Ah, the grand circus of the stock market! With its glittering, mind-boggling valuations that make even the most seasoned juggler dizzy with confusion. If you’re clutching your wallet and peering nervously at this spectacle, you’re not alone. The S&P 500 (^GSPC 0.74%) – that bloated, boastful beast – sports a trailing P/E ratio flirting with 27, or more flirtatiously, over 30 depending on the day’s whim. A number so high it makes the brightest unicorns seem affordable. Artificial intelligence (AI), the shiny new toy of the greedy, has traders under its spell-promising riches, sometimes more than the stocks can deliver before crashing into the dirt of reality. And if this AI bubble bursts, well, we might all be sliding into a nasty little bear market, like mice scurrying from the impending cat’s paw.

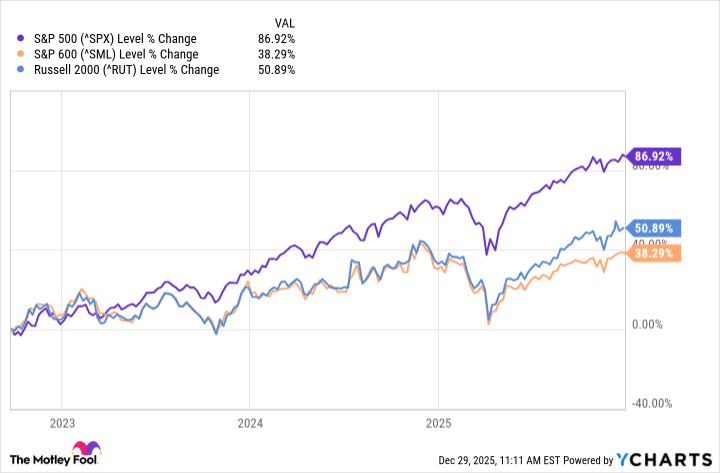

But hold the tears! If you peer beneath the gleaming surface, you’ll see that most stocks are not the lunatic inflated balloons they appear to be. Just a handful of tech giants-those greedy goblins gobbling up AI profits-are skewing the S&P’s valuation straight to the moon. Remove those monsters from the equation, and suddenly the index looks more Victorian modest-more in line with what sane folks would call “normal.” Meanwhile, the rest of the market-more sensible and less obsessed with robots-hides quietly below its long-term average, like a shy child hiding behind the curtains. That makes investments in the underdog ETFs, like the Vanguard S&P Small-Cap 600 ETF (VIOO 1.15%) or the Vanguard Russell 2000 ETF (VTWO 0.71%), whisper sweet promises of opportunity with a mischievous twinkle.

AI Mania: A Glittering Distraction for the Foolish

It’s a small, often-forgotten detail, but just because the S&P 500 acts as the golden boy of market barometers, it doesn’t mean it covers the entire zoo. No, this index is only the glittering tip of a very large, very dark iceberg. Most of the time, ETFs like the SPDR S&P 500 ETF Trust (SPY 0.70%) and the Vanguard S&P 500 ETF (VOO 0.69%) follow this flashy stripe of the market’s performance, because most stocks just mimic each other’s dances-tethered together by the invisible strings of market sentiment. But every so often, those strings fray, and the big, lazy cats of the S&P diverge from the small, scrappy mice of the Russell 2000.

Since the last bear, that bleak, rainy college of gloom ended in 2022, we saw a curious spectacle. A handful of AI-fueled stocks soared like inflated balloons, escaping their earnings with fanciful abandon. The rest, the humble small fries, kept growing profits but remained tethered to reality, with a trailing P/E ratio comfortably snoozing around 18-well within reach of the sensible. But don’t be fooled into thinking this is some freak accident. Data from World PE Ratio suggests the Russell’s forward P/E of 24.6 has been largely consistent since 2014, save for a rare COVID-induced hiccup. Meanwhile, the S&P 600 Small Cap Index, cloaked by the Vanguard ETF, is trading at a shocking bargain-P/E ratio currently at 17.9, with forecasts to rise to a sprightly 15.5 by year’s end, thanks to earnings that are predicted to leap like a frog on espresso shots.

Analysts Nose Deep into the Debt of Disparity

Some clever pundits-those watchful owls-have finally spotted the disparity, and they’re getting a bit bullish on the small-caps’ prospects. Chief Investment Officer Chris Tessin of Acuitas Investments leans into his metaphorical truck by noting, “You could drive a truck through the return differential.” Yes, and this truck is laden with mergers, acquisitions, and all sorts of financial cabbages, gnawing their way into the small-cap realm. Merrill Lynch’s charmers-those who make money from predicting where the market will wobble next-are also chirping happily. Marci McGregor, their head of portfolio strategy, points out that since the 1990s, small-caps tend to outperform their lumbering large-caps after the Fed slaps on the rate cuts a good six times out of ten.

But remember, oh eager investor, these wise words of long-term wisdom come with a caveat: this is no quick fix nor a fling. These are investments you must nurture like a garden-plenty of patience, a dash of faith, and a willingness to stay the course for years. Like a stubborn donkey, the small-cap sector demands perseverance, not magic.

Choosing Your Magical Carpet Ride

The Vanguard Russell 2000 ETF and its smaller sibling, the Vanguard S&P Small-Cap 600 ETF, are obvious choices-like picking the least dodgy pony in the paddock. Yet, they are not the only games in town. There are other small-cap ETFs, and an adventurous few might even dare to pick individual companies-though beware, most of these tiny businesses are as mysterious and fickle as fairy tales, often shrouded in foggy information. More often than not, it pays to hop onto the broad ETF train-trusting the conductor’s promise that time, not haste, will turn your investment into something richer than a pot of gold hidden at the end of a rainbow.

In short, if your portfolio looks like a stuffed-to-the-gills circus tent of overpriced giants, the humble Russell 2000 ETF could be your ticket out, a little engine with big plans. And maybe-just maybe-it will chug along enough to give you something worth smiling about.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-01-01 15:22