The air, my friends, is thick with whispers of “artificial intelligence.” A most curious phrase, as if intelligence were something one might misplace between the sofa cushions. Wall Street, that grand bazaar of hopes and anxieties, has been seized by a fever, a conviction that this… calculating engine… will somehow transmute base metals into gold. It is a time for careful observation, for separating the genuine glint from the fool’s pyrite. For the discerning investor, opportunities abound, though they are often shrouded in a fog of extravagant pronouncements and the scent of desperation. One must tread carefully, lest one’s portfolio be swallowed by the digital quicksand.

Meta Platforms: The Collector of Moments

Meta Platforms, formerly known by a simpler, less ambitious name, has embarked upon a grand experiment. It is accumulating moments, you see – not in albums or diaries, but in the ethereal realm of data. This company, a veritable spider spinning a web of connections, invests heavily in these calculating engines, and the results, thus far, are… intriguing. Revenue and earnings swell, driven by an algorithm that understands, with unsettling accuracy, the human penchant for distraction. The more time one spends gazing at the glowing rectangle, the more attractive the spectacle becomes to those who wish to sell things. It is a peculiar symbiosis, a dance between attention and commerce.

They gather data, you see, on our habits, our desires, our most fleeting whims. It is as if they are compiling a secret inventory of the human soul, to be sold to the highest bidder. The company’s recent expenditures on infrastructure have caused some consternation amongst the more timid investors, but I assure you, this is merely the price of building a cathedral to the digital god. They once dreamed of a “metaverse,” a virtual realm where one might escape the mundane realities of existence. That particular fancy seems to have cooled, but the company, like a resourceful cockroach, has adapted, cut its losses, and moved on.

Consider this: Meta boasts over 3.5 billion daily active users. A staggering number! It is a kingdom unto itself, a vast dominion of interconnected individuals. The possibilities for monetization are endless, extending far beyond the realm of advertising. Perhaps, through initiatives like “Meta AI,” they will unlock new avenues for extracting value from this captive audience. In short, it remains an attractive prospect, though one should always remember that even the most magnificent castles are built on shifting sands.

Apple: The Polisher of Apples

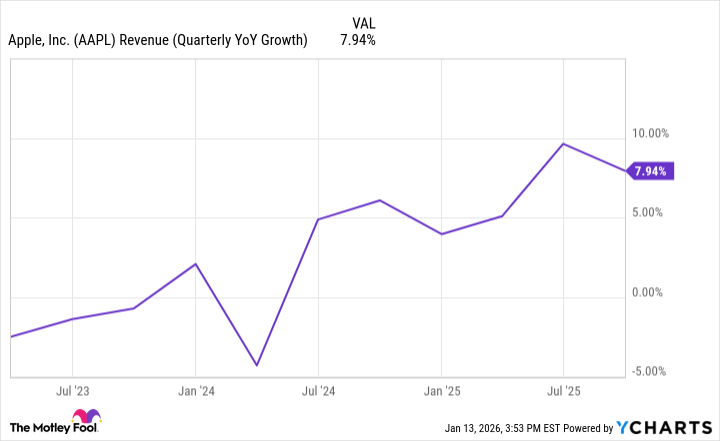

Apple, a company renowned for its ability to convince people they need things they never knew existed, has been somewhat slower to embrace this calculating engine craze. However, its latest offering, the iPhone 17, is proving to be a considerable success. It is as if they have sprinkled a little magic dust on the device, adding features powered by this new technology. This has triggered a robust cycle of renewals, and revenue growth has surged. It is a familiar pattern, a testament to Apple’s mastery of illusion and marketing.

They project double-digit revenue growth, a feat they haven’t accomplished in several years. It is as if they have discovered a perpetual motion machine, a way to generate wealth from thin air. Apple continues to invest in these calculating engines, enhancing its devices and attracting more users. With over 2 billion devices in circulation, they have a vast installed base, a captive audience eager to consume whatever shiny trinket they offer next. It is a formidable position, a testament to their ability to create desire where none existed before.

Recursion Pharmaceuticals: The Alchemist’s Laboratory

Recursion Pharmaceuticals, a small drugmaker with ambitions that far exceed its size, aims to revolutionize the way drugs are developed. They employ an AI-powered operating system, a virtual laboratory where millions of experiments are conducted. It is as if they are attempting to unlock the secrets of life itself, to create a universal cure for all ailments. They claim their approach could significantly reduce the time and cost of drug development. A noble goal, to be sure, but one fraught with peril.

Currently, the process of bringing a drug to market can take over a decade and cost billions. They promise to streamline this process, to accelerate the pace of innovation. If successful, everyone would benefit: patients would receive life-saving treatments faster, and drugmakers would generate higher profits. However, Recursion has yet to bring a single product to market. It is as if they are building a magnificent cathedral without laying a single foundation stone. Furthermore, none of their candidates are currently in phase 3 studies. And to make matters worse, larger companies, such as Eli Lilly, are now entering the fray, employing similar technologies. It is as if a giant is challenging a dwarf to a duel. The goal of licensing this operating system to other drugmakers seems… optimistic, to say the least.

In conclusion, Recursion Pharmaceuticals is a highly risky investment. Those who are not comfortable with such a level of uncertainty should seek their fortunes elsewhere. One should remember that alchemy, despite its alluring promises, rarely transmutes lead into gold.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- You Should Not Let Your Kids Watch These Cartoons

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- ‘Bugonia’ Tops Peacock’s Top 10 Most-Watched Movies List This Week Once Again

- The Hidden Treasure in AI Stocks: Alphabet

- TV Pilots Rejected by Networks

- USD RUB PREDICTION

- Mendon Capital’s Quiet Move on FB Financial

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

2026-01-17 00:52