In the curious theatre of finance, the artificial intelligence (AI) boom has miraculously conjured trillions of dollars from thin air for the tech elite and their adjacent acolytes in 2025. This extravagant display propelled the S&P 500 (^GSPC +0.19%) to heights previously reserved for the dreams of the most audacious stockbrokers. Yet, as with all splendid performances, it was not merely the machinations of innovation that buoyed investors; rather, a more pedestrian force-interest rate cuts-provided significant ballast.

Lower interest rates, akin to a benevolent benefactor, diminish the burden of debt, thereby inflating corporate profits. They similarly enable companies to procure additional funds to stoke the fires of growth, promising tantalizing returns for the ever-hopeful investor. However, in the shadowy corridors of power, the U.S. Federal Reserve grapples with the unsightly specter of rising unemployment, a condition that suggests the economy may soon face an existential crisis. Wall Street, ever the oracle, anticipates further interest rate reductions in this new year of 2026.

While one might assume that such reductions would herald a golden age for equities, the undertow of recession fears could provoke a contrary reaction amongst the jittery investors. Let us then contemplate the anticipated timing of these forthcoming rate cuts and their implications for your meticulously curated stock portfolio.

The Fed’s Dilemma: Unemployment on the Rise

The Federal Reserve finds itself ensnared in a dual mission-a Sisyphean task, if you will. It strives to maintain price stability, aspiring to a modest inflation rate of around 2% annually while simultaneously attempting to keep the economic engine revving at full employment, albeit without a precise target for the unemployment rate.

Throughout the year that was 2025, the Consumer Price Index (CPI) remained stubbornly above the Fed’s coveted 2% threshold, culminating in a November reading of 2.7%. Under normal circumstances, such figures would evoke a cautious approach to interest rate reductions; however, the relentless deterioration of the job market compelled policymakers into action as the curtain fell on the year.

The alarm bells first tolled in July, when the U.S. economy managed the paltry addition of just 73,000 jobs, far below the economists’ lofty predictions of 110,000. The Bureau of Labor Statistics, in a fit of candor, revised downward its previous estimates by a staggering 258,000 jobs, laying bare the precariousness of the economic landscape.

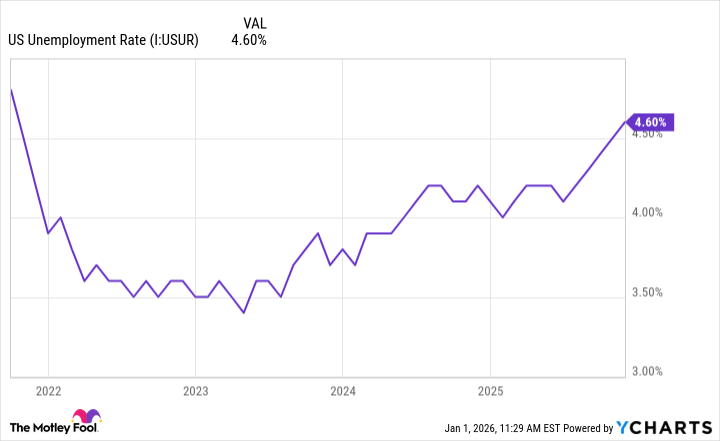

A cascade of disheartening jobs reports followed, nudging the unemployment rate up to 4.6% in November-the highest it had been in over four years.

Compounding these woes, in a rather alarming address on December 10, Fed Chairman Jerome Powell posited that employment figures might be artificially inflated by approximately 60,000 jobs per month due to data collection anomalies. His grim assessment suggested that the economy might be shedding 20,000 jobs monthly-an unexpected turn of events indeed.

Hence, it was little wonder that the Fed resorted to cutting interest rates in December, marking the third such reduction in 2025 and the sixth since the autumn of 2024.

Anticipated Cuts: A Prelude to Further Reductions

one in April and another in September.

The Stock Market’s Response to Further Rate Cuts

As previously noted, declining interest rates typically herald good fortune for the stock market, inflating corporate earnings like a well-tended soufflé. Yet, the rising unemployment rate casts a long shadow, serving as a potential harbinger of recession. Should such a downturn materialize, corporate earnings may inevitably suffer as consumers and businesses tighten their fiscal belts.

In such a dystopian scenario, one might expect the stock market to embark on a downward trajectory, regardless of the Fed’s zealous efforts to slash interest rates. Historical precedents abound, illustrating how economic cataclysms-ranging from the dot-com debacle to the global financial meltdown and the COVID-19 pandemic-have sent the S&P 500 into a nosedive, all while the Fed endeavored to prop it up with monetary salves.

At present, there are no overt signs of impending catastrophe, yet astute investors would be wise to remain vigilant for any signs of weakness in the labor market, treating them as ominous portents of a potentially dismal future.

To conclude on a slightly optimistic note, the S&P 500 concluded 2025 perched near record highs, serving as a testament to the notion that every market sell-off, correction, and bear phase has, in hindsight, been a mere fleeting inconvenience. Thus, should an economic downturn precipitate turbulence in the stock market in 2026, discerning long-term investors might well regard it as a prime opportunity for acquisition. 🐻

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Avantor’s Plunge and the $23M Gamble

- Gold Rate Forecast

- :Amazon’s ‘Gen V’ Takes A Swipe At Elon Musk: Kills The Goat

- Why the Russell 2000 ETF Might Just Be the Market’s Hidden Gem

- Top gainers and losers

- Umamusume: All current and upcoming characters

- ‘Peacemaker’ Still Dominatees HBO Max’s Most-Watched Shows List: Here Are the Remaining Top 10 Shows

- The Most Anticipated Anime of 2026

- 20 Anime Where the Protagonist’s Love Interest Is Canonically Non-Binary

2026-01-05 12:33