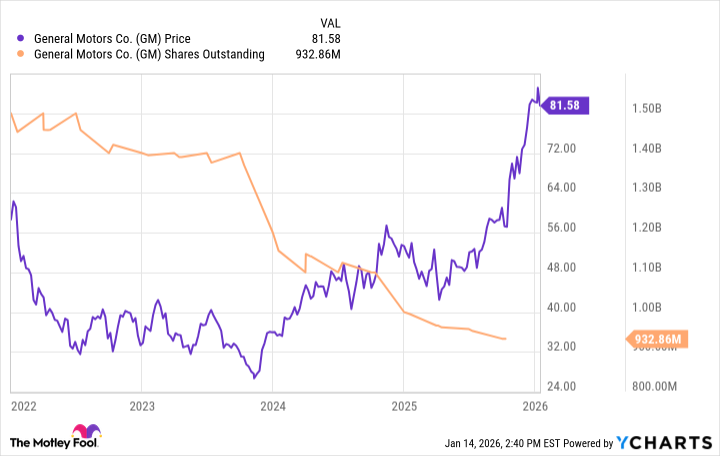

The astute observer will note that this is not a singular performance, but a recurring theme. General Motors, plagued by a stock price deemed by many to be unjustly modest, has, since 2023, authorized a staggering $16 billion in share buybacks. The result? A perceptible ascent in the share price, a visual confirmation of the diminishing number of shares, forming, as it were, an ‘X’ upon the chart – a most satisfying denouement for the informed investor.

The Peculiar Blindness of the Multitude

Ford and General Motors, fierce rivals upon the commercial field, often engage in similar strategies. Yet, while Ford favors the ostentatious display of dividends, General Motors prefers the more discreet elegance of share repurchases. Investors, alas, are easily captivated by the obvious, flocking to stocks boasting high dividend yields—much like moths to a flickering flame—and overlooking the hidden virtues of General Motors, whose dividend yield, though modest, belies a far greater potential.

Consider, if you will, the ‘total yield’—a figure encompassing both dividend payments and the value created by share buybacks. For General Motors, this number reaches an impressive 11.3%, a figure that dwarfs Ford’s 5.6%, according to the discerning analysts at Morningstar. The reason? A simple truth: Ford lacks a comparable commitment to repurchasing its own shares. General Motors, through judicious action, has demonstrably enhanced the worth of each remaining share. Most investors, blinded by superficial allure, overlook this fact. But let us, as discerning players upon the financial stage, not commit the same error.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- The Hidden Treasure in AI Stocks: Alphabet

- TV Pilots Rejected by Networks

- The Labyrinth of JBND: Peterson’s $32M Gambit

- The Worst Black A-List Hollywood Actors

- You Should Not Let Your Kids Watch These Cartoons

- Mendon Capital’s Quiet Move on FB Financial

- Live-Action Movies That Whitewashed Anime Characters Fans Loved

2026-01-17 21:34