In the grand theater of finance, where the human soul is tested by the caprices of yield and volatility, two titans stand: the iShares Core High Dividend ETF (HDV) and the Schwab U.S. Dividend Equity ETF (SCHD). Both claim to offer sanctuary to the weary income seeker, yet their paths diverge like the fates of Raskolnikov and Luzhin-twin souls adrift in the same storm, yet doomed to different ends. One whispers of stability; the other, of ambition. Which is the true vessel for salvation in 2026?

Snapshot (cost & size)

| Metric | HDV | SCHD |

|---|---|---|

| Issuer | IShares | Schwab |

| Expense ratio | 0.08% | 0.06% |

| 1-yr return (as of Dec. 30, 2025) | 9.5% | 1.5% |

| Dividend yield | 3.2% | 3.8% |

| Beta | 0.48 | 1 |

| AUM | $12 billion | $72 billion |

Beta measures price volatility relative to the S&P 500; beta is calculated from five-year weekly returns. The 1-yr return represents total return over the trailing 12 months.

SCHD, with its slender expense ratio of 0.06%, appears the ascetic, offering a yield of 3.8% like a monk’s quiet promise. Yet HDV, though slightly more costly (0.08%), has marched forward with the tenacity of a man haunted, delivering a 9.5% return in one year where SCHD stumbled to 1.5%. The question lingers: Is frugality a virtue or a shackle when the market’s tempest rages?

Performance & risk comparison

| Metric | HDV | SCHD |

|---|---|---|

| Max drawdown (5 y) | -15.41% | -16.86% |

| Growth of $1,000 over 5 years | $1,400 | $1,300 |

What’s inside the ETF portfolios

The Schwab U.S. Dividend Equity ETF, a colossus of $72 billion, hoards 103 stocks-a treasure trove skewed toward energy (19.34%), consumer defensive (18.5%), and healthcare (16.1%). Its crown jewels? Bristol Myers Squibb, Merck, Lockheed Martin, and ConocoPhillips. These names, absent from HDV’s ledger, speak of a fund that bets on the industrial heartbeat of America. Yet, in the shadow of high interest rates, the financial sector’s weight drags like a chain on its progress.

HDV, meanwhile, tightens its grip on 74 stocks, its fingers laced with energy and healthcare giants like Exxon Mobil, Johnson & Johnson, and Chevron. It is a fund that dances with fire, leaning into the volatile yet cash-rich energy sector. Here lies its paradox: the very instability that terrifies the timid investor fuels its outperformance. In the end, is it the fund’s strategy-or the investor’s will-that determines triumph?

For those seeking a Rosetta Stone to decode this quandary, the full guide awaits in the depths of this link.

What this means for investors

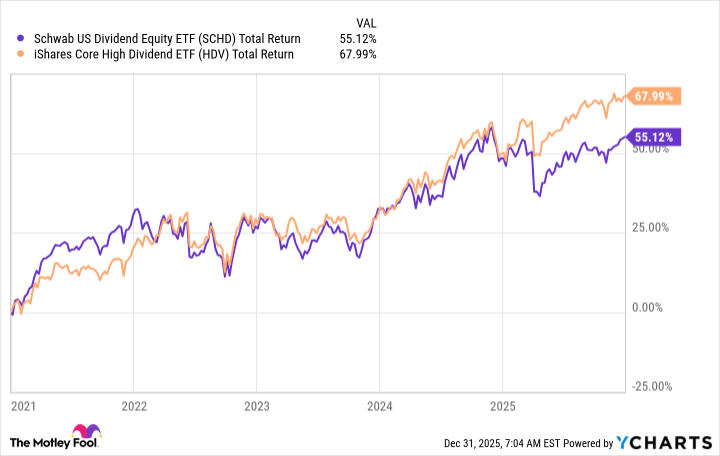

To the uninitiated, SCHD’s lower cost and higher yield seem the obvious path. Yet HDV, that sly fox, has outpaced its rival over one, three, and five years. Why? Because the market, like man, is a creature of contradictions. SCHD’s financial sector tilt has faltered in the age of high rates, while HDV’s energy embrace has thrived amid the chaos of oil and gas. The lesson is stark: yield alone is a poor compass; it is the quality of the dividend-and the fortitude of the company-that charts the course.

Both funds, in their own way, are disciples of discipline. HDV follows the Morningstar Dividend Yield Focus Index, a liturgy of high yields buttressed by financial strength. SCHD, bound to the Dow Jones U.S. Dividend 100, echoes this creed. Yet in the crucible of time, only those dividends sustained by growing cash flows and ironclad balance sheets endure. The rest are but ashes.

Consider this: the investor who fixates on yield alone may find themselves beggared by a single downturn. It is the unseen virtues-dividend growth, sector resilience, and the quiet power of compounding-that build empires. In this light, both SCHD and HDV are temples of wisdom, yet their altars demand different offerings.

The choice, then, is not merely financial but existential. Will you bet on the steady hand of SCHD, or the bold gambit of HDV? Perhaps the answer lies not in picking one, but in weaving both into the tapestry of your portfolio-a hedge against the madness of the market and the frailty of the human spirit.

Glossary

ETF (Exchange-Traded Fund): An investment fund traded on stock exchanges, holding a basket of assets like stocks or bonds.

Dividend yield: Annual dividends paid by a fund or stock divided by its current price, expressed as a percentage.

Expense ratio: The annual fee, as a percentage of assets, that a fund charges to cover operating costs.

Beta: A measure of a fund’s volatility compared to the overall market, typically the S&P 500.

AUM (Assets Under Management): The total market value of assets that a fund manages on behalf of investors.

Max drawdown: The largest percentage drop from a fund’s peak value to its lowest point over a specific period.

Portfolio concentration: The degree to which a fund’s assets are invested in a small number of holdings or sectors.

Sector tilt: When a fund allocates more assets to certain industry sectors compared to others or to a benchmark.

Total return: The overall return from an investment, including price changes and all dividends or distributions.

Leverage: Borrowing money or using financial instruments to increase the potential return (and risk) of an investment.

Hedging: Strategies used to reduce or manage investment risk, often through derivatives or offsetting positions.

ESG overlay: Incorporating environmental, social, and governance criteria into investment selection or portfolio management.

Read More

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-12-31 15:53