Last year, the tech stocks, as is their wont, proved a rather ripping good investment, largely thanks to the current enthusiasm for Artificial Intelligence – a subject that fills one with a delightful sense of the future, doesn’t it? And when one speaks of AI, Tesla (TSLA 0.14%) inevitably pops up, and with good reason, though one sometimes wonders if the hype exceeds the horsepower, as it were.

Mr. Elon Musk, that enterprising fellow, possesses a knack for captivating the investing public, promising innovations that would make Jules Verne blush. However, as the old timers say, deeds are the things, and Tesla’s recent performance has been, shall we say, a bit more earthbound. Last year saw a gain of a mere 11.4%, a distinctly un-sparkling result when compared to the S&P 500’s 16.4% and the positively zippy 20.4% of the Nasdaq Composite. A bit of a pickle, what?

The once-unstoppable Tesla seems to have entered a lower gear, and the reason, dear reader, is a rather glaring disconnect between the grand promises and the actual deliveries. It’s a bit like ordering a four-course banquet and receiving a rather solitary biscuit. One feels distinctly short-changed.

Let’s delve into the particulars. Sentiment remains buoyant, naturally, but the discerning investor knows that the upcoming earnings report on January 28th could very well set the stage for the remainder of 2026. A crucial moment, indeed, and one best approached with a healthy dose of skepticism and a well-placed monocle.

Tesla Gave Investors a Preview – and It Wasn’t Entirely Jolly

On December 29th, Tesla performed a rather unusual maneuver: it published a compendium of vehicle delivery estimates from the chaps on Wall Street. The analysts, you see, anticipated a total of 422,850 and 1,640,752 deliveries for the fourth quarter and full year, respectively. Quite a hopeful bunch, those analysts.

Four days later, the actual figures emerged. 418,227 and 1,636,129 vehicles, alas, fell slightly short of the consensus. A minor setback, perhaps, but consistently declining deliveries are hardly a recipe for a roaring success, are they? Especially when one considers that these electric vehicles are Tesla’s primary source of revenue and, more importantly, profit.

A shrinking market share adds another layer of concern. One suspects that investors are beginning to wonder if Tesla’s once-unassailable position is beginning to wobble. A bit of a fright, to be sure.

Tesla’s Interesting Start to 2026

As of January 12th, Tesla’s stock is, shall we say, holding its own in 2026. There have been a couple of fleeting rallies, naturally, and one anticipates more such bursts of optimism leading up to the earnings report. However, one must approach these rallies with a certain amount of caution. They tend to be as substantial as a puff of smoke.

The main variable fueling Tesla’s current volatility is, of course, Artificial Intelligence. Mr. Musk has long envisioned a transformation from mere automobile manufacturer to a tech-enabled services behemoth, with autonomous driving at the heart of it all. A robotaxi fleet, no less! A dashedly ambitious plan, wouldn’t you say?

Mr. Musk himself predicted that Tesla’s robotaxi service would be serving half the U.S. population by the end of 2025. A rather optimistic forecast, as it turned out. It’s one of many overzealous promises that haven’t quite materialized. While some bulls on Wall Street still see robotaxis as a trillion-dollar opportunity, the company has precious little to show for its investments thus far. One suspects that the rhetoric is beginning to ring a bit hollow.

Should One Buy Tesla Stock Before Earnings?

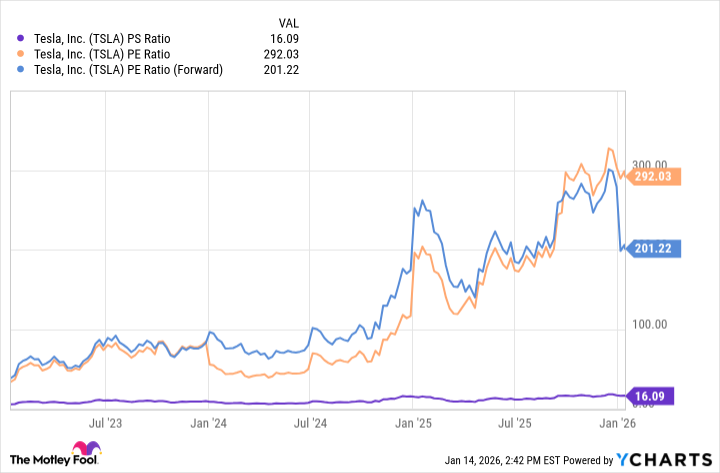

Analyzing Tesla through the lens of traditional value metrics – price-to-sales, price-to-earnings, and all that – is a bit like trying to fit a square peg into a round hole. It simply doesn’t quite work.

This profile suggests that Tesla is valued as a hypergrowth, high-margin technology business, despite being a capital-intensive car manufacturer with shrinking sales and profit margins. A curious state of affairs, wouldn’t you agree?

One suspects that Mr. Musk will use the majority of the upcoming earnings call to deflect attention from the realities of Tesla’s situation and once again put on a cheerleading display for robotaxis and other AI-related ambitions. A bit of a distraction, perhaps?

In one’s humble opinion, investors should not be swayed by such talking points. For the time being, Tesla remains an extremely volatile momentum stock. Investing at current price points essentially validates the AI thesis, despite the company achieving little traction in this field. Any rallies the stock experiences will likely be short-lived, fueled by traders rather than measurable progress. Against this backdrop, one would not recommend buying Tesla stock before the fourth-quarter earnings are released. A bit of prudence, you see, is never amiss.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- You Should Not Let Your Kids Watch These Cartoons

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- ‘Bugonia’ Tops Peacock’s Top 10 Most-Watched Movies List This Week Once Again

- The Hidden Treasure in AI Stocks: Alphabet

- South Korea’s Wild Bitcoin ETF Gamble: Can This Ever Work?

- Genius Act Sparks Banks vs Stablecoin Yields

- TV Pilots Rejected by Networks

- USD RUB PREDICTION

2026-01-16 16:52