Now, I’ve seen a good many things come and go in my time – booms, busts, fortunes made on snake oil, and fortunes lost on even sillier notions. Lately, it’s been this fever for artificial intelligence, a contraption that promises to do everything but polish your boots. Folks are payin’ premiums for these AI stocks, lookin’ for a quick ride to the moon, and forgettin’ the simple virtues of a steady nag. They’re chasin’ rainbows while a perfectly good dividend sits there, quiet as a church mouse.

That’s where a company like Procter & Gamble comes in. It ain’t glamorous, mind you. No whizz-bang gadgets or promises of world domination. Just soap, diapers, and things folks need, day in and day out. A fella can set his watch by the demand for a clean shirt, you see. And that, my friends, is a powerful thing in a world gone mad with speculation.

A Heap of Goods, and a History to Match

You likely know the name. P&G, they call it. Behind it are brands you’ve been acquainted with since you were a babe in arms – Tide, Gillette, Pampers, the whole kit and caboodle. They’re the biggest in the business, by a country mile, movin’ some $84.3 billion worth of goods last year. Dominatin’ ain’t easy, but they’ve managed it, and stayin’ on top, well, that’s a trick most can’t master.

Now, bein’ a giant has its drawbacks. More to manage, more eyes watchin’, and growth gets harder when you’re already a mountain. It’s like tryin’ to outrun a snail when you’re already the fastest horse in the county. But a fella who understands business knows that size, when handled right, is a powerful advantage.

Lately, P&G’s stock has taken a bit of a tumble – down 20% from its peak. Seems folks have been fixated on these fast-growin’ AI outfits and forgot about the virtues of a reliable earner. Consumers have been watchin’ their pennies, and that’s put a squeeze on profits. But I reckon this is a temporary affliction. A bit of a headwind, as they say. And a smart trader sees opportunity in a headwind, not reason to run for cover.

This ain’t a stock for get-rich-quick schemes. It’s a stock for folks who understand that wealth is built on steady accumulation, not wild speculation. And that dividend? It’s as solid as the hills. That’s why I’m lookin’ at this dip as a buyin’ opportunity, a chance to add a bit of ballast to my portfolio.

A Glimmer of Hope on the Horizon

Now, I won’t pretend things are perfect. P&G’s been navigatin’ some choppy waters. But they seem to have found their sea legs. Management is adaptin’, and the underlying economic currents are startin’ to shift.

Inflation, that pesky critter that’s been eatin’ away at folks’ pocketbooks, is finally showin’ signs of retreat. The Federal Reserve is predictin’ it’ll cool down to around 2% in the next couple of years. And economic growth is expected to pick up a bit. Even overseas, things are lookin’ a little brighter. These numbers may seem small, but they add up. They mean more money in folks’ pockets, and more demand for the things P&G sells.

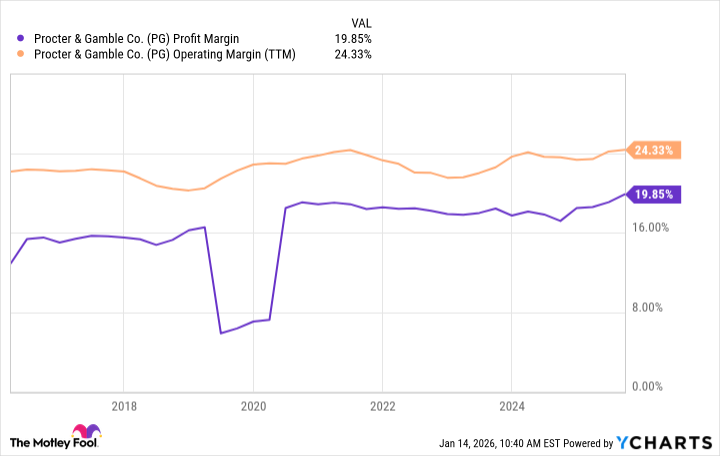

And here’s the clever part: P&G has managed to widen its profit margins during this turbulent period. That’s a sign of a well-run company, a company that knows how to adapt and thrive.

That dividend, you ask? It’s well-supported. Last year, they only paid out about 63% of their earnings in dividends. That leaves plenty of room for future growth and continued payouts. They’ve been payin’ a dividend for 135 years, and they’ve raised it every year for the past 69. That’s a record that’s hard to beat.

A Chance Worth Seizin’

Given P&G’s stature and its current yield of around 3%, it’s surprisin’ to see the stock languishin’. Folks are chasin’ after these AI moonshots and forgettin’ about the virtues of a reliable earner.

But I reckon this is a temporary situation. P&G has a long history of solid performance, rooted in the nature of its products and its dominance of several consumer goods categories. This dip is an opportunity to get in at a good price.

Don’t overthink it. We don’t know if P&G’s stock has hit its ultimate low just yet, but it’s a perfectly good time to dive in. A smart trader doesn’t wait for perfection. He seizes opportunity when it presents itself. And right now, P&G looks like a mighty fine opportunity indeed.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- You Should Not Let Your Kids Watch These Cartoons

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- ‘Bugonia’ Tops Peacock’s Top 10 Most-Watched Movies List This Week Once Again

- The Hidden Treasure in AI Stocks: Alphabet

- TV Pilots Rejected by Networks

- USD RUB PREDICTION

- Mendon Capital’s Quiet Move on FB Financial

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

2026-01-16 19:54