The fever dream of artificial intelligence… it has gripped the market, hasn’t it? A collective delusion of boundless prosperity. Three years now, the relentless ascent, fueled by capital and a desperate hope for… what? Salvation, perhaps? Or merely a larger number on a screen? The sheer volume of investment in this realm is… unsettling. It suggests a profound disquiet, a need to believe in something beyond the mundane. And where there is such fervor, there is, inevitably, a reckoning.

The whispers speak of another solid year for these AI-driven enterprises in 2026. Deutsche Bank, ever the pragmatist, points to continued infrastructure investments. But let us not mistake motion for progress. The very proliferation of these so-called ‘AI stocks’ has created a scarcity of true value. A desperate hunt for substance amidst the vaporware. The question, then, is not whether AI will grow, but where, amidst this chaos, can a rational investor find… purchase?

The Memory of Value: Micron’s Quiet Strength

Palantir, Nvidia, Broadcom… names that echo with the hubris of inflated expectations. They demand a premium, a tribute to the prevailing mania. Micron Technology, however, is an anomaly. A quiet corner in the storm. Trading at a mere eleven times forward earnings, nine times sales… it feels almost… indecent. As if the market has forgotten its existence. This, my friends, is where opportunity resides. Not in the dazzling spectacle, but in the overlooked, the undervalued. The very essence of value investing is to see what others fail to see.

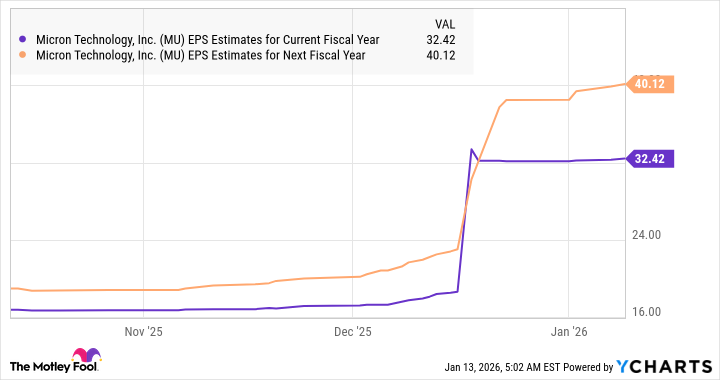

The projections speak of a doubling of revenue, a fourfold increase in earnings. Numbers, of course, are merely shadows on the wall. But the trend is undeniable. The demand for memory is surging, driven by this insatiable hunger for AI. And Micron, with its expertise in this critical component, is poised to benefit. It is a simple equation, really. Supply and demand. But the market, in its irrationality, often forgets the basics. It chases the mirage, ignoring the solid ground beneath its feet.

Counterpoint Research predicts a 40 to 50 percent increase in DRAM prices. A 20 percent jump in the next quarter. These are not mere fluctuations, but signs of a fundamental shift. The demand for memory, particularly high-bandwidth memory, is outpacing supply. The very architecture of AI, it seems, requires an ever-increasing appetite for data storage. And Micron, with its commitment to innovation, is well-positioned to capitalize on this trend. It is a comforting thought, in a world consumed by uncertainty.

The high-bandwidth memory chips, consuming three times the DRAM capacity of PC memory… it is a staggering statistic. The deployment of these chips in both GPUs and custom AI processors… it speaks to the growing sophistication of the technology. And the resulting shortage of capacity… it is a testament to the insatiable demand. The market, it seems, is finally waking up to the reality of limited resources.

But Micron is not alone in this pursuit of value. There is another company, Marvell Technology, that deserves our attention. A company that designs custom AI processors and networking chips. A company that has quietly built a solid client base, including the top four hyperscalers in the United States. A company that, like Micron, is trading at an attractive valuation.

Marvell’s Subtle Ascent: A Bargain in Plain Sight

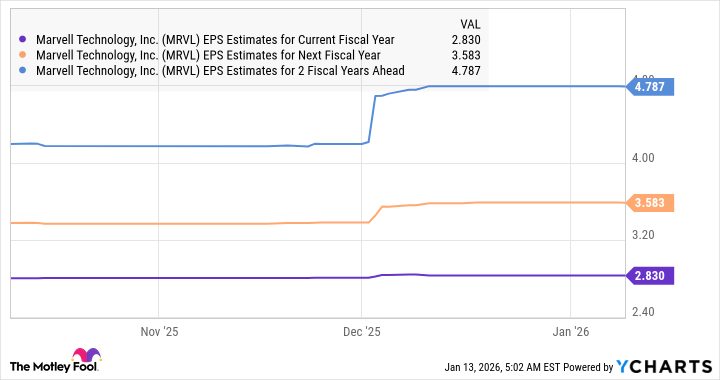

Marvell’s strength lies in its custom AI chip designs. Twelve of these designs are currently deployed in the data centers of its major clients. Emerging hyperscalers are also embracing this technology. This strong clientele is fueling healthy growth in both revenue and earnings. The company’s revenue increased by 51 percent in the first nine months of the fiscal year. Non-GAAP net income has more than doubled. These are not the numbers of a speculative bubble, but of a company that is genuinely thriving.

A forward earnings multiple of 23… lower than the Nasdaq-100 index. A sales multiple of 9.3… attractive, considering the remarkable top-line growth. Marvell’s growth is likely to accelerate, with additional design wins secured at U.S.-based hyperscalers. The ramp-up in production next year suggests that Marvell should be able to sustain its healthy growth levels. It is a reassuring thought, in a world where so many companies are struggling to keep pace.

The potential for expansion is significant. More than ten customers, with the possibility of securing over fifty chip designs. Analysts are forecasting an acceleration in the company’s growth rate. The improvement in earnings growth could justify a premium valuation in the future. The prospect of attracting more customers on board is a tantalizing one.

Like Micron, Marvell appears to be a top AI stock to buy in 2026 for investors seeking a value play within this rapidly growing sector. Its potential to become a long-term winner, based on the promising prospects of the custom AI processor market, is undeniable. It is a comforting thought, in a world where so much is uncertain. Perhaps, amidst the chaos and the frenzy, there is still room for reason, for prudence, for a little bit of… value.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- You Should Not Let Your Kids Watch These Cartoons

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- ‘Bugonia’ Tops Peacock’s Top 10 Most-Watched Movies List This Week Once Again

- The Hidden Treasure in AI Stocks: Alphabet

- South Korea’s Wild Bitcoin ETF Gamble: Can This Ever Work?

- TV Pilots Rejected by Networks

- USD RUB PREDICTION

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

2026-01-16 05:44