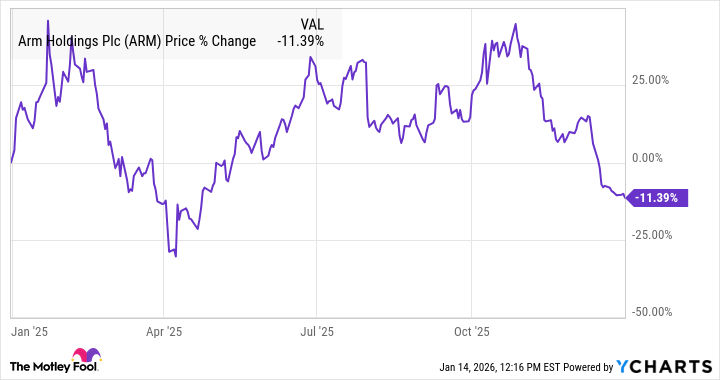

Let me be clear: investing is like dating someone who texts in all caps. You’re excited, confused, and slightly humiliated by your own choices. Case in point? Arm Holdings (ARM) in 2025. A stock that danced like a penguin on a trampoline-chaotic, charismatic, and ultimately a 11% loss for the year. But hey, at least it wasn’t NFTs. Yet.

S&P Global Market Intelligence says it all: 11% down, folks. A number that makes you question if you’ve accidentally sold your kidney to a shadowy figure on the internet. And the chart? A Jackson Pollock painting if ever there was one. Up, down, sideways-Arm spent most of the year pretending it wasn’t worried about an AI bubble, which, honestly, is like ignoring the elephant in the room… while the elephant texts you passive-aggressive tweets.

Arm’s Rollercoaster: Stargate, Tariffs, and Existential Dread

Arm started 2025 like it was auditioning for a Marvel movie. The Stargate Project-a $500 billion AI extravaganza with Nvidia, Oracle, OpenAI, and Softbank-had everyone whispering, “Genius!” until March hit. Then came the “Liberation Day” tariffs, which sent the stock into a nosedive faster than my bank account after I clicked “buy” on that suspiciously cheap YSL lipstick.

But! The stock bounced back, briefly, like a stubborn toddler refusing to nap. Then, poof! Earnings guidance that made investors groan louder than my roommate’s existential crisis over her Spotify Wrapped. And let’s not forget the AI bubble-because nothing says “confidence” like a stock valuation that makes you wonder if you’ve accidentally priced it in cryptocurrency. 🤷♂️

Here’s the kicker: Arm doesn’t sell chips. It licenses them. Picture this: You’re a landlord collecting rent from tenants who’ve turned your apartment into a black hole of innovation. They (Nvidia, etc.) build the future; you collect royalties. It’s a solid gig… if you don’t mind growing at half the speed of your peers while they party like it’s 2021. Again.

In its first half of fiscal 2026, Arm reported 24% revenue growth. But licensing is a fickle lover-revenue spikes one quarter, vanishes the next. It’s the financial equivalent of a hot flash: exciting, confusing, and best discussed in hushed tones with a glass of wine.

Yet! There’s hope. Arm’s new Compute Subsystems (CSS) are like giving your tenants a toolbox and saying, “Go build a spaceship.” And the cloud partnerships? Microsoft, Alphabet, Amazon-big names with bigger appetites. If this goes well, Arm could be the unassuming barista who ends up marrying a tech mogul. If not? Well, at least you’ll have the merch.

The Road Ahead: Optimism, Anxiety, and a Side of ROI

Arm’s guiding for $1.225 billion in Q3 revenue-a 24% jump. Adjusted EPS? Up to $0.41. Numbers that make you want to high-five your screen… or question why you’re high-fiving your screen. The bottom line? Investors crave more. And honestly, who can blame them? This isn’t exactly the financial equivalent of a Michelin star-it’s more like a five-star review for a gas station burrito.

But here’s the wealth-builder whisper: Arm’s got moats. Deep ones. Licensing dominance, AI bets, and a business model that’s less “get rich quick” and more “get rich slowly while sipping chamomile tea.” It’s not sexy. It’s not viral. But if you’re in it for the long game, Arm’s play might just be the calm before the next AI storm. Or, you know, another hurricane. Shrug emoji here.

Either way, the market’s a rom-com: full of twists, cringe, and the nagging feeling you’ve missed the plot. But if you’re smart, you’ll watch it with popcorn-and a fire extinguisher. 🙃

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Live-Action Movies That Whitewashed Anime Characters Fans Loved

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- ‘Bugonia’ Tops Peacock’s Top 10 Most-Watched Movies List This Week Once Again

- USD RUB PREDICTION

- South Korea’s Wild Bitcoin ETF Gamble: Can This Ever Work?

- TV Pilots Rejected by Networks

2026-01-14 21:43