Ah, the audacity of human ambition! Behold the striking revelation that Brazil’s B3 Stock Exchange, that grand arena of financial endeavor, has decreed the inception of a stablecoin in the coming year! This marvel, I daresay, is not merely a petty token but a profound instrument, intended to fortify liquidity across the bewildering tapestry of market segments-both the tokenized and the time-honored.

Brazil’s Stock Exchange Embarks on the Path of Stablecoin Creation

The Facts

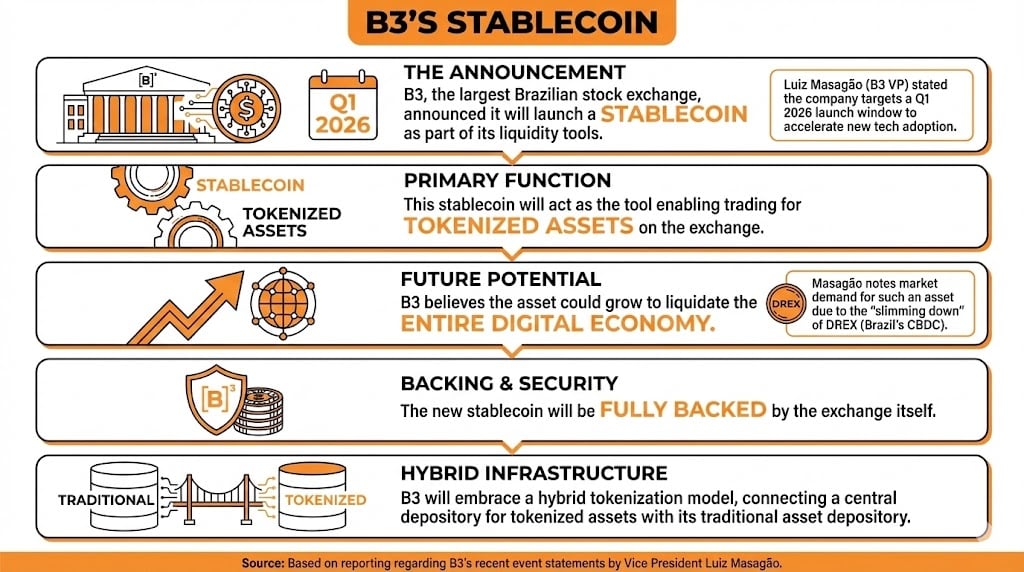

In a proclamation that echoes through the annals of modern finance, the esteemed B3 has declared its intention to incorporate a stablecoin into its repertoire of liquidity tools by the dawn of 2026. How quaint it is, this marriage of tradition and innovation!

At a recent gathering-no doubt filled with the usual pomposity-B3’s Vice President of Products and Customers, the illustrious Luiz Masagão, unveiled the anticipation for this initiative, targeting the first quarter of 2026 as the fateful moment for launch, as if the cosmos itself aligned for such an event.

Masagão, with all the gravitas of a philosopher, proclaimed that this stablecoin shall serve as the key to unlock trading avenues for tokenized assets. Yet, there is an air of optimism as he muses that it may evolve into something of far greater significance. He opined:

It can be much more than that. With DREX losing its luster, the market yearns for an asset capable of liquidating the entirety of our digital economy. What a splendid ambition!

Alongside this audacious stablecoin, which shall be backed by the very exchange itself (how reassuring!), the company envisions embracing a model of tokenization for various assets, akin to a painter preparing a canvas of hybrid offerings-connecting the old with the new, the tangible with the ethereal.

“The expansion of our product scope is crucial,” Masagão emphasized, as though he were unveiling the secrets of the universe, while the company anticipates launching a staggering 22 products next year, including weekly bitcoin dollar options, because why not?

Why It Is Relevant

The audacity of rolling out a stablecoin places B3 at the forefront of global financial innovation-who would have thought? A testament, indeed, to the trust these digital assets command in the Brazilian and broader Latin American markets, where transactions flourish daily, settling thousands via stablecoins like USDT and USDC! Truly, a revelation worthy of note.

Looking Forward

While B3 aspires to position its forthcoming stablecoins as pivotal drivers of tokenized markets, the question lingers-will traders embrace this newfangled technology? Masagão’s remarks suggest a hopeful outlook, especially following the Brazilian central bank’s decision to trim the ambitions of its own central bank digital currency ( CBDC), as if they too are caught in the tumultuous tide of market evolution.

FAQ

-

What stablecoin initiative is Brazilian stock exchange B3 planning?

B3 intends to unveil a stablecoin as part of its liquidity tools starting Q1 2026, heralding the adoption of new technologies in trading. -

What will the stablecoin enable besides trading?

The stablecoin aims to facilitate trading for tokenized assets and holds the potential to evolve into other significant financial instruments. How delightful! -

How does this stablecoin impact B3’s market positioning?

Its issuance positions B3 as a pioneer in adopting stablecoin technology, reflecting the burgeoning trust in digital assets across Brazil and Latin America-feel the excitement! -

What are B3’s broader plans in the tokenized asset space?

B3 aims to implement a hybrid model for tokenized assets, with aspirations to launch 22 products next year, including weekly bitcoin dollar options-hold onto your hats!

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- The Worst Black A-List Hollywood Actors

- Quentin Tarantino Reveals the Monty Python Scene That Made Him Sick

- TV Shows With International Remakes

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Hulu, Including ‘Fire Force’

2025-12-19 14:00