So, Ethereum’s derivatives market is doing this whole “decisive shift” thing, and apparently, the price is about to jump back over $3,000. 🤑 On-chain data says traders are in full-on hoard mode, like squirrels with acorns, but with crypto. 🌰

ETH’s still hanging out below $3,000, but everyone’s acting like it’s already there. Classic crypto optimism-or delusion? You decide. 🤷♂️

Ethereum’s Leverage Ratio: Because Why Not Go All In? 🎲

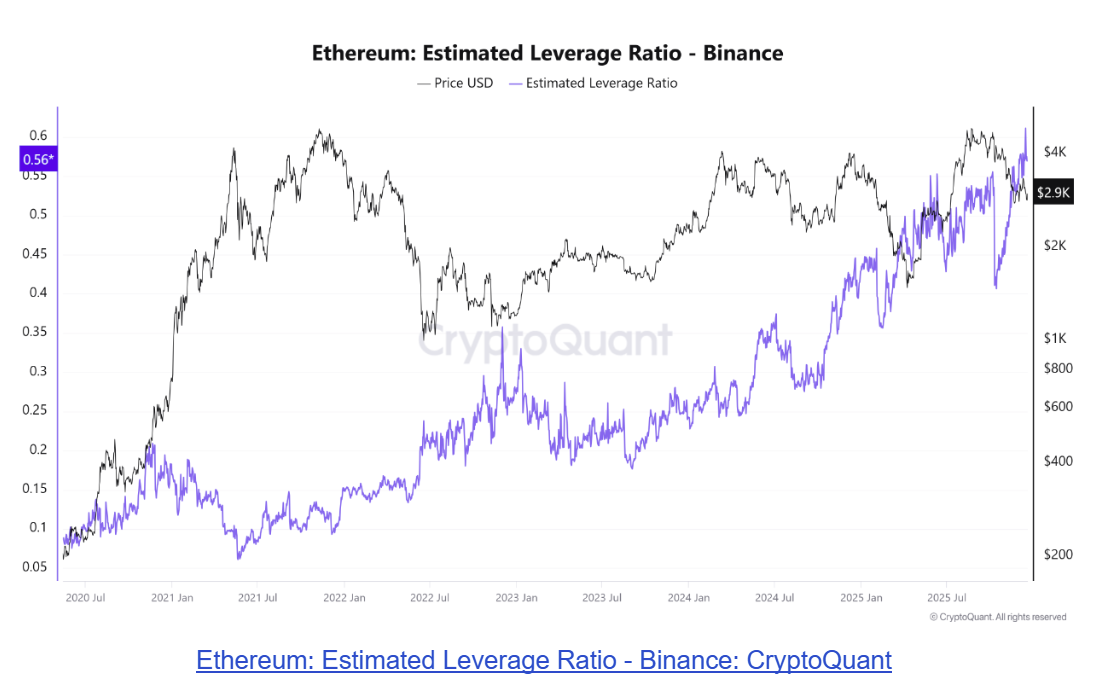

CryptoQuant’s data shows Ethereum’s Estimated Leverage Ratio on Binance hit 0.611-an all-time high. 🎉 Apparently, this means traders are borrowing like there’s no tomorrow, hoping the price goes brrr. 🚀 But let’s be real, leverage is just a fancy way of saying “I’m gambling with money I don’t have.” 💸

This ratio spiking is like everyone at the casino doubling down on red. Sure, it could pay off, or it could end in tears. But hey, who doesn’t love a good liquidation party? 🎉

Ethereum: Estimated Leverage Ratio – Binance: CryptoQuant. Because charts make everything look smarter. 📈

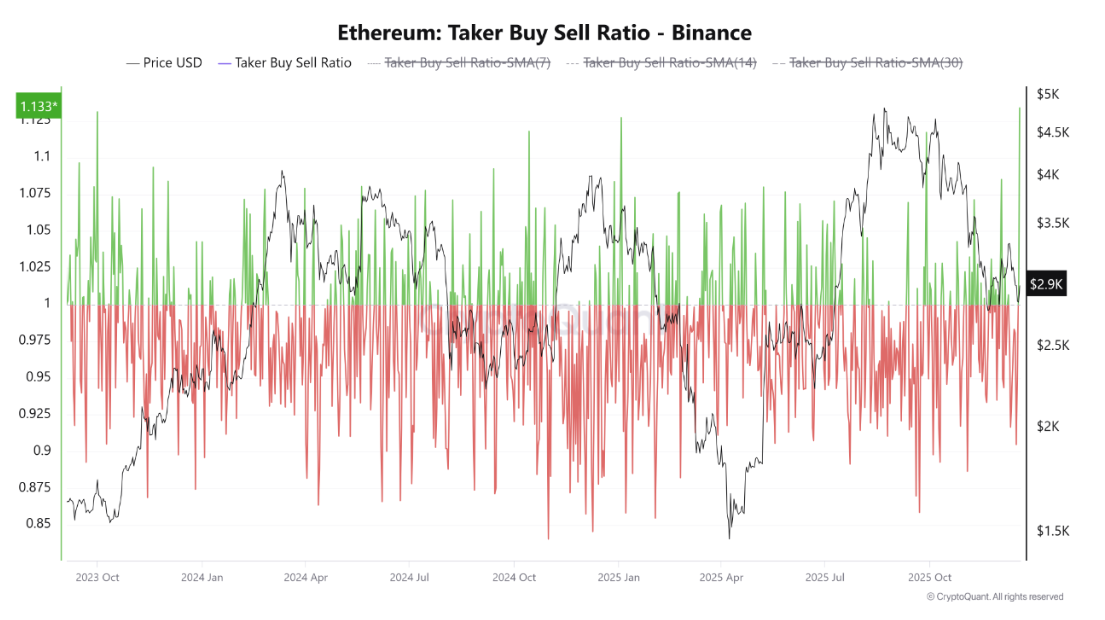

Oh, and the Taker Buy Sell Ratio just hit 1.13 on Binance. Last time that happened was September 2023. 🗓️ Basically, more people are buying than selling, which is either a sign of confidence or mass hysteria. You be the judge. 🤪

All this buying pressure with ETH at $2,900? Sounds like traders are betting on $3,000 like it’s a sure thing. Spoiler: it’s not. But good luck to them! 🍀

Analyst Ted Pillows Draws Lines on a Chart, Calls It a Roadmap 🗺️

Crypto analyst Ted Pillows (yes, that’s his name) says ETH hit a demand zone between $2,700 and $2,800 and bounced back. Groundbreaking stuff. 🧐 If buyers keep it up, we could see $3,100 to $3,200. Or not. Who knows? ¯\_(ツ)_/¯

But if it fails, we’re looking at $2,500. Because why not? It’s crypto-expect the unexpected. Or just expect to lose money. Your call. 💸

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- Wuchang Fallen Feathers Save File Location on PC

- QuantumScape: A Speculative Venture

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- 9 Video Games That Reshaped Our Moral Lens

2025-12-21 01:41