People buy stocks for all sorts of reasons. Some chase the adrenaline rush of a moonshot. Others just want to feel rich while their portfolio withers like a raisin in the sun. Few bother to notice the quiet engine humming beneath the ticker tape: dividends. They’re the financial equivalent of a dependable old dog. Not flashy. Not loud. But loyal as hell.

History? It’s a broken record. From 1940 to 2024, dividends accounted for 34% of the S&P 500’s total returns. Numbers don’t lie. People do. But the market? It just sits there, indifferent, like a cat watching a stock plummet. Compounding? That’s where the magic lives. Between 1960 and 2023, 85% of the S&P’s gains came from reinvested dividends. You read that right. Eighty-five percent. The rest is noise. The rest is panic.

The secret to becoming a dividend millionaire

Everyone loves a high yield. It’s the siren song of income investors. But sirens sink ships. A company paying 8% dividends while bleeding cash is a tragedy waiting to happen. So it goes. Dividends cut midstream feel worse than a divorce. Trust me. I’ve seen it. I’ve lived it.

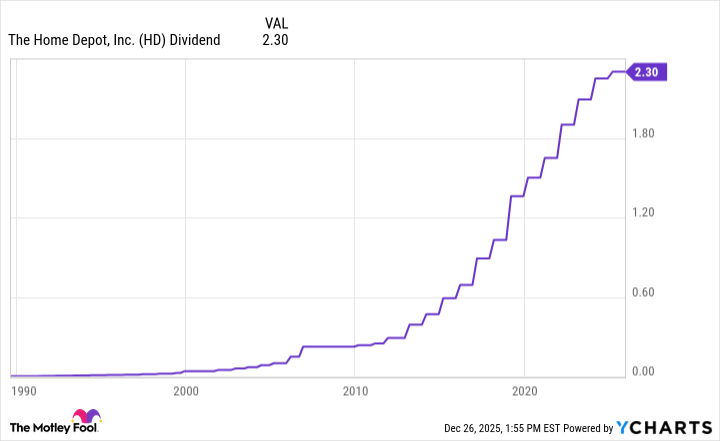

Steady wins the race. Look for companies that drip dividends like a leaky faucet. Reliable. Predictable. Boring, even. But boring companies survive recessions. They outlive CEOs. They bury competitors. Home Depot, for example, yields 2.6%. A pittance, you say? A $10,000 investment in 1990 became $1 million by 2015. Reinvested dividends do that. Time does the rest. So it goes.

What’s the formula? Simple. Find companies with:

- Cash flows smoother than a jazz saxophone.

- Dividend growth streaks longer than a politician’s speech.

- Balance sheets that don’t tremble when interest rates sneeze.

Dividend Kings are your best bet. These 56 firms have raised payouts for 50+ years. They’ve survived wars, crashes, and disco. But even kings have bad days. Do your homework. Or don’t. The market will punish you either way.

Top stock and ETF for a potential millionaire dividend portfolio

Parker-Hannifin yields 0.8%. That’s barely a whisper. But this industrial dinosaur has raised dividends for 69 years. Sixty-nine. It’s the Energizer Bunny of cash flow. Since 2000, shares rose 3,800% with reinvested dividends. Not bad for a company that makes hydraulic parts. So it goes.

Prefer something hands-off? Vanguard’s Dividend Appreciation ETF (VIG) holds 338 dividend growers. It’s like owning a piece of capitalism’s backbone. Tech giants. Healthcare titans. Financial heavyweights. Expense ratio: 0.05%. Returns since 2006: 500%+. Dividends did the heavy lifting. The fund avoids high-yield traps. It favors survivors. It favors you.

Remember: Compounding is a game of patience. High yields are fireworks. Pretty. Loud. Gone in a minute. Dividend growth is a campfire. Slow. Steady. Warm. You’ll thank me later. Or you won’t. The market’s a fickle friend. So it goes 📈.

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- Silver Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- DOT PREDICTION. DOT cryptocurrency

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-12-28 18:52