The entity known as CoreWeave – a designation applied with a precision that feels, even now, somewhat arbitrary – experienced a trajectory in the recent fiscal cycle that can only be described as a demonstration of the market’s inherent, and frankly unsettling, capriciousness. A rise, initially, of 367% following the ritualistic offering of shares – a procedure whose logic remains, to this observer, opaque – was followed by a decline, equally pronounced, from a peak attained in June. The current valuation represents a diminution of 51% from that ephemeral high. One notes, with a detached curiosity, that the company is still elevated 125% above its initial price. A temporary reprieve, perhaps, before the inevitable reckoning.

The stated function of CoreWeave is the provision of specialized computational infrastructure – a network of data centers powered by what are termed “graphics processing units.” These units, it is asserted, facilitate the construction, deployment, and scaling of “artificial intelligence” applications. The term “artificial” feels particularly loaded, given the increasingly blurred lines between the constructed and the genuine. The company also caters to larger entities – “cloud computing giants” – who require additional processing capacity. This arrangement suggests a parasitic relationship, a dependency that feels… precarious.

The demand for this capacity, we are informed, consistently exceeds the supply. A shortage of approximately 10 gigawatts is projected annually through 2028, according to a report from Goldman Sachs – a name that resonates with the weight of unseen forces. CoreWeave, therefore, operates within a system of constrained resources, a closed loop where scarcity dictates value. The company itself acknowledges this, stating that demand “far exceeds available capacity.” A self-fulfilling prophecy, perhaps, meticulously constructed to justify ever-increasing prices.

As of the third quarter of the recent fiscal year, CoreWeave operated 41 data centers in the United States and Europe, offering 590 megawatts of active power. Plans are in place to add at least 1 gigawatt in the next year or two. This expansion, however, is already accounted for. The capacity has been “sold” – a transaction that feels less like a commercial exchange and more like a pre-ordained allocation of dwindling resources. The company’s revenue backlog stands at nearly $56 billion – a figure that inspires not confidence, but a vague sense of unease. Revenue increased by 134% year over year to $1.36 billion. A growth rate that feels… unsustainable. Lucrative contracts with entities such as OpenAI and Meta Platforms have been secured. The acquisition of these contracts, one suspects, is less a testament to CoreWeave’s merit and more a consequence of its position within a limited ecosystem.

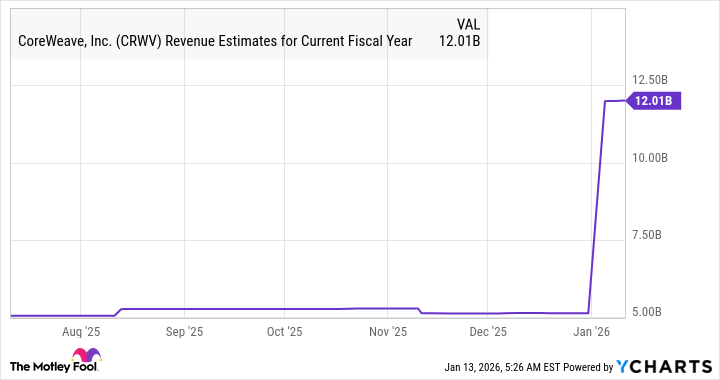

The company projects revenue of $5.1 billion for the current fiscal year, a 165% increase over the previous year. Analysts anticipate a doubling of this figure in 2026, reaching approximately $12 billion. This projection, however, relies on a continuation of current trends – a dangerous assumption in a world governed by unpredictable forces.

The current trading multiple of 9.3 times sales feels… incongruous, given the company’s growth rate. It is only slightly higher than the average multiple for the U.S. technology sector. One could argue that CoreWeave deserves a premium, but such arguments are often based on speculative projections and wishful thinking. Even at the current multiple, achieving $12 billion in sales could result in a market capitalization exceeding $104 billion – more than double the current value. A doubling that feels… inevitable, yet strangely hollow.

Therefore, one observes a situation ripe for… adjustment. A recalibration of expectations. A re-evaluation of intrinsic value. An investment in CoreWeave, at this juncture, is not merely a financial transaction; it is an acceptance of a predetermined outcome. A willingness to participate in a system that operates according to rules that are, at best, opaque, and at worst, actively designed to perpetuate a state of controlled scarcity. It is, in essence, a surrender to the inevitable. And, from a strictly pragmatic perspective, it may also prove to be… profitable.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- You Should Not Let Your Kids Watch These Cartoons

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- ‘Bugonia’ Tops Peacock’s Top 10 Most-Watched Movies List This Week Once Again

- The Hidden Treasure in AI Stocks: Alphabet

- South Korea’s Wild Bitcoin ETF Gamble: Can This Ever Work?

- Genius Act Sparks Banks vs Stablecoin Yields

- TV Pilots Rejected by Networks

- USD RUB PREDICTION

2026-01-16 17:33