When great wealth clashes with tax laws, it often leads to very public disagreements with tax authorities. Many famous people have faced scrutiny for not reporting all their income or for using unlawful ways to lower their taxes. These situations frequently result in large fines and even jail time, which often attract a lot of media attention. This report looks at several well-known individuals who have faced legal problems due to tax evasion or similar financial issues. Their experiences highlight how important it is to be financially honest and demonstrate that tax laws apply to everyone, even internationally.

Wesley Snipes

The well-known actor was found guilty of three minor offenses related to not filing his federal taxes. After losing his appeals, he spent three years in prison. Prosecutors stated he hadn’t paid millions in taxes during a very successful period of his career. His lawyers claimed he’d been given bad advice by financial advisors who believed the tax laws were incorrect. Since being released, the actor has been working to revive his career and pay off what he still owes to the government.

Lauryn Hill

The singer admitted to not paying taxes on over a million dollars of earnings. She was sentenced to three months in prison, followed by home confinement and probation. In court, she explained she’d stepped away from public life and her career to prioritize her family’s well-being. She ultimately paid back all the taxes and interest she owed. The case shed light on the financial difficulties that can affect even highly successful musicians.

Shakira

The internationally famous singer was involved in a major legal case in Spain concerning where she officially lived for tax purposes. Authorities claimed she spent enough time in the country each year to be considered a resident and therefore owed a significant amount in taxes. To avoid a long court case and potential jail time, she reached an agreement with officials. She paid a fine of several million dollars, plus the taxes she had originally disputed. The singer stated she had followed the guidance of her financial advisors during the years in question.

Fan Bingbing

A hugely popular Chinese actress vanished from public life for several months while authorities investigated her finances. They found she’d been using hidden contracts to underreport her income from movies. To avoid criminal charges, she was required to pay around $130 million in back taxes and penalties. The case sparked a widespread overhaul of the entertainment industry and changed how celebrities’ earnings are disclosed in China. She’s slowly returned to acting and public appearances since then.

Lionel Messi

A famous soccer player and his father were convicted of tax fraud in Spain for using offshore accounts to conceal income from endorsements and avoid paying taxes. He initially received a 21-month prison sentence, but it was changed to a substantial fine due to his clean record. The athlete maintained he was dedicated to his sport and relied on his father and financial team to manage his money. Despite the conviction, his career continued to thrive with moves to several international clubs.

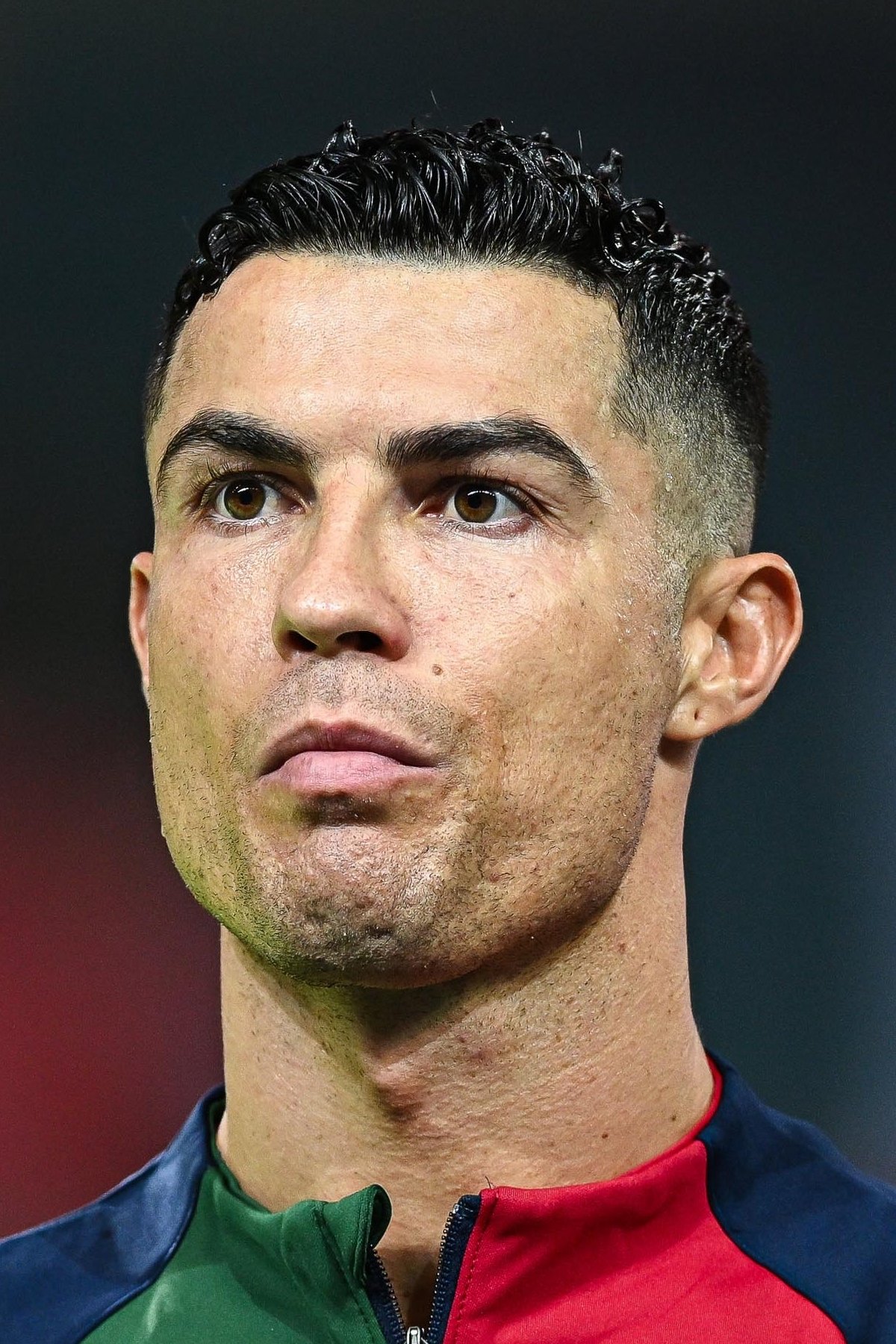

Cristiano Ronaldo

A globally recognized athlete recently settled a legal dispute with Spanish authorities over claims he concealed income from endorsements in offshore accounts. He agreed to pay almost twenty million dollars to resolve the issue, and while he received a suspended prison sentence, he won’t actually serve any jail time. The athlete stated he didn’t intentionally try to avoid paying taxes and agreed to the settlement to move past the legal trouble. This situation underscores the increasing focus by governments worldwide on tracking the income of high-profile international athletes.

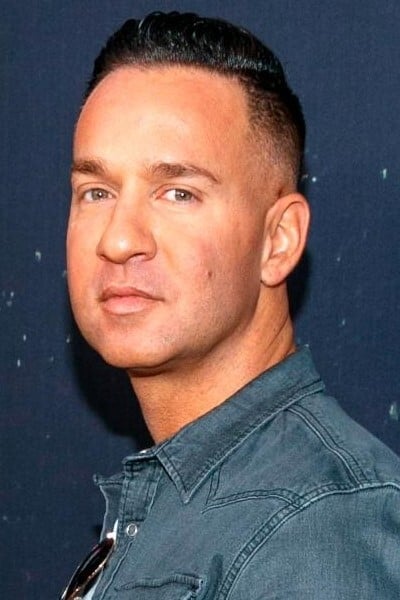

Mike Sorrentino

The reality TV star from ‘Jersey Shore’ faced charges of tax evasion and working with others to hide income. He and his brother were accused of not reporting millions of dollars they earned through their businesses. He admitted guilt and spent eight months in prison. After being released, he publicly promoted sobriety and smart money habits. His legal troubles were later featured on his TV show.

Teresa Giudice

The star of ‘The Real Housewives of New Jersey’ went through a major legal battle with her husband, facing accusations of fraud and not paying taxes. She admitted guilt to some of the charges and spent almost a year in prison. They were accused of concealing money and lying on financial documents, including loan and bankruptcy paperwork. After being released, she wrote a book about her experience in prison and went back to appearing on reality TV. The whole situation significantly affected her family and how the public saw her.

Joe Giudice

He faced legal trouble similar to his reality star wife and was found guilty of financial crimes, including not paying his taxes. After serving over three years in prison, he was handed over to immigration authorities. Because he wasn’t a U.S. citizen, he was eventually deported to Italy. He fought for years to be allowed back to his family, but ultimately remained in Italy. His experience highlights that tax crimes can have serious consequences beyond just financial penalties.

Nicolas Cage

The actor faced a large tax bill after the government accused him of not paying millions in taxes over several years. He stated his financial manager had caused him financial problems and significant debt. To cover what he owed, he sold many of his personal possessions, including several homes and a valuable comic book collection. Since then, he’s consistently worked in movies to pay off his debts and get his finances back on track. The actor has been public about his financial difficulties and his commitment to meeting his legal responsibilities.

Willie Nelson

A country music icon faced a major tax scandal when the government took his possessions to settle a large debt. He owed over $16 million in unpaid taxes and fees because of bad advice from his financial team. In a surprising step, he released an album called ‘The IRS Tapes’ to help pay his legal costs. His fans rallied around him, and he eventually got his assets back after reaching a settlement. He’s remained a popular and successful musician for many years since then.

Stephen Baldwin

The actor got into legal trouble for not paying state income taxes for three years. He admitted guilt and had to pay back a large sum of money in taxes and fines. He was able to avoid jail time by reaching an agreement with the court and was placed on probation. He explained that bad advice from his lawyers and financial advisors led to the tax issues. He ultimately fulfilled all the court’s requirements and has continued his career in entertainment.

Ja Rule

The rapper and actor was imprisoned for both illegal weapons possession and not paying his federal taxes. He confessed to not reporting several million dollars in earnings from his successful music career. He spent two years in prison and repaid the government over a million dollars. Since being released, he’s been working on different business ventures and performing again. He’s also openly discussed the importance of managing finances responsibly and getting advice from people you can trust.

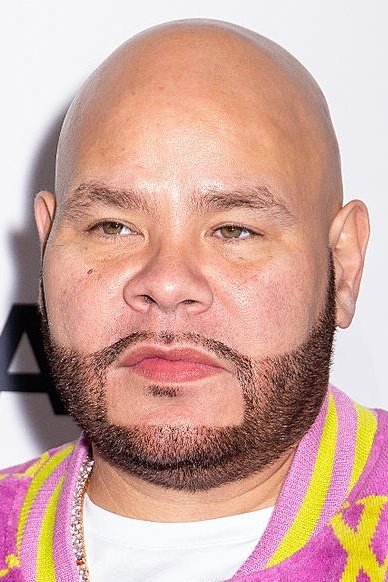

Fat Joe

The popular hip hop artist admitted to not filing his federal taxes for two years. As a result, he received a four-month prison sentence and was required to pay a large fine plus the taxes he owed. He took responsibility for the mistake and apologized. After completing his sentence, he quickly resumed his music career and has since been working to educate others in the music industry about financial responsibility.

Domenico Dolce

As a huge fan of their work, I was really worried when I heard one half of that iconic fashion duo was caught up in a long legal fight in Italy. Apparently, they were accused of using some complicated financial arrangements – a company in Luxembourg, specifically – to avoid paying taxes on all their success. It was a real rollercoaster! They were initially found guilty and even sentenced to prison, which was shocking. Thankfully, that decision was overturned, and after a lot of back and forth, Italy’s highest court finally cleared them completely, saying everything was above board. It was a big deal for the whole fashion world and really showed just how complicated international tax laws can be.

Stefano Gabbana

He cofounded a well-known luxury brand and, like his partner, became caught up in a tax evasion investigation. Both were initially convicted, but he fought to prove his innocence in Italian courts, consistently claiming the company had always followed the law. His eventual acquittal was a major win for both him and the brand. The entire case highlighted the difficulties international companies face when navigating tax laws in different countries.

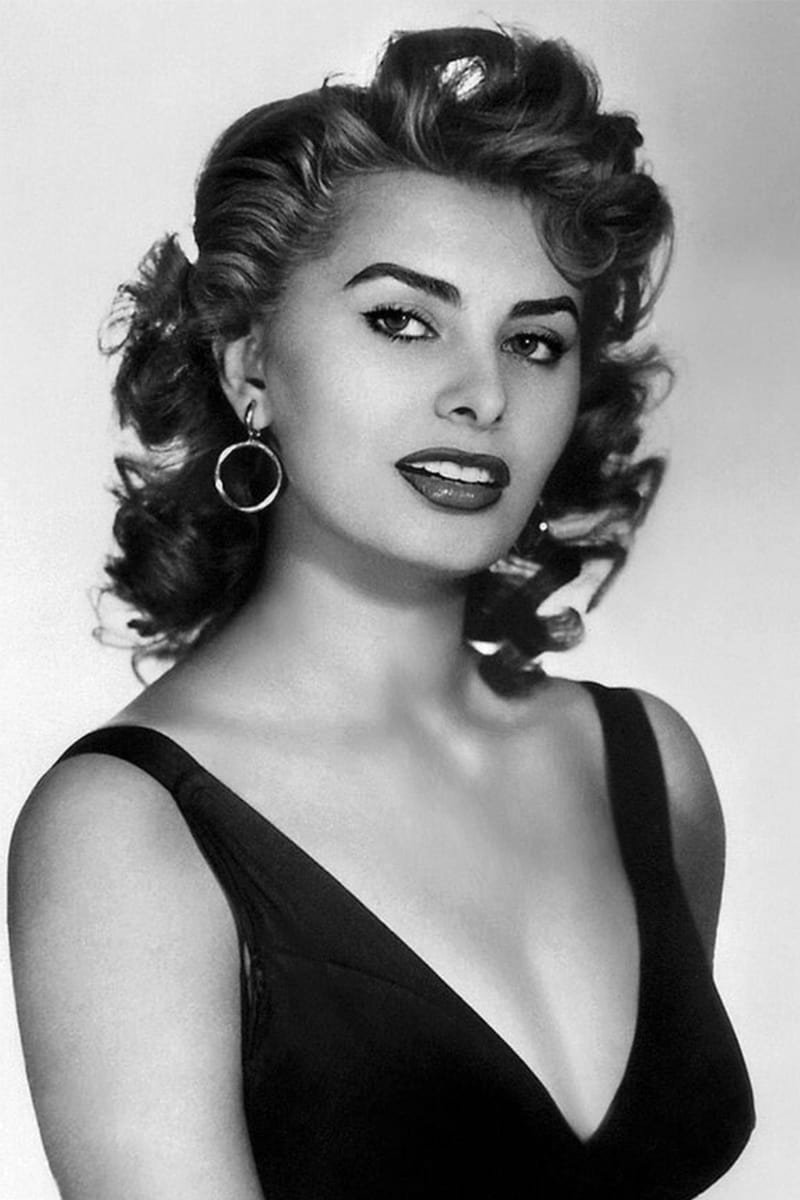

Sophia Loren

The celebrated Italian actress was imprisoned for seventeen days because of a decades-old disagreement with tax authorities, stemming from returns filed in the 1970s. She was accused of not reporting all of her earnings and failing to pay the correct taxes. Years later, Italy’s highest court determined she had been right about her calculations all along. While the ruling confirmed her innocence, she had already suffered through a public scandal and time in jail. Her case remains a well-known example of a celebrity facing severe consequences over disputed taxes.

Chuck Berry

The groundbreaking musician who helped create rock and roll had several run-ins with the law, including a conviction for not paying his taxes. He received a four-month prison sentence and was required to do community service because he hadn’t reported his income correctly. Authorities claimed he preferred cash payments and didn’t keep accurate records of his concert earnings. Despite these problems, he continued to perform and inspire countless musicians. He remains a hugely influential figure in the world of popular music.

Al Capone

The infamous gangster wasn’t brought to justice for his violent acts, but surprisingly, for not paying his taxes. After years of trying and failing to convict him of other crimes, federal investigators successfully built a tax evasion case against him. He received an eleven-year prison sentence and was ordered to pay substantial fines and back taxes. He spent a significant portion of his sentence at Alcatraz before being released due to failing health. This case became an important example of how tax laws could be used to prosecute well-known figures suspected of other illegal activities.

Richard Hatch

The first winner of ‘Survivor’ got into serious legal trouble after failing to pay taxes on his $1 million prize. He was found guilty of tax evasion and spent more than three years in prison. He claimed the show’s producers should have handled the taxes, or that he’d seen wrongdoing on set, but the court didn’t agree. He even went back to prison for violating the terms of his release. His situation is still the most well-known case of a reality TV contestant facing legal issues because of their winnings.

Boris Becker

The retired tennis star was found guilty of concealing money and loans to avoid paying his debts after declaring bankruptcy. A London court convicted him of multiple offenses related to bankruptcy laws and sentenced him to two and a half years in prison. He spent some time in jail before being sent back to his native Germany. Previously, he had also been accused of tax evasion in Germany concerning where he lived. His financial and legal problems have been widely discussed since he stopped playing tennis.

Pamela Anderson

The actress and model had outstanding tax debts with the government for several years, reportedly owing hundreds of thousands of dollars in both federal and state taxes at various points in her career. She worked with financial advisors to pay off these debts. She’s publicly discussed the challenges of managing money and the need for good financial guidance. Despite these financial difficulties, she’s continued to have a successful career in television and film.

Lil Kim

The popular hip hop artist recently resolved a long-standing issue with the IRS, addressing over a million dollars in unpaid taxes accumulated over almost ten years. This came alongside other legal troubles, including a previous prison sentence related to perjury. After years of effort, she’s successfully managed her debts and rebuilt her financial stability. Despite these challenges, she remains a major force in music and continues to create new work for her fans.

Method Man

The rapper, a member of the Wu-Tang Clan, was arrested after failing to file his taxes for several years. He owed New York state a substantial amount in back taxes and penalties. He admitted guilt and paid everything he owed to avoid going to jail. He explained that he was simply unorganized and hadn’t taken care of his finances. Since then, he’s been diligent about his taxes and continues to thrive in his music and acting career.

Marc Anthony

The well-known singer and actor had recently been dealing with tax problems, owing the government several million dollars in unpaid taxes on his properties and income. He promptly paid off the debts to avoid legal issues. He stated his financial team was responsible for the errors and has since restructured his business. Despite these challenges, he continues to be a hugely popular Latin artist with fans around the world.

Lindsay Lohan

The actress went through a difficult period of financial hardship and legal troubles, including owing back taxes. At one point, the government took money directly from her bank accounts to cover what she owed. With help from colleagues and by continuing to work, she was able to pay off her debts. These financial problems were often connected to personal issues and a lot of public attention. More recently, she’s successfully returned to acting and has been working to get her life back on track, both personally and financially.

Judy Garland

Judy Garland, the beloved star of ‘The Wizard of Oz,’ faced serious money troubles and owed a lot in taxes later in life. The government took money from her paychecks and eventually her house to cover what she owed. These problems stemmed from bad advice from her representatives and her own health issues. Even though she was a famous actress, she spent much of her career trying to pay off debts. Her experience is often cited as an example of how little financial security actors had during Hollywood’s Golden Age.

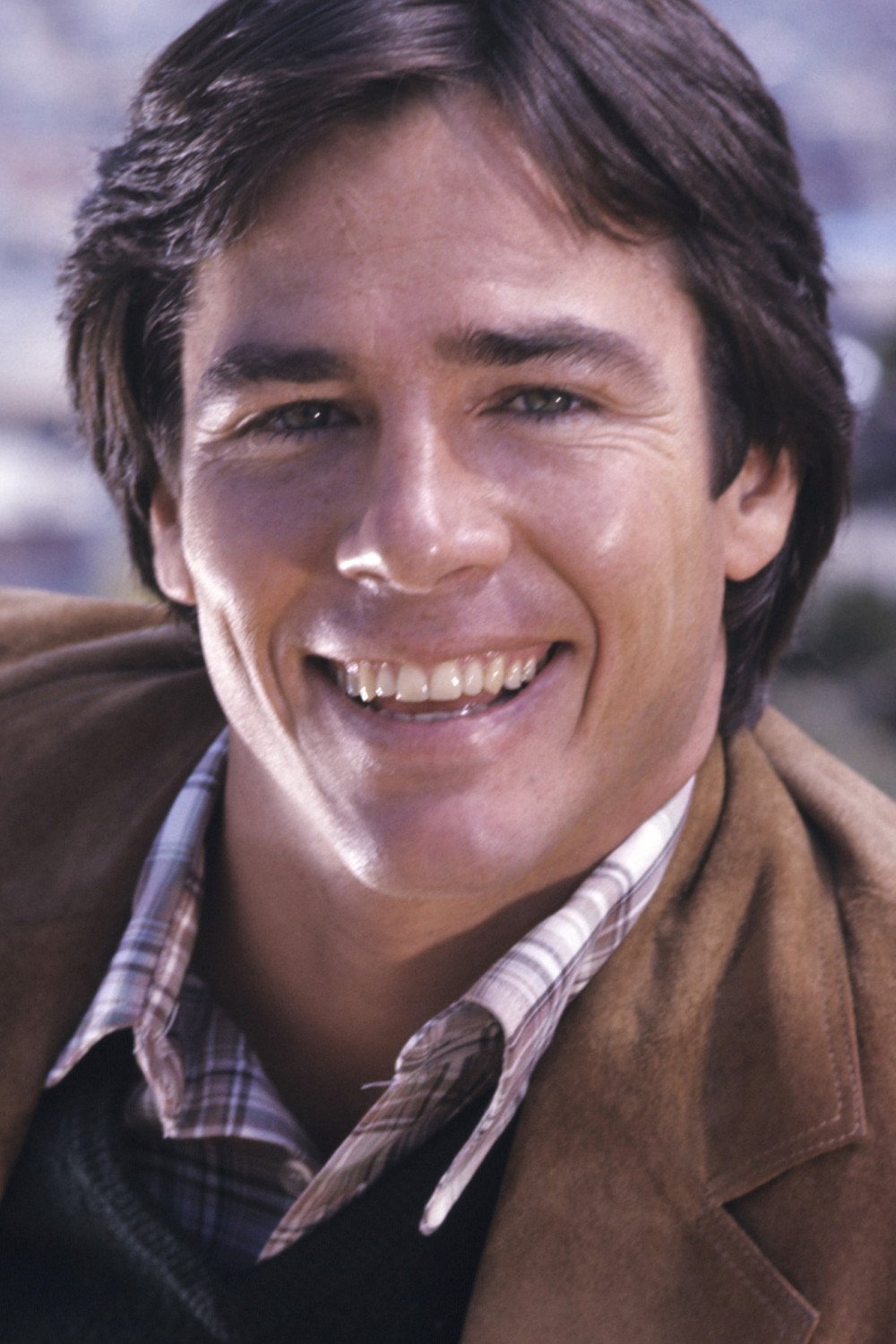

Pete Rose

A famous baseball player went to prison for not accurately reporting his income to the government. He didn’t include money he made from selling autographs and collectibles, or from winning bets on horse races. He was sentenced to five months in prison and had to pay back the taxes he owed, plus interest. This happened while he was also banned from baseball for life because of his gambling. For decades, he’s been working to rebuild his image and get inducted into the Baseball Hall of Fame.

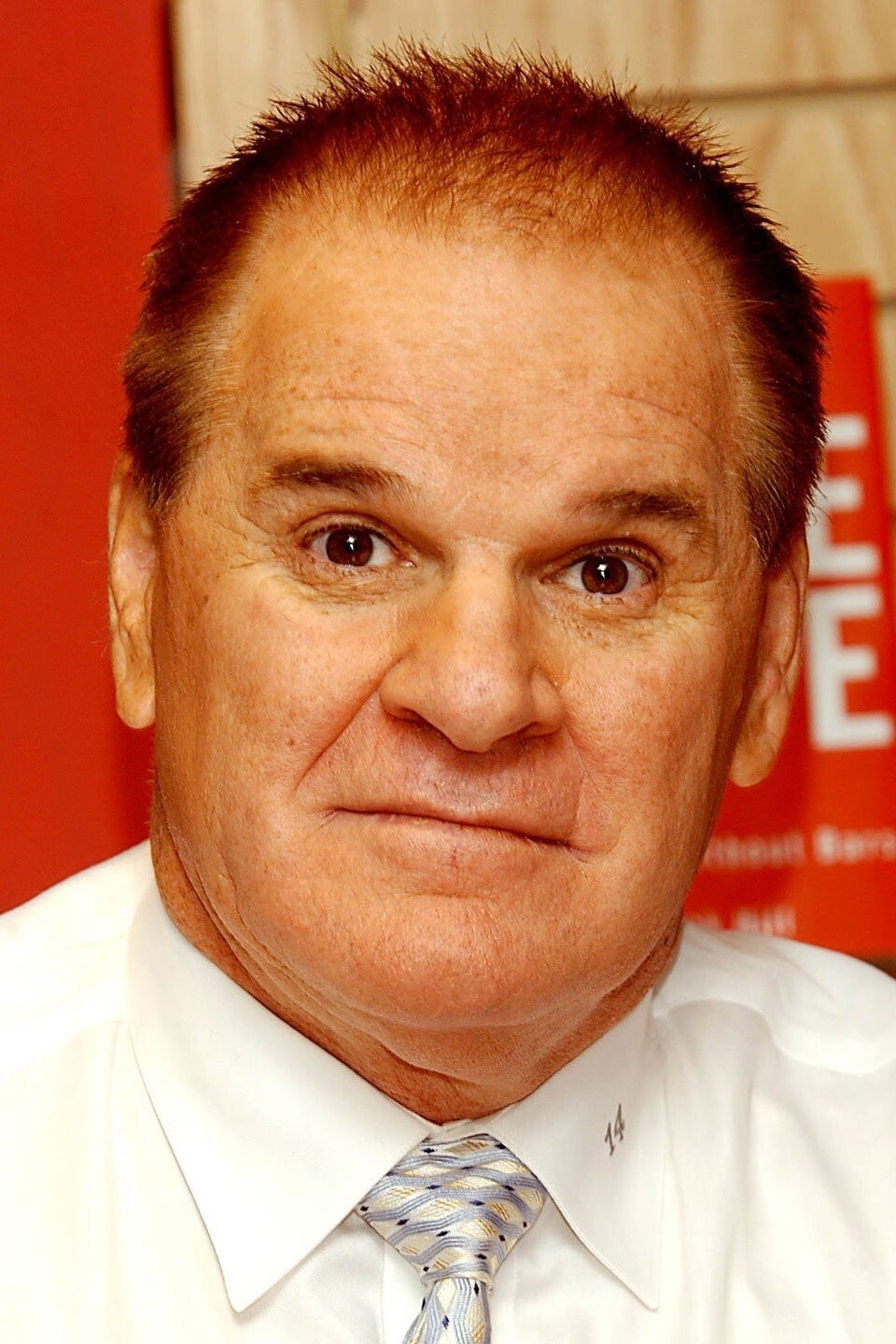

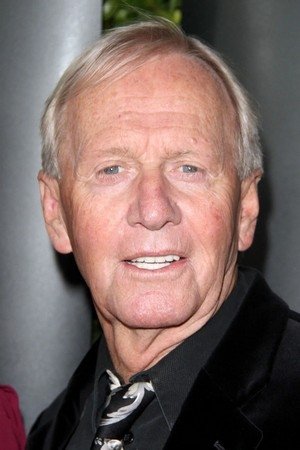

Paul Hogan

Paul Hogan, famous for his role in ‘Crocodile Dundee’, spent years arguing with the Australian tax office over where he officially lived and how much tax he owed. At one point, he wasn’t allowed to leave Australia until he agreed to pay some of the disputed amount. Hogan insisted he was a U.S. resident and didn’t owe taxes to Australia. The legal fight finally ended with a private settlement after several years. He remains a beloved figure in Australia and around the world.

Jimmy Carr

A popular British comedian received significant criticism when it became known he’d used a legal, but controversial, method to reduce his tax bill. The Prime Minister publicly stated the comedian’s actions were unethical. Although the scheme wasn’t against the law, the comedian apologized and ended his involvement due to the strong public reaction. He’s since made light of the situation in his shows and continues to be a successful TV presenter. The incident led to a widespread discussion in the UK about whether wealthy individuals should be held to a higher ethical standard when it comes to tax planning.

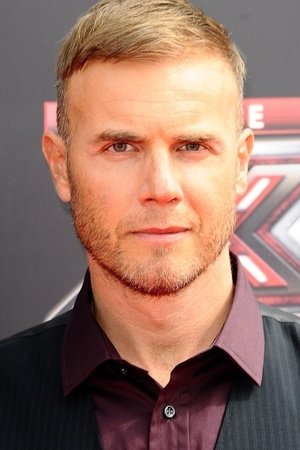

Gary Barlow

The Take That singer became embroiled in a major tax scandal linked to a music investment plan. The courts determined the plan was created solely to avoid paying taxes and ordered those involved to repay millions. While some called for him to give up his honors, he opted to pay what he owed and continue his public work. He publicly apologized, explaining he hadn’t knowingly done anything wrong. Since then, he’s concentrated on his music and supporting charities.

Chris Tucker

I was really surprised to learn that the star of ‘Rush Hour’ had some major tax problems a while back – apparently, he owed several million dollars in back taxes. It sounds like managing his finances became difficult after he first became famous. Thankfully, he was able to work things out with the government and agreed to a payment plan to get everything settled. Even though he hasn’t taken on a ton of roles lately, he’s still incredibly well-respected, especially in comedy, and a lot of fans, like me, have been curious about what’s been going on behind the scenes.

Dionne Warwick

The iconic singer recently filed for bankruptcy after facing years of money problems and owing a large amount in taxes. Reports indicate she owed millions to both the federal and state governments because of issues managing her business. This filing allows her to get her finances back on track and resolve outstanding tax debts. Despite these challenges, she continues to perform and make music, striving to regain her financial stability. With a career lasting decades, she remains one of the most celebrated female singers ever.

Mary J. Blige

As a huge fan, it was really shocking to learn that the singer had been dealing with some serious tax issues for years. Apparently, she owed the government millions while also going through a very public divorce – talk about a tough time! Thankfully, she and her team were able to work things out and pay off her debts. She’s even talked about how important it is to stay on top of your finances, which is a good message. Despite everything, she hasn’t missed a beat! She’s still releasing amazing albums and getting rave reviews for her acting. She’s truly a powerhouse and continues to inspire me and so many others.

Sinbad

The comedian and actor struggled with serious financial problems, filing for bankruptcy twice because he owed a large amount of money in taxes and other debts. He reportedly owed the government millions of dollars in back taxes accumulated over many years. He attributed his difficulties to unsuccessful business ventures and high spending. Despite these challenges, he has continued to work steadily in entertainment and pay down his debts. Many people admire his ability to bounce back from such significant financial hardship.

Toni Braxton

Despite achieving huge success as a singer, she twice faced bankruptcy because of poor financial decisions and problems with taxes. She owed a lot of money to both the government and other companies, and health issues made it difficult for her to work and earn money. Eventually, she paid off her debts and has continued to thrive in music and television. Her story is often used to illustrate how unstable finances can be, even for successful musicians.

Burt Reynolds

The famous actor struggled with money problems toward the end of his life, even filing for bankruptcy and owing a lot of back taxes. He was in danger of losing his property and tried to fix things by selling possessions and continuing to act. Despite these difficulties, he remained a popular and respected figure in Hollywood, celebrated for his incredible career. He discussed his financial struggles honestly in his autobiography.

MC Hammer

The rapper gained notoriety when he filed for bankruptcy despite his previous success, revealing significant debt. A large portion of this debt was back taxes owed to the government from when he was at the height of his career. He’d spent a considerable amount of money on a lavish lifestyle, including a large property and many employees, before his income decreased. Eventually, he managed to pay off his debts and reinvented himself as an entrepreneur and investor in technology. Now, he frequently speaks publicly about the importance of financial responsibility and careful planning.

Todd Chrisley

Todd Chrisley, the star of the reality show ‘Chrisley Knows Best,’ was found guilty of several financial crimes, including not paying taxes and committing bank fraud. He and his wife were accused of working together to cheat banks and conceal their income to avoid paying taxes. He received a twelve-year prison sentence and was ordered to repay the money he owed. Throughout the trial, Chrisley insisted he was innocent, claiming a former employee was to blame. His legal troubles have been widely reported in the news and have overshadowed his family and their show.

Julie Chrisley

Julie Chrisley, wife of Todd Chrisley, was also found guilty of financial crimes. She was convicted of tax evasion and bank fraud, resulting in a seven-year prison sentence. Prosecutors presented evidence showing she actively participated in obtaining millions of dollars through fraudulent loans. She began serving her sentence in a federal prison while her lawyers appealed the verdict. As a result of the convictions, the couple’s reality TV shows were canceled.

Hunter Biden

I’ve been following the case of the President’s son, and it’s been quite a situation. He ended up admitting guilt to charges related to not paying his taxes on time and filing incorrect returns. Apparently, the prosecution argued he was living a really extravagant lifestyle while not fulfilling his tax responsibilities for years. He’s now paid everything he owed, with some help from someone else, but he’s still dealing with the legal fallout. It’s become a huge topic of conversation, both politically and in the public eye.

Martha Stewart

The well-known businesswoman went to federal prison for insider trading and also faced questions about her taxes. She was found guilty of conspiring to break the law, trying to block the investigation, and lying to federal investigators. After getting out of prison, she had to pay large fines and was temporarily prevented from being a company leader. Despite this, she successfully rebuilt her public image and became even more successful in the years that followed. Her comeback from such a serious legal issue is widely considered one of the most remarkable career turnarounds in media history.

Terrence Howard

The actor from ‘Empire’ has been investigated for tax issues for several years. Authorities have examined his finances, as well as those of his ex-wife, to ensure all income was correctly reported. He’s dealt with tax liens before and has been trying to settle financial disagreements with the government. The actor has voiced his annoyance with the lengthy legal process, but continues to work on high-profile TV and movie projects.

Courtney Love

Throughout her career, the singer and actress has struggled with money issues, including tax debts and lawsuits. She’s reportedly owed a large sum – hundreds of thousands of dollars – in back taxes to the federal and state governments. These financial difficulties have been made more complex by legal disputes over her late husband’s estate and her own business ventures. She’s been working to resolve her debts while continuing her career in music and art. Even with these challenges, she remains an important artist in the world of alternative rock.

Ozzy Osbourne

A famous rock star and his wife recently resolved a significant tax issue with the government. They owed over a million dollars in back taxes and interest accumulated over several years. They promptly paid the debt and stated their financial advisors were responsible for the mistake. The couple has publicly acknowledged past errors and emphasized the need for reliable financial professionals. Despite this, they’ve maintained their status as one of the most well-known families in the entertainment industry through their music, television show, and other ventures.

Sharon Osbourne

She was caught up in a family tax issue, both as a public figure and in her role managing their finances. She publicly admitted a mistake in overseeing their tax returns. To resolve the problem quickly and avoid legal issues, she and her partner immediately paid all outstanding taxes. Despite the scandal, she has continued to thrive in her career as a talk show host and judge on talent shows, and her honest handling of the situation helped her family move forward.

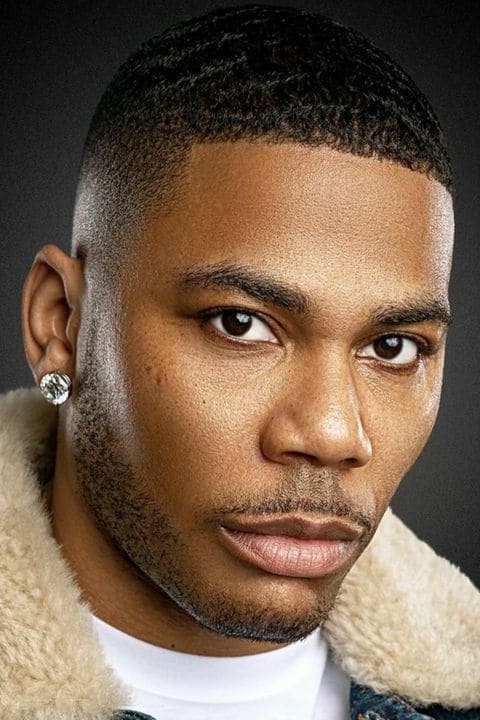

Nelly

The Grammy-winning rapper recently faced a multi-million dollar tax debt with the federal government. When the news became public, his fans launched a campaign to stream his songs, hoping to help him earn enough money to cover it. He’s been working with financial advisors to resolve the issue and pay what he owes. Despite this, he continues to tour, release new music, and grow his other businesses, remaining a highly successful artist from the early 2000s.

Heidi Fleiss

The woman famous as the “Hollywood Madam” went to prison for 21 months after being convicted of not paying taxes and hiding money earned from her escort service. The trial received a lot of media attention, with details emerging about her famous clients. Since getting out of prison, she’s focused on rescuing animals and has lived a more private life. Her case is frequently used as an example of how tax laws can be used to prosecute people involved in otherwise illegal activities.

Share your thoughts on these celebrity tax scandals in the comments.

Read More

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- TON PREDICTION. TON cryptocurrency

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Bitcoin, USDT, and Others: Which Cryptocurrencies Work Best for Online Casinos According to ArabTopCasino

- 39th Developer Notes: 2.5th Anniversary Update

- Is Kalshi the New Polymarket? 🤔💡

- Bitcoin and XRP Dips: Normal Corrections or Market Fatigue?

2026-01-14 00:21