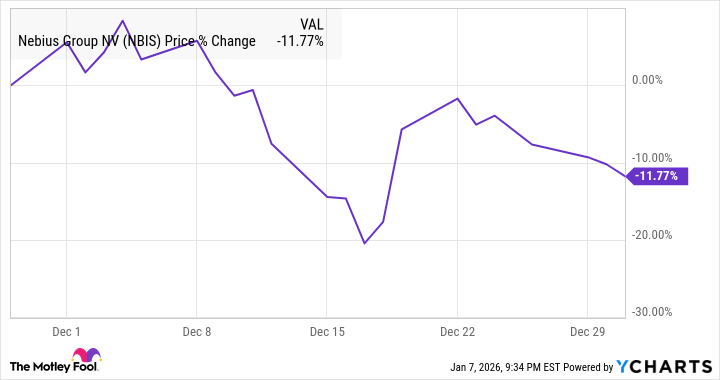

The moth of Nebius Group (NBIS 4.10%) fluttered toward the flame of December, only to find its wings singed by Oracle’s earnings report-a Pyrrhic fire that illuminated the fragile architecture of the neocloud sector. The stock, a delicate creature of speculative capital, tumbled 11% over the month, not for lack of ambition, but for the cruel arithmetic of market psychology.

Oracle, that gilded oracle of silicon and cloud, had stumbled, its capital expenditures swelling to $12 billion like a bloated leviathan. The figure, a grotesque parody of fiscal prudence, cast a pall over Nebius and its ilk. CoreWeave, another neocloud star, flickered in tandem, their fates entwined in the capricious dance of AI hype. One might almost admire the symmetry: Oracle, the titan, and Nebius, the nimble acrobat, both dancing to the same erratic tune.

The chart of Nebius’s performance in December resembles a sonnet written in candlelight-beautiful, volatile, and doomed. Its volatility is the natural consequence of a business model that conflates GPU depreciation with existential poetry. To buy chips, to rent them out, to borrow against the future-such alchemy is as sensible as building a cathedral from sand. The debt, that sly serpent, coils ever tighter around the neck of expansion.

A Month of Moths and Mirrors

Nebius, for all its bravado, is a moth in a room of mirrors, each reflection a gamble. The 19% plunge following Oracle’s report was less a collapse than a correction-a reminder that even the most glittering speculative ventures are bound by gravity. Yet the stock rebounded, buoyed by Micron’s bullish report, which suggested that the demand for high-bandwidth memory chips is not a mirage, but a mirage with a budget. The analyst upgrade for CoreWeave, meanwhile, was a wink to the faithful: the neocloud is not dead, merely napping.

December’s narrative is one of chiaroscuro: light and shadow, hope and despair. Oracle’s stumble revealed the precariousness of the neocloud’s edifice, yet Micron’s ascent hinted at a deeper, more enduring current. The market, that fickle lover, oscillates between infatuation and indifference, and Nebius, caught in the crossfire, must navigate the tempest with the grace of a tightrope walker.

The 2026 Gambit

As we step into 2026, the AI trade stirs like a dragon awakening from hibernation. Nebius, now up 15% through January 7th, has caught the scent of Nvidia’s CEO Jensen Huang at CES-a scent as intoxicating as it is ephemeral. Northland’s price target of $211, a figure that defies even the most optimistic of spreadsheets, suggests that the market still believes in the alchemy of GPUs and capital. And who are we, mere mortals, to question the arithmetic of hope?

The Rubin platform’s deployment in H2 2026 is the final act in this grand opera of capitalism. Will it be a crescendo or a cacophony? Only time, that inscrutable critic, will judge. For now, Nebius remains a stock of paradoxes: unprofitable yet beloved, risky yet resilient, a creature of the future yet shackled by the present. To invest in it is to bet on the moonshot, to embrace the chaos of innovation with the stoicism of a philosopher.

And so, dear reader, we are left to ponder: is Nebius a phoenix or a pyre? The answer, as always, lies in the numbers-and the stories we tell ourselves about them. 🔮

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- The Sega Dreamcast’s Best 8 Games Ranked

- :Amazon’s ‘Gen V’ Takes A Swipe At Elon Musk: Kills The Goat

- How to rank up with Tuvalkane – Soulframe

- Nvidia: A Dividend Hunter’s Perspective on the AI Revolution

- Tulsa King Renewed for Season 4 at Paramount+ with Sylvester Stallone

- DeFi’s Legal Meltdown 🥶: Next Crypto Domino? 💰🔥

- Ethereum’s Affair With Binance Blossoms: A $960M Romance? 🤑❓

- Thinking Before Acting: A Self-Reflective AI for Safer Autonomous Driving

2026-01-08 06:52