Author: Denis Avetisyan

A new computational analysis of two decades of financial reporting reveals a strategic evolution in how climate change is framed, driven by key actors and their arguments.

This study employs large language models to analyze actor-frame-argument dynamics in financial news, demonstrating a shift in climate discourse over time.

Despite the growing influence of financial news on climate investment, systematic analysis of its underlying discourse remains surprisingly limited. This study, ‘Actors, Frames and Arguments: A Multi-Decade Computational Analysis of Climate Discourse in Financial News using Large Language Models’, addresses this gap through a novel computational framework applied to two decades of reporting from Dow Jones Newswire. Our analysis reveals a significant shift in framing, moving from emphasis on climate risk and regulation to narratives of economic opportunity and innovation, concurrent with a rise in the prominence of financial institutions as key voices. How do these evolving narratives shape investment decisions and, ultimately, the trajectory of climate action?

Mapping Climate Discourse: A Rigorous Analytical Foundation

The discourse surrounding climate change is remarkably dynamic, shifting alongside scientific advancements, political agendas, and public perception. Consequently, simply tracking mentions of ‘climate change’ proves insufficient for grasping the complexities of the conversation; a nuanced understanding demands tools capable of dissecting how climate issues are being discussed, by whom, and with what underlying rationale. Robust analytical methods are therefore essential to move beyond superficial observation and enable researchers to identify emerging trends, dominant narratives, and potential misinformation. These tools facilitate the mapping of the entire ‘climate conversation’, providing a crucial foundation for informed policy-making and effective communication strategies. Without such analytical power, critical shifts in the climate narrative risk remaining undetected, hindering efforts to address this global challenge.

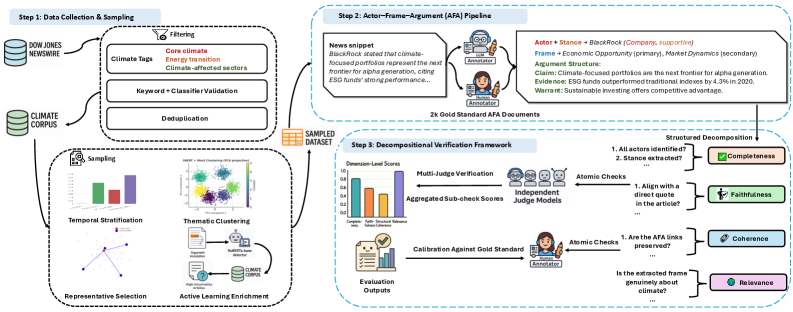

A novel analytical framework, termed the ‘Actor-Frame-Argument Pipeline’, has been developed to methodically dissect climate change discussions appearing in news media. This pipeline isn’t simply keyword-based; it’s designed to identify who is speaking about climate change – the key actors involved – and how they are presenting the issue – the frames they employ. Crucially, the system doesn’t stop at framing; it extracts the underlying arguments being made, allowing for a nuanced understanding of the diverse perspectives shaping public discourse. By automating this complex process, researchers gain access to a structured dataset capable of revealing patterns, trends, and shifts in the climate conversation, offering a powerful tool for monitoring and analyzing the evolving narrative.

The analytical framework utilizes advanced Large Language Models to automate the complex task of dissecting climate change discourse. By identifying key actors – individuals, organizations, or entities – and their specific framing of related issues, the system moves beyond simple keyword searches to understand how climate change is being discussed. Critically, this automated approach achieves a high degree of accuracy, registering an argument extraction F1-score of 75.1%. This performance is remarkably close to that of a traditionally trained model, lagging only by 3.3 percentage points despite being built on a significantly smaller dataset, demonstrating the power and efficiency of this novel application of artificial intelligence to climate communication analysis.

Data and Methodology: Establishing a Verifiable Corpus

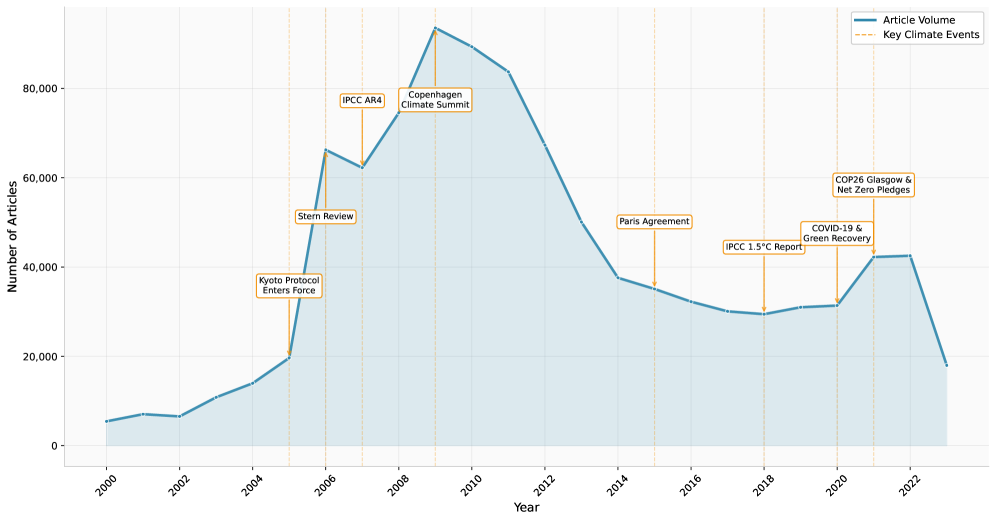

The foundation of this analysis is the ‘Dow Jones Climate News Corpus’, a dataset comprising 980,061 news articles published over a twenty-year period. This corpus represents a substantial collection of climate-related reporting, offering a broad temporal scope for investigating trends and patterns in climate news coverage. The articles included originate from Dow Jones newswires and associated publications, ensuring a consistent and professional journalistic standard throughout the dataset. The corpus’s size and duration are intended to provide sufficient data for statistically significant and robust analyses of climate-related discourse.

The ‘Dow Jones Climate News Corpus’ underwent analysis via the ‘Actor-Frame-Argument Pipeline’, a process subsequently validated by the ‘Decompositional Verification Framework’. This framework facilitated a step-by-step assessment, from initial ‘Actor Identification’ through ‘Argument Extraction’, to ensure result accuracy. Quantitative evaluation revealed a deviation of less than 0.03 from human assessment benchmarks, indicating a high degree of correspondence between automated analysis and expert judgment. This rigorous verification process minimizes the potential for inaccurate conclusions drawn from the corpus data.

The applied evaluation framework enables assessment of individual pipeline components, specifically ‘Actor Identification’ through ‘Argument Extraction’, to isolate potential error sources. This granular approach minimizes the likelihood of identifying statistically significant but ultimately meaningless correlations. Validation against human-annotated gold standard data demonstrated performance metrics of 0.78 for precision, 0.74 for recall, and 0.71 for the F1 score, indicating a strong level of agreement between automated analysis and human judgment.

A Shifting Narrative: From Perceived Risk to Opportunity Framing

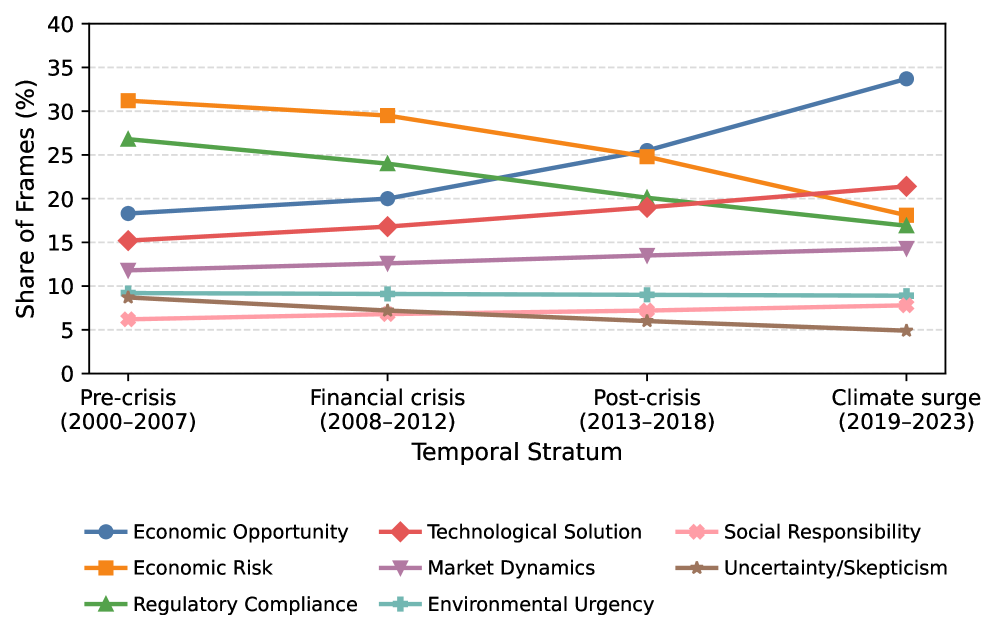

Analysis of publicly available data indicates a statistically significant shift in framing related to climate change discussions after 2015 (p<0.01). Prior to this period, discourse predominantly centered on potential economic risks and the need for regulatory compliance. Following 2015, the emphasis measurably decreased for both the ‘Economic Risk Frame’ and the ‘Regulatory Compliance Frame’, indicating a substantive change in how climate change is being discussed and perceived within the analyzed datasets. This shift is supported by quantitative analysis demonstrating a statistically reliable divergence from pre-2015 trends.

Analysis of post-2015 discourse reveals a growing emphasis on the potential economic benefits associated with climate change mitigation and adaptation. This “Economic Opportunity Frame” manifests as discussions centering on new markets, green investments, and the financial gains achievable through sustainable practices. Concurrently, the “Technological Solution Frame” gains prominence, highlighting innovation in areas such as renewable energy, carbon capture, and climate-resilient infrastructure as key drivers of economic growth and opportunity. This combined focus represents a shift from viewing climate action solely as a cost or obligation towards recognizing its potential as a source of economic advancement.

Analysis of communications from financial institutions demonstrates a statistically significant increase in framing climate change as an economic opportunity rather than a financial risk after 2015. This shift is evidenced by a greater emphasis on potential returns from investments in green technologies, sustainable infrastructure, and climate resilience projects. Data indicates these institutions are increasingly discussing climate change not as a compliance cost or a threat to asset values, but as a driver of innovation and a source of new revenue streams, suggesting a fundamental change in perception from liability to investment area.

Implications and Future Directions: Balancing Incentive and Systemic Risk

Recent observations suggest a promising convergence between financial motivations and the pursuit of climate solutions. This shift isn’t merely rhetorical; it’s demonstrably influencing investment strategies and spurring innovation across multiple sectors. Previously viewed as separate concerns – profitability versus sustainability – these forces are increasingly intertwined, as investors recognize both the financial risks of climate change and the potential for substantial returns in green technologies and sustainable business models. This alignment is fostering a new wave of venture capital, research and development, and large-scale infrastructure projects focused on decarbonization, renewable energy, and climate resilience. The resulting economic incentives are not simply addressing the problem; they are actively driving the creation of solutions, potentially accelerating the transition to a low-carbon future and demonstrating that environmental responsibility and economic growth are not mutually exclusive goals.

While framing climate action as a source of economic opportunity has demonstrably increased engagement and investment, this emphasis risks eclipsing the critical need for proactive systemic risk management. Current discourse frequently prioritizes the potential gains of a green economy – innovation, job creation, and market expansion – potentially delaying or diminishing attention towards the very real and substantial threats posed by climate change itself. This imbalance could lead to insufficient regulatory oversight and inadequate safeguards against escalating environmental and financial risks, creating a scenario where the pursuit of profit inadvertently exacerbates the problems it aims to solve. A comprehensive approach necessitates balancing the narrative of opportunity with a frank acknowledgement of the inherent dangers and a robust framework for mitigation, ensuring long-term stability alongside economic growth.

Further investigation into the shifting language surrounding climate finance is crucial, as subtle changes in discourse can significantly influence both policy formulation and investment choices. Researchers must delve into how opportunity-focused framing – emphasizing potential gains – interacts with, or potentially obscures, discussions of inherent risks and the necessity for robust regulatory frameworks. Analyzing this evolving rhetoric requires interdisciplinary approaches, combining linguistic analysis with economic modeling and policy science, to determine whether current communication strategies are effectively channeling capital towards truly sustainable solutions or simply reinforcing existing market trends. Ultimately, a deeper understanding of this discourse will reveal its power to shape not only financial flows but also the long-term trajectory of climate action itself, informing more effective and equitable strategies for a sustainable future.

The computational analysis detailed within demonstrates a clear evolution in climate discourse, shifting from depictions of risk to narratives of opportunity. This transition, meticulously mapped across two decades of financial news, echoes a fundamental principle of logical transformation. As Alan Turing observed, “Sometimes it is the people who no one imagines anything of who do the things that no one can imagine.” The study reveals how actors strategically deploy framing and arguments – a process akin to constructing a provable theorem. The observed shift isn’t merely a change in language, but a demonstrable restructuring of the narrative landscape, rigorously identified through the framework’s actor-frame-argument methodology, showcasing how seemingly subtle alterations can yield significant conceptual outcomes.

What’s Next?

The application of Large Language Models to discourse analysis, as demonstrated, yields patterns. However, discerning causation remains elusive. Identifying a shift in framing – from risk to opportunity – is a descriptive act, not an explanation of why such a shift occurred. Future work must rigorously connect these observed narratives to quantifiable financial behaviors. If a narrative reliably precedes a particular investment strategy, then – and only then – can one begin to speak of meaningful insight.

A fundamental limitation lies in the inherent stochasticity of these models. Reproducibility, a cornerstone of scientific validity, is compromised by the non-deterministic nature of the algorithms employed. A result obtained today may not be replicated tomorrow without specific seeding and parameter locking. This is not merely a technical inconvenience; it introduces a level of uncertainty unacceptable in fields demanding precision. The challenge is not simply to achieve higher accuracy, but to engineer determinism into the core of the analytical process.

Ultimately, the true test of this approach will be its predictive power. Can these models anticipate shifts in discourse before they manifest in financial markets? Until then, it remains an elegant, if somewhat speculative, exercise in pattern recognition. The elegance, it must be noted, derives from the mathematical structures underpinning the models themselves, not from any demonstrated mastery of the messy, illogical world they attempt to represent.

Original article: https://arxiv.org/pdf/2601.10142.pdf

Contact the author: https://www.linkedin.com/in/avetisyan/

See also:

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- You Should Not Let Your Kids Watch These Cartoons

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- ‘Bugonia’ Tops Peacock’s Top 10 Most-Watched Movies List This Week Once Again

- The Hidden Treasure in AI Stocks: Alphabet

- South Korea’s Wild Bitcoin ETF Gamble: Can This Ever Work?

- TV Pilots Rejected by Networks

- USD RUB PREDICTION

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

2026-01-16 07:03