Ah, Ethereum, that fickle siren of the crypto seas, currently bobbing above the $3,000 mark with all the stability of a tipsy aristocrat at a garden party. Weeks of volatility have left the market as jittery as a debutante at her first ball, yet here we are, clinging to the illusion of calm. Beneath this veneer, however, the bears are sharpening their claws, analysts wailing like harbingers of doom about weakening momentum, macro uncertainty, and the relentless selling pressure across risk assets. Extreme fear, they say, dominates the positioning-investors as skittish as a cat in a room full of rocking chairs. 🦝

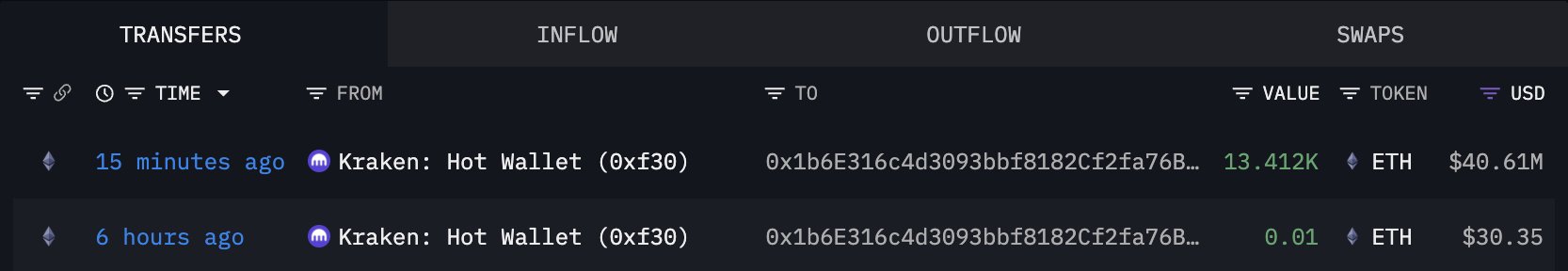

Amid this carnival of pessimism, one entity dares to stand apart: Bitmine, that digital asset mining and investment vehicle helmed by the indefatigable Tom Lee. While the masses cower in their bunkers, Bitmine has apparently decided that now is the hour to double down on Ethereum, accumulating a cool 13,412 ETH, or roughly $40.61 million. One can only imagine the scene: Lee, quaffing a glass of claret, declaring, “Fear? Nonsense! This is merely the market’s way of offering us a discount!” 🥂

Bitmine, you see, is no mere speculator. Oh no. It operates with the patience of a spider weaving its web, focusing on long-term participation in blockchain infrastructure. Mining operations, strategic accumulation-these are its tools, its modus operandi. While the retail rabble flutters about like moths in a flame, Bitmine plays the long game, its eyes fixed on the asymmetric upside. A multi-year horizon, they call it. How very grand. 🕷️

The contrast, my dear reader, is as stark as a Waugh novel. Retail investors, those poor souls, remain defensive, their fingers hovering over the sell button like nervous schoolboys. But Bitmine? It strides forward, undeterred, a beacon of contrarianism in a sea of fear. Historically, such divergence has often heralded transitional phases in the market cycle. One wonders if Bitmine has stumbled upon the next great turning point-or if it’s simply tilting at windmills. 🏰

Bitmine’s Bold Ethereum Accumulation: A Stroke of Genius or Folly?

On-chain data from Arkham confirms the deed: Bitmine has added another 13,412 ETH to its coffers, a move as bold as it is baffling. Its total holdings now stand at a staggering 3.769 million ETH, valued at around $11.45 billion. This places Bitmine among the largest Ethereum holders globally, a fact that either inspires confidence or raises eyebrows, depending on one’s disposition. 🧐

This is no mere speculation, mind you. It is a deliberate, calculated approach, centered on long-duration exposure to Ethereum’s network value. Bitmine, it seems, is betting on Ethereum’s future role within the digital asset ecosystem, a future it believes will be as luminous as a summer’s day in the Cotswolds. Whether this confidence is well-placed remains to be seen. After all, the crypto markets are as predictable as a Waugh protagonist’s next scandal. 🎢

Historically, large-scale purchases during periods of extreme fear have often coincided with prices trading below perceived intrinsic value. Bitmine’s accumulation behavior suggests it believes Ethereum is undervalued, a diamond in the rough waiting to be polished. Yet, as we all know, even diamonds can shatter under sufficient pressure. Will Bitmine’s bet pay off, or will it be left holding the bag? Only time will tell. ⏳

While this activity does not eliminate the risk of further downside-heaven forbid!-it does signal that structurally patient capital continues to deploy. The growing divergence between bearish sentiment and aggressive accumulation underscores a market environment where positioning, rather than headlines, may offer clearer insight into longer-term expectations. Some investors, it seems, are using current pessimism as an opportunity to build exposure, a strategy as old as the hills. 🌄

Ethereum’s Price: A Tale of Woe and Waning Bullishness

Ethereum, poor dear, is currently trading just above the $3,000 level, attempting to stabilize after a prolonged corrective phase. The chart, alas, tells a tale of woe: ETH remains below its key medium-term moving averages, with the 50-day and 100-day MAs acting as dynamic resistance overhead. Each attempt to push higher has been met with selling pressure, a reminder that the market’s bullish momentum is as fleeting as a summer breeze. 🍃

Structurally, the price action since the October peak reflects a clear sequence of lower highs and lower lows, confirming that ETH is still mired in a bearish trend on the daily timeframe. The recent bounce from the $2,800-$2,900 zone suggests some demand, but volume remains as muted as a Waugh dinner party conversation, indicating a lack of conviction from buyers. This supports the view that the current move is corrective rather than the start of a new impulsive rally. A corrective move, indeed-how very tedious. 😒

From a support perspective, the $2,900 area is now critical. A sustained loss of this level would expose ETH to a deeper retracement toward the $2,600-$2,700 region, where prior consolidation occurred. On the upside, bulls would need a decisive daily close above the descending moving averages near $3,300 to invalidate the bearish structure. Until then, the chart points to consolidation under resistance rather than trend reversal. How very unexciting. 🛑

Overall, the picture is one of ongoing distribution and elevated risk of further downside. Until ETH reclaims key moving averages with expanding volume, price action suggests that the bears will continue to hold sway. But fear not, dear reader, for in the world of crypto, fortunes can change as quickly as a Waugh character’s allegiances. Stay tuned, and keep your wits about you. 🎭

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The Weight of Choice: Chipotle and Dutch Bros

- The Best Actors Who Have Played Hamlet, Ranked

2025-12-23 02:26