One might imagine the situation thus: two gentlemen of impeccable breeding-Vanguard’s Dividend Appreciation ETF (VIG) and Schwab’s U.S. Dividend Equity ETF (SCHD)-both strolling the hallowed halls of the U.S. stock market, each with a portfolio of dividend-paying companies. Yet their approaches are as different as a well-tailored suit and a man in a waistcoat made entirely of cheese. One seeks breadth and growth, the other a lavish yield, and the astute investor must decide which to invite to their financial soiree.

A brief comparison of these funds, much like comparing the tea at Lady Bracknell’s to the tea at a village fete, reveals divergences in cost, performance, and portfolio construction. Let us peruse the ledger with the precision of a man who has never lost a wager-and the skepticism of one who suspects the dice may be weighted.

A Snapshot (Cost & Size)

| Metric | VIG | SCHD |

|---|---|---|

| Issuer | Vanguard | Schwab |

| Expense ratio | 0.05% | 0.06% |

| 1-yr total return (as of Dec. 19, 2025) | 14.9% | 6% |

| Dividend yield | 1.6% | 3.8% |

| Beta | 0.79 | 0.73 |

| AUM | $120.4 billion | $72.5 billion |

Beta measures price volatility relative to the S&P 500; beta is calculated from five-year weekly returns. The 1-yr return represents total return over the trailing 12 months.

Both funds are low-cost, like two butlers who agree on the importance of not charging for tea. Yet SCHD, with its 3.8% yield, is the sort of guest who arrives with a silver platter of dividends, while VIG, with its 1.6%, offers a modest tray of scones and a promise of growth. One might say SCHD is the life of the party-but does one wish to dance with someone who may collapse under the weight of their own generosity?

Performance & Risk Comparison

| Metric | VIG | SCHD |

|---|---|---|

| Max drawdown (5 y) | (20.4%) | (16.8%) |

| Growth of $1,000 over 5 years (in terms of total returns) | $1,721 | $1,530 |

What’s Inside

The Schwab U.S. Dividend Equity ETF, with its 14.2-year track record, is akin to a man who has mastered the art of the high-yield monologue. It tracks the Dow Jones U.S. Dividend 100 Index, which includes 103 high-yielding, high-quality U.S. stocks. Its portfolio is a veritable feast for the energy (19.3%), consumer defensive (18.5%), and healthcare (16.1%) sectors. Top holdings include Merck & Co, Amgen, and Cisco Systems. A concentrated approach, one might say, for those who prefer their income served with a side of risk.

The Vanguard Dividend Appreciation ETF, by contrast, is the quiet gent who sips his tea and speaks of long-term growth. It tracks the S&P U.S. Dividend Growers Index, a roster of 338 stocks with a 10-year streak of dividend increases. Its sector tilt is toward technology (27.8%), financial services (21.4%), and healthcare (16.7%), with top holdings like Broadcom, Microsoft, and Apple. A broader spread, much like a dinner party with guests from all walks of life-and a Jeeves-like strategy of excluding the top 25% highest-yielders to avoid the unstable sort.

For further enlightenment on the art of ETF investing, one might consult the full guide at this link, though it is worth noting that guides, like gurus, often have a vested interest in the matter.

What This Means for Investors

Investing in dividend ETFs is the financial equivalent of hiring a butler to fetch you tea every morning. It is an easy, low-cost way to generate passive income without the bother of selecting individual stocks. VIG and SCHD are among the top dividend ETFs, both focusing on reliable, sustainable dividends. But here lies the rub: SCHD’s 3.8% yield is more than double VIG’s, yet it is a bit like inviting a man with a gold-plated pocket watch to your picnic-impressive, but perhaps not the most practical choice.

SCHD’s focus on high-yield stocks is, to be fair, a dashingly clever bit of code. However, it filters out the companies that pay high yields but may not sustain them. Most of its top holdings offer yields of 3% or higher, which is rather like a man who promises to bring a cake to every party and then forgets the oven.

VIG, on the other hand, is less about the immediate gratification of yield and more about the slow, steady increase in dividends. Its index excludes the top 25% highest-yielders, much like a host who insists on polite conversation rather than drunken revelry. Instead, VIG includes only companies with at least a decade of dividend increases-a sort of dividend decathlon champion.

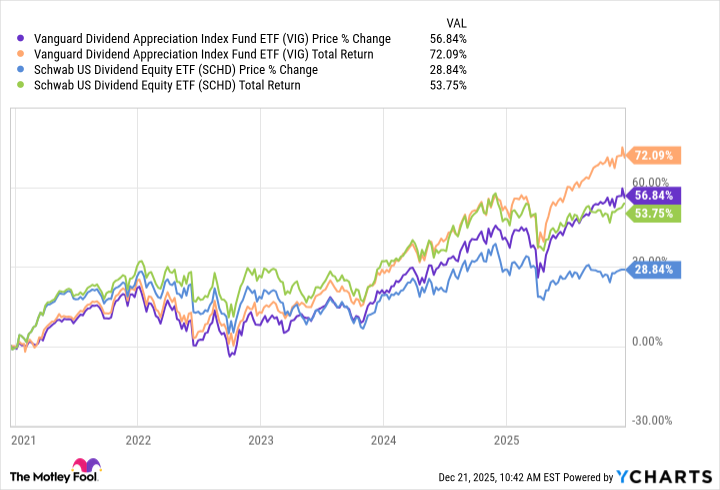

Here’s the most intriguing part: Income investors often chase yield like a dog chases a postman. Yet VIG demonstrates that dividend growth, with reinvested dividends, can outperform high-yield stocks in the long run. It is the difference between a man who saves a shilling a week and one who spends a pound on a hat he cannot afford.

To be fair, VIG’s larger portfolio also contributes to its total returns. Investors seeking stable, growing dividends may prefer VIG, much like one might prefer a well-mannered guest to a flamboyant raconteur. After all, stability is the spice of life-or at least the foundation of a sound portfolio.

Glossary

Dividend yield: The annual dividend payment divided by the current price, presented as a percentage-like a man’s waistcoat measured against his height.

Expense ratio: The annual fee charged by a fund, expressed as a percentage of assets-akin to the cost of a butler’s tea.

Beta: A measure of volatility relative to the market, much like a man’s nerves at a dinner party.

Max drawdown: The largest decline in a fund’s value over a period-similar to the depth of a gentleman’s pockets after a losing streak.

Asset under management (AUM): The total value of assets managed by a fund-like the size of a host’s silverware collection.

Sector tilt: A fund’s preference for certain industries-much like a man’s preference for claret over champagne.

Dividend growth: The consistent increase in dividend payments over time-akin to a man’s waistline after a decade of scones.

Large-cap: Companies with a large market value-like the elder statesmen of the stock market.

Index: A benchmark tracking a group of securities-much like a man’s reputation at a country club.

Portfolio construction: The process of selecting assets for a fund-akin to assembling a dinner party guest list.

Total return: The investment’s price change plus dividends-like a man’s fortune after a year of prudent investments.

Drawdown: A decline in value before a new peak-similar to a man’s spirits after a rainy day.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The Weight of Choice: Chipotle and Dutch Bros

2025-12-21 20:23