Bitcoin, that once-proud titan, now limps through the market’s gauntlet, its $90,000 citadel crumbling under the weight of doubt. Investors, clutching their portfolios like a drunkard clings to a lamppost, whisper of a bear market that smells more like a bear hug from despair. Bulls? They’re as rare as a honest broker. The price action, a stalemate more dramatic than a soap opera finale, offers no clues-just a shrug from the gods of finance.

XWIN Research Japan, those oracle of charts, decree that Bitcoin’s dance is a “range-bound consolidation”-a fancy way of saying it’s stuck in a holding pattern while the world burns. For three months, it’s flapped its wings like a chicken in reverse, while gold and silver strut like peacocks at a gala. Geopolitical tensions? Policy chaos? Lower rates? All excuses for the masses to flee to the glittering arms of precious metals. Silver, the wild child of the bunch, even outperforms gold with a flair for drama and a dash of speculative spice.

This schism? It’s Bitcoin’s Waterloo. Institutional investors, with their spreadsheets and suits, allocate to gold and silver like they’re ordering fine wine-deep, liquid, and with rules written in stone. Bitcoin, meanwhile, is the party guest who shows up in pajamas, begging for scraps. Its role as a “high-beta risk asset” is a title that makes it the financial equivalent of a fireworks show in a windstorm-thrilling, but not exactly a safe bet when the sky is falling.

The King of Risk Can’t Rule in a Reign of Fear

Bitcoin’s plight is a tragedy in four acts: Act I, the crowd flocks to gold and bonds like refugees to a bunker. Act II, Bitcoin waits on the sidelines, hoping for an invite. Act III, short-term holders sell their losses like hot potatoes. Act IV, the market yawns. Unlike gold’s loyal base of buyers (the kind who’d buy a bar even during a recession), Bitcoin’s fans are fickle, their love as fleeting as a crypto influencer’s integrity. And the data? It’s a love letter to the apocalypse: Bitcoin’s demand is negative, and short-term holders are selling at a loss, adding pressure like a toddler stomping on a balloon.

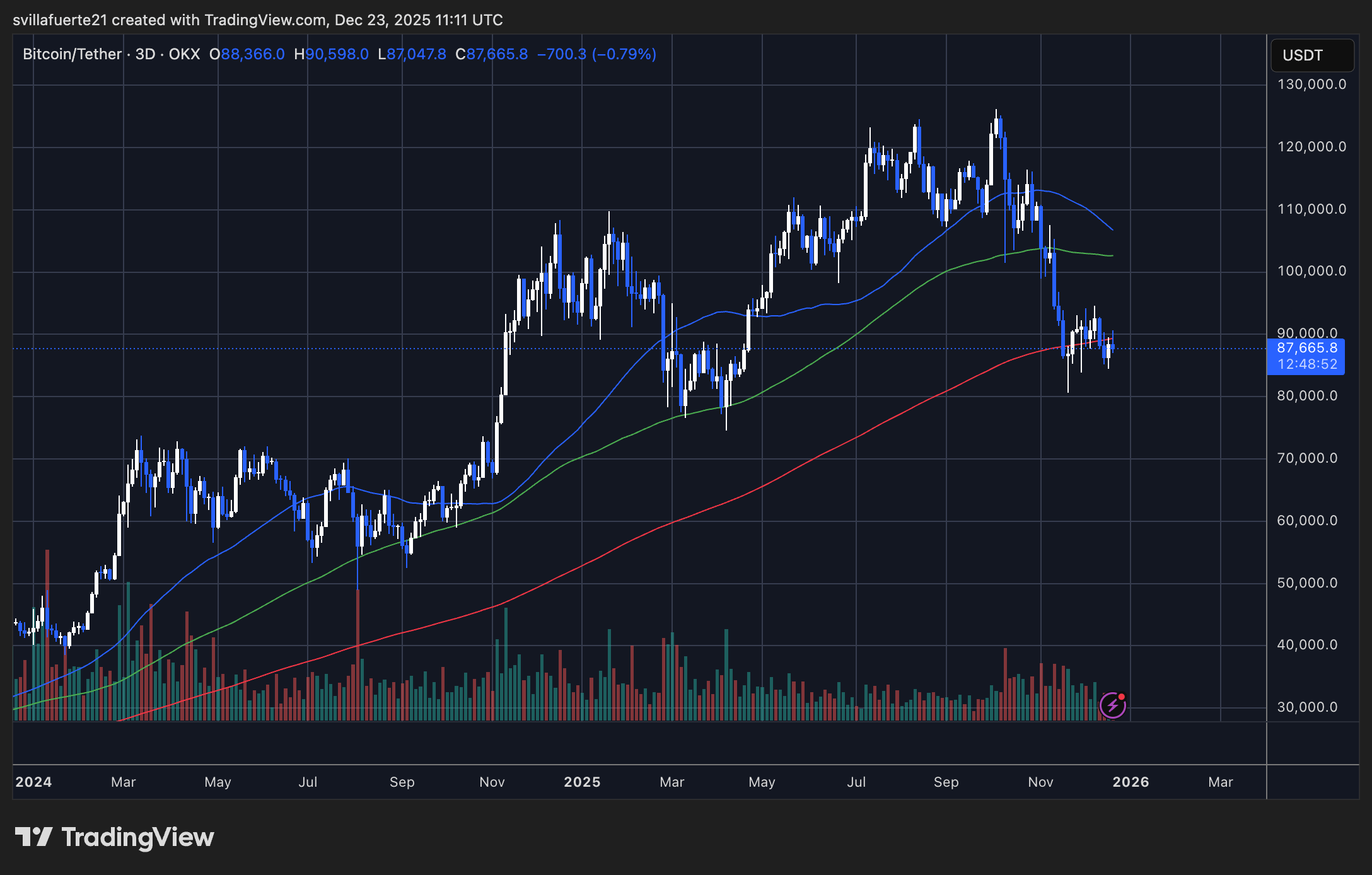

Meanwhile, Bitcoin clings to the $87,000-$88,000 range like a hangman’s noose. Its 50-day moving average, once a lifeline, now sags like a deflated bungee cord. The 100-day MA, that “dynamic support,” is a mirage in the desert of hope. Break below it, and the 200-day MA looms like a grumpy uncle with a ledger. Volume? It’s the ghost of past rallies-thin and faint, like the last breath of a dying candle.

In this theater of the absurd, Bitcoin’s fate hinges on whether apparent demand turns positive and short-term holders stop selling like they’re running from a crypto cult. Until then, gold and silver reign supreme, while Bitcoin watches from the shadows, a king without a kingdom. 🐴💥

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Gay Actors Who Are Notoriously Private About Their Lives

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The Best Actors Who Have Played Hamlet, Ranked

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

2025-12-24 02:52