Ah, the stock market-a place where humans gamble with numbers while the universe yawns. Index funds, those paragons of simplicity, are often recommended like a well-rehearsed joke. Yet, as any seasoned observer of financial absurdity knows, the punchline lies in the unexpected. Consider the Vanguard Mid-Cap ETF (VO 0.21%), a creature of peculiar charm, which may yet outperform the S&P 500 in a contest of endurance that stretches into the twilight of time.

While the S&P 500 ETFs are the celebrities of the market, the Mid-Cap ETF is the quiet friend who always brings a thoughtful gift. Its portfolio, a mosaic of companies valued between $2 billion and $10 billion, occupies a curious liminal space-neither the fledgling chaos of startups nor the bureaucratic inertia of giants. (Imagine a teacup that’s neither hot nor cold, but somehow always just right.)

In the Sweet Spot of Existence

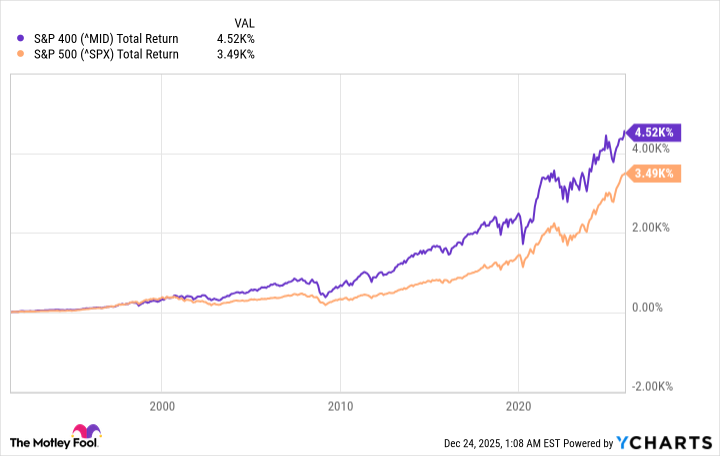

The CRSP US Mid Cap index, which the ETF mirrors, has long been a thorn in the side of its larger counterparts. Since 1991, it has outpaced the S&P 500 with the persistence of a toddler refusing to nap. (One might speculate that the universe, in its infinite wisdom, favors companies that haven’t yet mastered the art of scale.)

Mid-sized firms, you see, are the cosmic equivalent of a well-balanced breakfast-no longer scrambling to survive, but still brimming with potential. Take UiPath, the AI robotics firm that recently ascended to the S&P 400, or Robinhood and Carvana, which have since graduated to the S&P 500. Each found their moment, much like a well-timed punchline.

Yet, for all its virtues, the Mid-Cap ETF is not without its quirks. Some constituents will falter, others will vanish like a poorly remembered dream. But here’s the rub: enough thrive to keep the whole ensemble ahead of the pack. (It’s like a party where most guests are terrible, but the host is reliably excellent.)

Investing in such a fund is akin to hiring a personal trainer for your portfolio-no need to chase every undercovered stock, which is like trying to catch rain with a net made of spaghetti. Just let the ETF do its thing, and marvel at the absurdity of it all. (And yes, the universe will eventually end. But until then, this ETF might just outlive you.)

📈

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Silver Rate Forecast

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- Why Nio Stock Skyrocketed Today

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-12-29 18:42