The air is thick with talk of artificial intelligence, a fever dream of innovation. And, as with all such fevers, there is a flush, a heat, and then, inevitably, a reckoning. Many speak of bubbles, comparing this moment to the brief, incandescent glow of the early 2000s. There is, of course, genuine activity, real money changing hands among the larger firms. But a careful observer – and one who has seen a few cycles – cannot help but notice certain valuations that seem…detached from the earth. Palantir Technologies is one such case.

The stock, it must be said, has been…energetic. Since 2023, it has climbed with a vigor that suggests not a measured ascent, but a desperate scramble. A rise of 2,700% is not merely impressive; it is, in its way, unsettling. One begins to wonder if the market is pricing the company’s potential, or merely its reflection in a particularly optimistic mirror.

I have added Palantir to my watch list, not with any particular animosity, but with a certain…weariness. It is a stock that demands attention, but perhaps not investment, at least not at this altitude. Those already holding shares might consider a prudent review of their positions. One does not wish to be left clinging to a diminishing cloud.

The Business of Seeing

Palantir, at its core, offers a means of discerning patterns in data. It allows its clients – initially, primarily governmental entities – to make decisions based on information, rather than intuition. A noble pursuit, certainly. The company’s early successes were built on serving those who require precise intelligence, a niche market with demanding clients. Resource allocation, logistical challenges – these were problems Palantir solved with a quiet efficiency.

The logical step, of course, was expansion into the commercial sector. And, by all accounts, Palantir has been equally successful in this endeavor. The third quarter revealed a revenue split of $633 million from government contracts and $548 million from commercial clients. Both sectors are growing at a brisk pace – 55% and 73%, respectively. It is a testament to the quality of their software, no doubt. But growth, as any seasoned investor knows, is not the same as value.

Since the beginning of 2023, Palantir’s trailing twelve-month revenue has increased by 104%. A respectable figure, to be sure. But it pales in comparison to the stock’s ascent. One begins to suspect that the market is not valuing the company’s earnings, but rather the idea of its earnings. And ideas, however brilliant, are notoriously unreliable assets.

A Premature Celebration

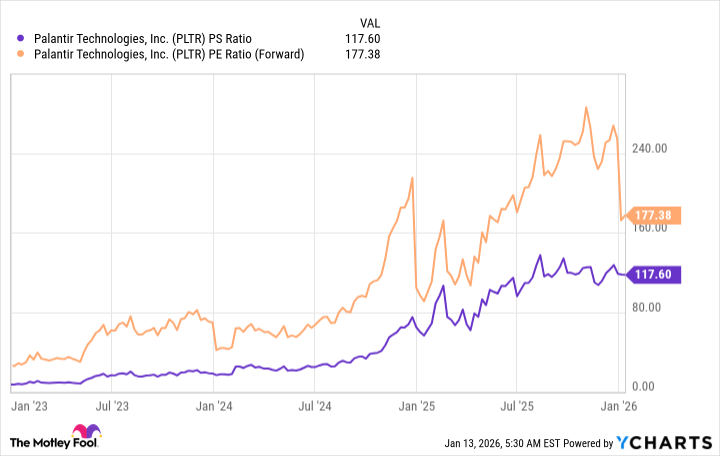

The stock’s valuation is, shall we say, ambitious. A price-to-sales ratio of 117, and a forward price-to-earnings ratio of 177…these are numbers that demand justification. Most companies trading at such levels are experiencing exponential growth, doubling or tripling their revenue each quarter. Palantir’s 63% revenue increase in the third quarter, while commendable, falls short of that mark. And Wall Street analysts project a mere 42% growth rate for 2026. A slowdown is inevitable, and when it arrives, the consequences could be…unpleasant.

Furthermore, Palantir’s profit margins are remarkably high – 40% in the third quarter. An impressive feat, certainly. But it also suggests that the company has reached a point of diminishing returns. There is little room for further improvement. To justify its current valuation, Palantir must not only maintain its growth rate, but accelerate it. A tall order, even for the most innovative of companies.

I do not dismiss Palantir as a business. It is a genuinely impressive enterprise, and its achievements deserve recognition. But the stock has outrun its fundamentals. It is a fragile thing, perched precariously on a foundation of optimism. A correction is not merely likely; it is, in my view, inevitable. The market, like life itself, has a way of bringing even the most ambitious of dreams back down to earth.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- You Should Not Let Your Kids Watch These Cartoons

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- ‘Bugonia’ Tops Peacock’s Top 10 Most-Watched Movies List This Week Once Again

- The Hidden Treasure in AI Stocks: Alphabet

- South Korea’s Wild Bitcoin ETF Gamble: Can This Ever Work?

- TV Pilots Rejected by Networks

- USD RUB PREDICTION

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

2026-01-16 05:02