Now, the Stock Market, that enormous, rumbling beast, has been enjoying a rather splendid feast for a few years. A feast of artificial intelligence, you see. It’s puffed itself up like a prize-winning pumpkin, and everyone’s been gobbling up the shares. Normally, you can expect a decent 7% return after all the fuss and bother, but this AI business has sent things quite topsy-turvy.

Since 2023, it’s been snarfing up returns at a rate of 21% a year – nearly triple the usual amount! It’s a bit like feeding a greedy goose endless buckets of corn. Wonderful while it lasts, but you know something has to give. Clever investors, the ones with a bit of sense, aren’t just gazing at those soaring prices. They’re peering beneath the surface, checking for wobbly bits.

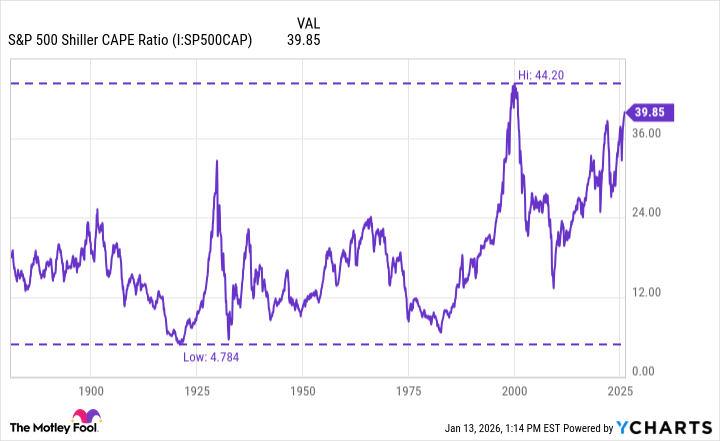

We’re going to have a look at a rather curious measuring stick – the CAPE ratio – to see just how stable this whole shebang really is. It’s a bit like a doctor checking a patient’s pulse, only instead of a heartbeat, it’s measuring how much investors are willing to pay for every pound of company earnings over the last ten years. It smooths out the bumps and blips, you see, and gives you a rather clearer picture.

Right now, this CAPE ratio is perched at 39.8. A rather alarming height, actually. The last time it wobbled up this high was back in the year 2000, just before the dot-com bubble went pop! A most unpleasant sound, like a giant bubblegum bubble bursting in your ear.

What Does a Rising CAPE Ratio Mean?

If you look back through the history books, you’ll find this CAPE ratio has only reached such dizzying heights a couple of times. Once in the roaring twenties, and again, as we’ve said, just before the dot-com disaster. Both times, the market took a most spectacular tumble, like a clumsy giant tripping over his own feet.

Now, a rising CAPE ratio doesn’t guarantee a crash, mind you. It simply suggests that everyone is terribly optimistic, which is often a sign that things are about to get a bit… precarious. It’s like building a tower of sweets – it looks marvelous, but it’s bound to topple eventually.

Will the Stock Market Crash in 2026?

The Stock Market, that enormous beast, may be marching towards a rather nasty collision with history. But sensible investors should take a step back and have a good, long think. It’s a bit like a lion tamer deciding whether to enter the cage.

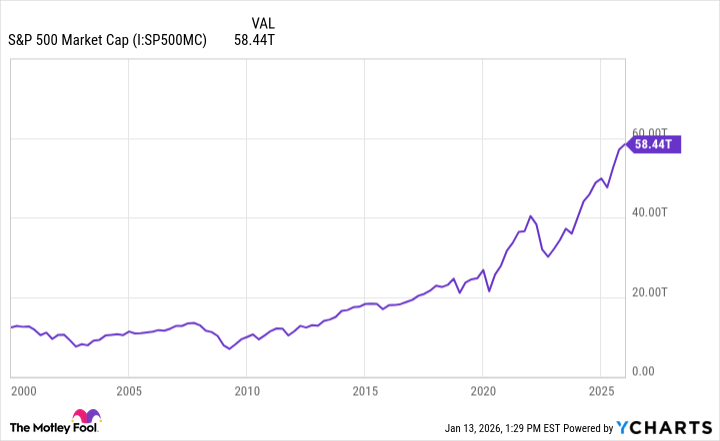

The entire S&P 500 is worth a staggering $58 trillion. And ten of the most valuable companies within it gobble up a whopping $26 trillion of that – nearly half! This means the whole market is being tugged around by a very small group of giants. Giants who are currently riding high on this AI wave.

If you look closely, companies like Nvidia, Alphabet, Meta Platforms, Broadcom, Amazon, and Taiwan Semiconductor Manufacturing don’t seem too expensive, if you consider their earnings. They’re reasonably priced, if not downright cheap. Like finding a perfectly good sweet that hasn’t been inflated to ridiculous prices.

The truly expensive bits, the ones most likely to cause trouble, are lurking outside that top ten or fifteen. It’s like a delicious cake with a few rotten cherries hidden inside.

My advice? Reduce your exposure to those wildly fluctuating growth stocks, those speculative investments you’re hoping will turn into mountains of money. Instead, focus on solid, dependable businesses with a variety of income streams. Companies that are built to last, not just to flash and sparkle.

These larger companies are the blue chips, the reliable ones. And keeping a bit of cash on hand wouldn’t go amiss either. It’s like having a secret stash of sweets for a rainy day.

This strategy will strengthen your portfolio for the long haul, whether the Stock Market crashes in 2026 or not. And remember, a little bit of caution can save you a great deal of bother.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- You Should Not Let Your Kids Watch These Cartoons

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- ‘Bugonia’ Tops Peacock’s Top 10 Most-Watched Movies List This Week Once Again

- The Hidden Treasure in AI Stocks: Alphabet

- TV Pilots Rejected by Networks

- The Labyrinth of JBND: Peterson’s $32M Gambit

- USD RUB PREDICTION

- Mendon Capital’s Quiet Move on FB Financial

2026-01-17 05:02