The market, a restless lepidopterist, flits about its all-time highs, yet to suggest abstinence from collecting specimens would be a folly. Indeed, a discerning eye can still alight upon opportunities – fragile, perhaps, but possessing a peculiar luminescence. Should ten thousand dollars find itself momentarily unburdened, I propose a trio of holdings, each a study in contrasting trajectories, poised, as it were, on the cusp of 2026.

Nvidia: The Gilded Cage

Nvidia, a name now uttered with the reverence once reserved for titans of industry, has ascended to a market capitalization that would make Croesus blush. Its dominion stems, naturally, from the graphic processing units—those silicon sprites that conjure the illusions of artificial intelligence. To call them merely ‘powerful’ would be akin to describing a Fabergé egg as ‘shiny.’ They are the engines of this new conjuration, and Nvidia, its benevolent, if implacable, sorcerer.

But even the most gilded cage cannot entirely contain ambition. Analysts, those oracles of Wall Street, predict another year of frankly preposterous growth – a fifty percent surge in revenue. A number so audacious it almost invites disbelief. This is fueled, of course, by the insatiable appetite of the ‘hyperscalers’ – those digital behemoths who consume data as a moth consumes light – and the imminent arrival of ‘Rubin,’ a new architecture promising further enchantments. To witness such expansion in a company of this magnitude is, if not unprecedented, certainly rare – a botanical anomaly in the concrete jungle.

Nvidia, in short, is a phenomenon. And 2026 will likely provide yet another chapter in its improbable, almost baroque, saga.

MercadoLibre: The Southern Bloom

Turning south, we encounter MercadoLibre, a name perhaps less familiar to those fixated on the northern hemisphere. Often – lazily – likened to Amazon, this analogy, while possessing a superficial truth, obscures a more intricate reality. Yes, it is a vast e-commerce platform, boasting a logistics network capable of delivering goods with unsettling swiftness. But to reduce it to a mere imitation is to ignore the peculiar, almost indigenous, financial ecosystem it has cultivated.

Latin America, unlike the United States, lacked a robust digital payment infrastructure when the e-commerce wave first broke. MercadoLibre, therefore, didn’t simply import a solution; it built one, from the ground up. This has granted it a dominance in two critical growth areas – e-commerce and fintech – offering investors a chance to participate in trends that have already proven their efficacy elsewhere. It is, in essence, a second blooming of a familiar flower, but with a distinctly southern fragrance.

Currently, the stock lingers nearly 20% below its zenith – a rare opportunity to acquire shares of a consistently outperforming company. Such ‘sales’ are infrequent, and this particular specimen should be secured before it returns to its accustomed heights.

The Trade Desk: A Shadow Play

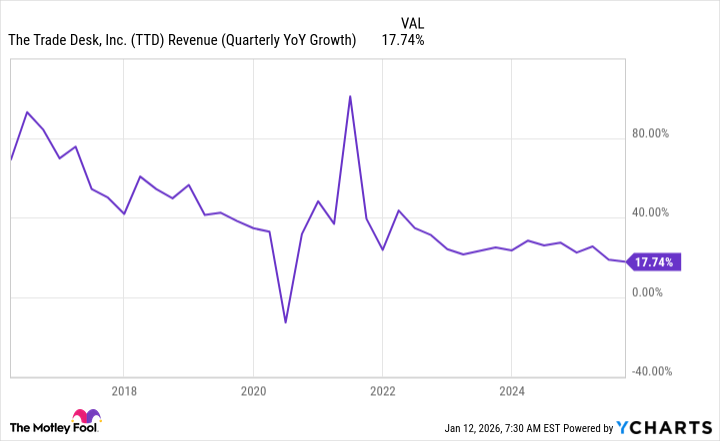

Finally, we arrive at The Trade Desk, a company whose performance, unlike its peers, is not currently bathed in radiant light. It operates an ad technology platform, connecting those who wish to advertise with the optimal digital spaces. A noble endeavor, certainly, but one constrained by the walled gardens of Facebook and Google. However, it thrives in the more open landscapes, particularly in the burgeoning realm of connected television.

Recent months have witnessed a stumble – a glitch in the rollout of its new, AI-powered platform. Issues persist, but the customer base remains remarkably loyal – 95% retention in the third quarter, a streak unbroken for eleven consecutive years. Growth, at 18%, remains respectable, though it represents the lowest rate in the company’s history (excluding the anomalous quarter distorted by the pandemic).

This has understandably unsettled investors. However, they overlook a crucial factor: political revenue. The third quarter of 2024 was saturated with political advertising – a phenomenon absent in 2025. This created a distorted comparison, exaggerating the apparent decline. The Trade Desk remains a strong company, poised for above-average growth, and currently trades at a mere 18 times forward earnings. The S&P 500, by contrast, commands a multiple of 22.4. To acquire a faster-growing company at a lower price? A rather elementary calculation, wouldn’t you agree? I anticipate a resurgence in 2026, and suggest acquiring shares while they remain, shall we say, undervalued.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- You Should Not Let Your Kids Watch These Cartoons

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- ‘Bugonia’ Tops Peacock’s Top 10 Most-Watched Movies List This Week Once Again

- The Hidden Treasure in AI Stocks: Alphabet

- South Korea’s Wild Bitcoin ETF Gamble: Can This Ever Work?

- TV Pilots Rejected by Networks

- USD RUB PREDICTION

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

2026-01-16 07:02