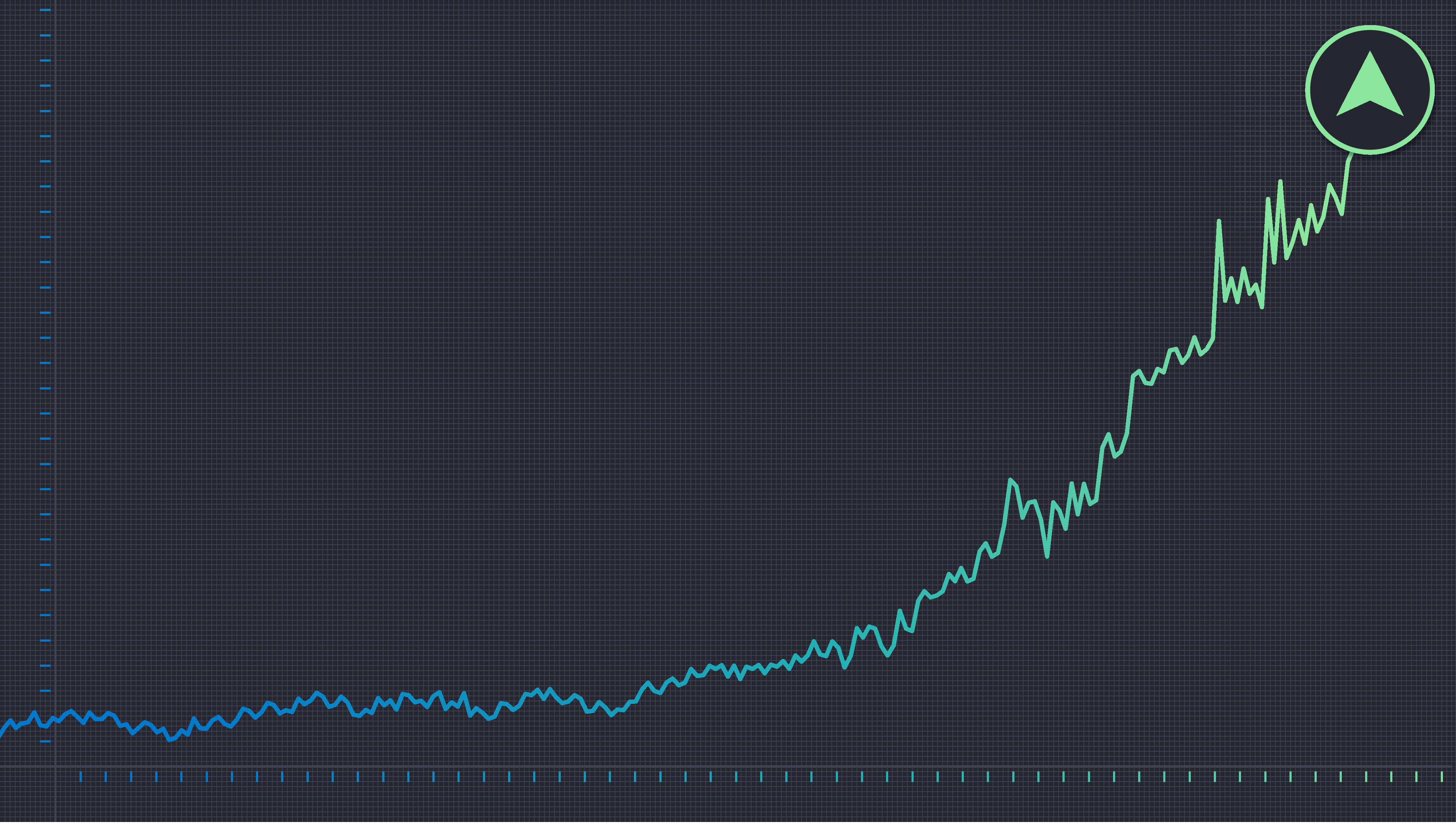

AppLovin (APP 1.82%) has emerged as a glittering jewel in the stock market’s treasure chest for the year 2025, its value ascending with an almost supernatural vigor-120% increase year-to-date as of this scribbling. This remarkable rise unfolds as the advertising technology company not only boasts impressive top-line growth but also profits that soar like a kite caught in a tempest.

Yet, one might ponder: what drives investors to furrow their brows over such figures? The very same facts, like a two-faced coin, can lead to disparate conclusions. On one hand, the business appears resplendently robust compared to its former self of yore; on the other, the price at which eager investors now find themselves beckoned is far less forgiving, a veritable siren luring them toward rocky shores.

Indeed, AppLovin stands as a quintessential case study of a flourishing enterprise shackled by an unappealing stock price.

The Engines of AppLovin’s 2025 Ascent

The growth of AppLovin is akin to a locomotive barreling down the tracks, impossible to ignore.

In its quest to provide software and AI solutions that help businesses ensnare, monetize, and expand their audiences, the company reported a staggering third-quarter revenue increase of 68% compared to the previous year, surpassing $1.4 billion. Adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) surged by an astounding 79%, reaching $1.12 billion.

Even more striking is the overarching view of AppLovin’s performance over the calendar year. The trailing nine-month revenue as of September 30 had ballooned to approximately $3.8 billion, a commendable 72% increase from the previous annum. With net income eclipsing $2.2 billion-a jaw-dropping enhancement of 128%-the adjusted EBITDA for this period soared by 90%, reaching a magnificent $3.1 billion.

However, a discerning investor must not overlook a significant detail amidst these jubilant figures: the trajectory of growth has begun to exhibit signs of moderation. Though the third-quarter revenue growth of 68% retains its brisk pace, it lags behind the remarkable 77% achieved in the second quarter.

Ultimately, the narrative remains clear: in the annals of 2025, AppLovin has metamorphosed from a niche entity in the ad-tech realm into a formidable platform demonstrating extraordinary profitability.

A Valuation that Offers Little Room for Error

When a stock experiences a meteoric rise, the inquiry seldom revolves around the company’s operational efficiency. In AppLovin’s case, the engines are running at full throttle. The more pressing question is whether the current valuation leaves any margin for error, a conundrum akin to attempting to balance a teetering tower of teacups on a tightrope.

With a price-to-sales ratio hovering around 40 and a price-to-earnings ratio of 50 at the time of writing, it is abundantly clear that investors harbor expectations of sustained vigorous growth.

While no imminent decline looms on the horizon, management hints at a potential deceleration in the fourth quarter. Their guidance suggests revenue will range between $1.57 billion and $1.60 billion, alongside adjusted EBITDA estimated at $1.29 billion to $1.32 billion. This forecast implies a year-over-year revenue growth of 57% to 60%-still impressive, yet a distinct retreat from the 68% growth seen in Q3.

Proponents of AppLovin may argue that the company’s initiatives aimed at enhancing capabilities for self-service advertisers could propel continued high growth rates. Nevertheless, it may take some time for these endeavors to manifest palpable results.

As AppLovin’s CEO Adam Foroughi remarked during the third-quarter earnings call, “We’re already witnessing spending from these self-service advertisers grow roughly 50% week-over-week.” Yet, he sagely added, “It’s too soon for this to be significant…” thus acknowledging the promise hidden within the fog of uncertainty surrounding the platform’s future success as an open haven for all advertisers.

In light of the stock’s elevated valuation, prudence becomes the investor’s ally. This lofty valuation constricts any room for missteps. Coupled with the perils confronting any advertising platform-such as the ever-volatile macroeconomic environment that could curtail advertiser budgets, or the capricious winds of technological advancement that could disrupt ad tracking-the margin for error grows perilously thin.

Nonetheless, there exists much to admire in AppLovin’s execution; their guidance indicates that this momentum may indeed persist. However, in the wake of such a significant surge, it might prove wise for investors to linger on the sidelines, biding their time and hoping for a more favorable entry point.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- EUR UAH PREDICTION

2025-12-27 06:49