The nascent industry of electric vertical take-off and landing – eVTOL, a term that sounds suspiciously like a nervous cough – flutters on the horizon, promising aerial commutes and a liberation from terrestrial tedium. As yet, however, the skies above our cities remain blessedly free of buzzing, airborne contraptions. There is a certain poetic justice in this delay, a momentary reprieve from the relentless march of ‘progress.’ Many, naturally, have seized upon this potential – this shimmering mirage of future transport – as a fertile ground for speculative investment. And among the hopefuls, Joby Aviation (JOBY +3.11%) has ascended, if not gracefully, then with a considerable burst of investor enthusiasm, a 360% leap since the commencement of 2023. A remarkable trajectory, though one must always inquire: how much of this lift is genuine propulsion, and how much merely the hot air of hype?

The question, posed with a certain calculated imprecision, is this: could a stake in Joby Aviation presently double one’s capital? It’s a siren song, isn’t it? A doubling. So neat, so symmetrical. But the markets, alas, rarely adhere to such pleasing geometries.

A Cooling of the Fever, or Merely a Pause for Breath?

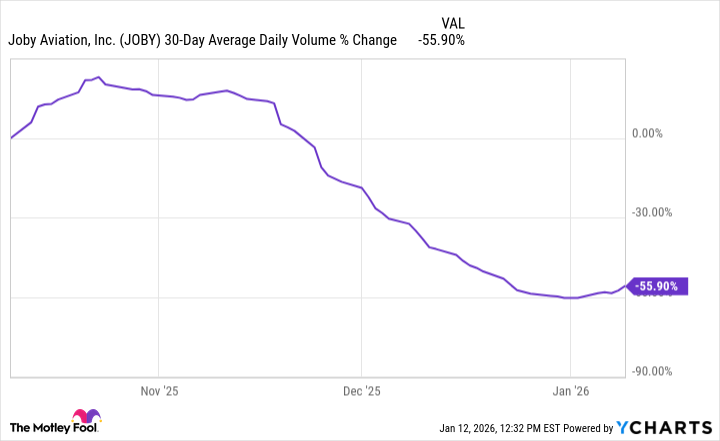

Joby assures us – and assurances, in this realm, are often more vapor than substance – that progress toward certification is underway. Test flights are being conducted, and the Middle East, ever receptive to extravagant displays of technological ambition, is being eyed as a potential launch market. One pictures gleaming, chrome-plated air taxis flitting between opulent hotels and desert palaces. A charming vision, certainly, but one predicated on a rather optimistic timeline. The market, it seems, has begun to exhibit a touch of skepticism, a momentary lapse in fervor. The stock has shed over 5% in recent months, and trading volumes have dwindled, suggesting a waning appetite for this particular brand of aerial dream.

Speculative stocks, like delicate butterflies, are easily pinned by the capricious winds of investor sentiment. Joby, in particular, appears unusually vulnerable to the whims of retail investors, those impulsive creatures who often mistake hope for analysis. Without a compelling narrative – a breakthrough, a contract, a dazzling demonstration – it remains, shall we say, tethered to the earth by the gravity of reality.

Should the company manage to initiate air taxi services – anywhere, really – it would undoubtedly provide a considerable jolt to the stock. But the question lingers: is there sufficient altitude remaining for further ascent, given the already lofty valuation?

The Weight of Expectation

Joby’s market capitalization, currently hovering around $14 billion, is, to put it mildly, ambitious. It reflects an extraordinary degree of optimism, a willingness to assign a substantial value to a business model that remains, as yet, unproven. Even if these eVTOLs do manage to transport passengers, fundamental questions persist: will there be sufficient demand? Will they prove practical, reliable, and – crucially – profitable? These are not merely technical hurdles; they are existential challenges.

Analysts, those cautious custodians of financial prudence, remain unconvinced, at least for the moment. The consensus price target, as of Monday, suggests a potential downside of over 10%. Of course, this could change. Approval for the eVTOLs, successful launch of services – these events would undoubtedly alter the calculus. But for now, Joby remains a high-risk, high-reward proposition, a gamble dressed in the guise of innovation.

A Double or a Descent?

Joby’s stock trades as if it occupies a realm entirely separate from its competitors. Archer Aviation, for instance, boasts a market capitalization of a mere $6.4 billion. If Joby fails to demonstrate a clear and compelling advantage – a superior technology, a more robust business plan, a greater degree of safety – it could face significant downward pressure. The air, after all, is a crowded space.

There is, undeniably, potential for Joby to double in value. eVTOLs, in the long term, could revolutionize urban travel, alleviating congestion and offering a novel mode of transportation. But potential, like a phantom limb, is not the same as reality. Joby has not yet proven that it will be successful, let alone profitable.

At the end of the day, this remains a highly speculative company, one that has accumulated losses exceeding $1 billion over the past year. Unless one possesses a particularly robust appetite for risk, a wait-and-see approach may be the most prudent course of action. The inherent risks of eVTOL stocks are considerable enough; Joby’s inflated valuation only amplifies them. A gilded cage, perhaps, but a cage nonetheless.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Live-Action Movies That Whitewashed Anime Characters Fans Loved

- Gold Rate Forecast

- You Should Not Let Your Kids Watch These Cartoons

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- ‘Bugonia’ Tops Peacock’s Top 10 Most-Watched Movies List This Week Once Again

- USD RUB PREDICTION

2026-01-15 20:15